Hellena Trade

Well-known member

- Messages

- 272

- Likes

- 48

#GOLD

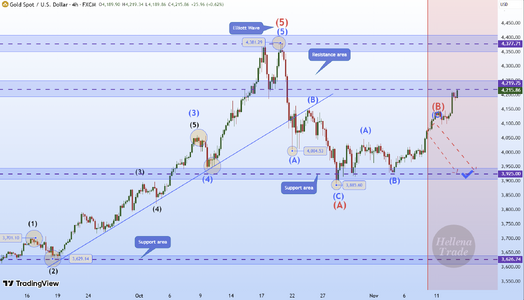

🔔(UPDATE)🥇 GOLD (4H): LONG to resistance area 4219.

➖➖➖➖➖➖➖➖➖

➡️I think there will still be a move to the 3807 area this week to be able to take a favorable position.

But for now gold is in a bit of a flat. Well, we will keep a close eye on the situation.

🔔(UPDATE)🥇 GOLD (4H): LONG to resistance area 4219.

➖➖➖➖➖➖➖➖➖

➡️I think there will still be a move to the 3807 area this week to be able to take a favorable position.

But for now gold is in a bit of a flat. Well, we will keep a close eye on the situation.