You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Still at work.

Once I'll get home, I'll practice more on the simulator.

Objective: make 5 trades in a row, and always have a profitable 5-trades balance.

Method: only make 1 bet per stock.

This will teach me that I have an edge, if I do, or teach me the edge, in case I still don't have one. And it will teach me that having an edge is inversely proportional to trading (in the sense of over-trading). The harder and more compulsively you look for trades, the less you will be able to pick the good opportunities. That's why some recommend to not spend your money out of your trading account, because if you count on your trading for your living expenses, this will put pressure on you to make money, and therefore to trade more.

Once I'll get home, I'll practice more on the simulator.

Objective: make 5 trades in a row, and always have a profitable 5-trades balance.

Method: only make 1 bet per stock.

This will teach me that I have an edge, if I do, or teach me the edge, in case I still don't have one. And it will teach me that having an edge is inversely proportional to trading (in the sense of over-trading). The harder and more compulsively you look for trades, the less you will be able to pick the good opportunities. That's why some recommend to not spend your money out of your trading account, because if you count on your trading for your living expenses, this will put pressure on you to make money, and therefore to trade more.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

The rule of only being able to make one trade per day in real trading and one trade per stock on the chart game is something that gives you tremendous power: you know there's no rush and that you'll be able to pick the best opportunity out of plenty of opportunities. It's a rule that encourages you to be picky, and it totally removes impulse trading. There can be no impulse trading if you are required to discard a majority of what you perceive as "opportunities". But can we still do this once we start making money almost every time we trade? Well, the trick I think is to still be "picky" no matter how good you seem to be and no matter how many opportunities you feel you're missing. You've got to feel as if you're wasting opportunities. The fear of missing opportunities is what makes you overtrade, trade compulsively and similar. By only allowing one trade per day, you know from the start that you will waste most opportunities, and you'll get used to picking the best opportunity there is. Furthermore it encourages longer term trades (since you won't feel like staying out of the market for the rest of the day), and to let profits run, since if you get out, you won't be able to get back in (and you'll miss the larger move).

In particular it gets rid of these things:

1) revenge trading: if you lose or miss a profit, there will be no more trades available to make your loss or missed profit back.

2) overconfident trading: if you win, there will be no trades available to return what you won by trading carelessly because you feel infallible.

3) doubling up on losers: if your trade is not going well, you won't be able to add it to by buying lower or similar. It either succeeds or fails, but you can't add to it.

4) hesitating when you're losing: you won't be tempted to second-guess your trade and exit early, because that's the only trade you can make today. But also, you will think about it more and choose more carefully, so you'll be less likely to have doubts about it.

And, the next day, whether you won or lost, you'll be over it.

In particular it gets rid of these things:

1) revenge trading: if you lose or miss a profit, there will be no more trades available to make your loss or missed profit back.

2) overconfident trading: if you win, there will be no trades available to return what you won by trading carelessly because you feel infallible.

3) doubling up on losers: if your trade is not going well, you won't be able to add it to by buying lower or similar. It either succeeds or fails, but you can't add to it.

4) hesitating when you're losing: you won't be tempted to second-guess your trade and exit early, because that's the only trade you can make today. But also, you will think about it more and choose more carefully, so you'll be less likely to have doubts about it.

And, the next day, whether you won or lost, you'll be over it.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

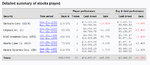

A majority of winners, but an overall negative balance.

Lesson taught by defeats? If there's no ceiling, then go long, and if there's no floor, then go short. It means we're above resistance and below support. Basically the same old lesson about support and resistance. Even with a stock, if price breaks below support, it will go down. Even though it's less likely on stocks because in time they go up more than down.

One trade per stock, that's all. I'll keep doing it more and more, until (hopefully) I'll ace it. I am good at obsessing, so let's obsess with this thing.

You know what? The tendency would be to do the opposite. If you see price on bottom of the chart, the tendency would be to say it will go up, and viceversa. The reality is that it falls to the floor below, and above. Every chart looks like a room, with a ceiling and a floor, and price looks like a ball bouncing around. The problem is that it only looks like a room, but it is not a room. That's how we all get screwed. Who knows, maybe if a chart didn't have the clearly defined borders in bold but cloudy undefined borders, we wouldn't make that mistake of picking tops and bottoms. Think about it, when in a chart there's a peak with a lot of space above it (whether the same chart window has a higher peak in sight or not),.you don't feel like picking a top. But if it's framed so that the peak is near the border of the chart window, then you feel much more like picking a top, when actually it's the same exact chart and the same information. No one talks about this. Why? We largely get screwed because of how chats look, or because even if we look at the overall life of price, we donìt... well you get my point.

I mean: check it out! I just did it again. It looked like a bottom and I went long, but then it only looked like a floor of a room, but it wasn't. So I went long and lost 50 percent of my account. This simulator is awesome. It's revealing all the tricks that a chart (even by just its framing) is playing on you.

This is telling me something else: instead of playing support and resistance, I could just play break outs. When it touches the ceiling I go long and viceversa. We'll see. I'll post all my 5-stocks 5-trades games.

Lesson taught by defeats? If there's no ceiling, then go long, and if there's no floor, then go short. It means we're above resistance and below support. Basically the same old lesson about support and resistance. Even with a stock, if price breaks below support, it will go down. Even though it's less likely on stocks because in time they go up more than down.

One trade per stock, that's all. I'll keep doing it more and more, until (hopefully) I'll ace it. I am good at obsessing, so let's obsess with this thing.

You know what? The tendency would be to do the opposite. If you see price on bottom of the chart, the tendency would be to say it will go up, and viceversa. The reality is that it falls to the floor below, and above. Every chart looks like a room, with a ceiling and a floor, and price looks like a ball bouncing around. The problem is that it only looks like a room, but it is not a room. That's how we all get screwed. Who knows, maybe if a chart didn't have the clearly defined borders in bold but cloudy undefined borders, we wouldn't make that mistake of picking tops and bottoms. Think about it, when in a chart there's a peak with a lot of space above it (whether the same chart window has a higher peak in sight or not),.you don't feel like picking a top. But if it's framed so that the peak is near the border of the chart window, then you feel much more like picking a top, when actually it's the same exact chart and the same information. No one talks about this. Why? We largely get screwed because of how chats look, or because even if we look at the overall life of price, we donìt... well you get my point.

I mean: check it out! I just did it again. It looked like a bottom and I went long, but then it only looked like a floor of a room, but it wasn't. So I went long and lost 50 percent of my account. This simulator is awesome. It's revealing all the tricks that a chart (even by just its framing) is playing on you.

This is telling me something else: instead of playing support and resistance, I could just play break outs. When it touches the ceiling I go long and viceversa. We'll see. I'll post all my 5-stocks 5-trades games.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Ok, so here's what i've been doing in this game and maybe in the next ones: i look at the past 4 years, and guess where it will go for the next year or so.

Then take a position and hold it until the end. I want to get good at this. Because this apparently stupid exercise is teaching me where probability lies, which is counter-intuitive. You see price at the top of the chart, and yet it's not likely to come down (maybe, I'll see), and viceversa. Maybe. I'll tell you in another 200 games. Hopefully I won't start remembering the charts I am playing because otherwise I'll easily win. Hopefully they have enough stocks and history.

Then take a position and hold it until the end. I want to get good at this. Because this apparently stupid exercise is teaching me where probability lies, which is counter-intuitive. You see price at the top of the chart, and yet it's not likely to come down (maybe, I'll see), and viceversa. Maybe. I'll tell you in another 200 games. Hopefully I won't start remembering the charts I am playing because otherwise I'll easily win. Hopefully they have enough stocks and history.

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

Ok, screw this: there's no point in going short, because you keep on getting these margin calls that screw your game.

So if price is near bottom from now on I will just wait: NOT bet that it's a bottom just because price is low, but wait for a reversal before I go long.

If price is at the ceiling I will bet on more rising. If the whole chart looks like a range, I will go long and short, accordingly. I will allow myself to exit early if I feel like it, and not stay until the end of the period.

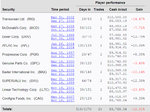

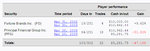

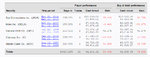

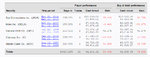

Here's the last 5 trades:

So if price is near bottom from now on I will just wait: NOT bet that it's a bottom just because price is low, but wait for a reversal before I go long.

If price is at the ceiling I will bet on more rising. If the whole chart looks like a range, I will go long and short, accordingly. I will allow myself to exit early if I feel like it, and not stay until the end of the period.

Here's the last 5 trades:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

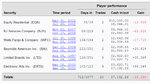

Not good... got bored and frustrated and... screwed up really badly, practically every trade.

Ok, adding one healthy restriction: all my trades will last 1 week, whether profitable or not.

I will observe the charts for 4 years of history and only make a prediction on the next week. Open trade, click one week ahead, close trade. That's all. This will force me to use a stoploss, and a takeprofit. I will only step in when I am confident that I'm able to predict the next week. It seems easy, and if it is, so what? All i need to learn one profitable way of trading. One way of trading that I am positive I can make money with. That's all I need. I don't need to try and do it the hard way.

So, from here on, it will be 10 one-week trades (on the weekly charts) and I will be reporting all the results I get, whether good or bad.

Wait... more things that might help me: since stocks go up more than down, I will just go LONG.

Other than this, I'll see what rules I'll follow, and I will write them down if they work.

If I still cannot manage to be profitable with these 10 one-week trades LONG-only, then it will take me practice, and if I still cannot get profitable with practice, I will have to start doing the opposite of what I do.

Ok, adding one healthy restriction: all my trades will last 1 week, whether profitable or not.

I will observe the charts for 4 years of history and only make a prediction on the next week. Open trade, click one week ahead, close trade. That's all. This will force me to use a stoploss, and a takeprofit. I will only step in when I am confident that I'm able to predict the next week. It seems easy, and if it is, so what? All i need to learn one profitable way of trading. One way of trading that I am positive I can make money with. That's all I need. I don't need to try and do it the hard way.

So, from here on, it will be 10 one-week trades (on the weekly charts) and I will be reporting all the results I get, whether good or bad.

Wait... more things that might help me: since stocks go up more than down, I will just go LONG.

Other than this, I'll see what rules I'll follow, and I will write them down if they work.

If I still cannot manage to be profitable with these 10 one-week trades LONG-only, then it will take me practice, and if I still cannot get profitable with practice, I will have to start doing the opposite of what I do.

Last edited:

Yamato

Legendary member

- Messages

- 9,840

- Likes

- 246

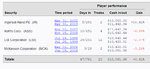

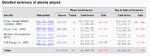

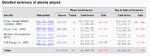

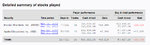

I got so addicted to the last chart that I kept on trading and ended up with 13 trades rather than just 10.

This is my first really good series. Made 60%, and a minority of profitable trades. I was bottom picking as usual. I think the best situation (for these LONG-only trades lasting 2-weeks) is a hammer on support.

This is my first really good series. Made 60%, and a minority of profitable trades. I was bottom picking as usual. I think the best situation (for these LONG-only trades lasting 2-weeks) is a hammer on support.

- Status

- Not open for further replies.

Similar threads

- Replies

- 10

- Views

- 3K