Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

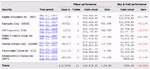

Examples of the 4 types of trades I am studying:

1. Breakout above resistance (40): LONG opportunity (ongoing example)

SECOND MOST FREQUENT SITUATION

Have learned to be profitable with these trades (it seems easy now).

2. Bounce on support (12sh): LONG opportunity (ongoing example)

MOST FREQUENT SITUATION

Have learned to be profitable with these trades (it's a little harder than with breakouts above resistance).

3. Breakout below support (30): SHORT opportunity (ongoing)

LEAST FREQUENT SITUATION

Have NOT learned to be profitable with these trades (I think it will be the hardest thing to learn).

4. Bounce on resistance (100): SHORT opportunity (it happened already)

THIRD MOST FREQUENT SITUATION

Have NOT learned to be profitable with these trades (I think I'll be able to learn soon).

You see that I am not using the concept of trend. The trend is a confusing concept to me when I am talking about support and resistance and I'd rather translate it as follows. "Uptrend" is a breakout above resistance. "Down trend" is a breakout below support. The other two situations are "range". Since all these patterns are necessarily oversimplified we have to draw some lines somewhere. Obviously nothing is clearly defined like in geometry. This is how I prefer to draw my lines and make my simplifications.

In terms of how often these 4 situations happen, I am just referring to the charts of the "chart game". Don't object that the EUR is different or other things. I am ony talking about the charts I am playing and it's just an estimate. I am open to changing my mind, if someone shows me I am wrong.

I realize that all these situations and their frequency all depend on how you define s/r, trend... and I don't know yet a univocal way of defining s/r or else I would have automated it already. But if there's no univocal way of defining s/r, then it's not going to be easy to discuss them.

Lowest low, swing low... there's some formulas out there that attempt to define them, but I suck at formulas anyway. Let me know if you can help me in any way regarding these matters.

1. Breakout above resistance (40): LONG opportunity (ongoing example)

SECOND MOST FREQUENT SITUATION

Have learned to be profitable with these trades (it seems easy now).

2. Bounce on support (12sh): LONG opportunity (ongoing example)

MOST FREQUENT SITUATION

Have learned to be profitable with these trades (it's a little harder than with breakouts above resistance).

3. Breakout below support (30): SHORT opportunity (ongoing)

LEAST FREQUENT SITUATION

Have NOT learned to be profitable with these trades (I think it will be the hardest thing to learn).

4. Bounce on resistance (100): SHORT opportunity (it happened already)

THIRD MOST FREQUENT SITUATION

Have NOT learned to be profitable with these trades (I think I'll be able to learn soon).

You see that I am not using the concept of trend. The trend is a confusing concept to me when I am talking about support and resistance and I'd rather translate it as follows. "Uptrend" is a breakout above resistance. "Down trend" is a breakout below support. The other two situations are "range". Since all these patterns are necessarily oversimplified we have to draw some lines somewhere. Obviously nothing is clearly defined like in geometry. This is how I prefer to draw my lines and make my simplifications.

In terms of how often these 4 situations happen, I am just referring to the charts of the "chart game". Don't object that the EUR is different or other things. I am ony talking about the charts I am playing and it's just an estimate. I am open to changing my mind, if someone shows me I am wrong.

I realize that all these situations and their frequency all depend on how you define s/r, trend... and I don't know yet a univocal way of defining s/r or else I would have automated it already. But if there's no univocal way of defining s/r, then it's not going to be easy to discuss them.

Lowest low, swing low... there's some formulas out there that attempt to define them, but I suck at formulas anyway. Let me know if you can help me in any way regarding these matters.

Last edited: