Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

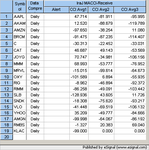

fibbo said:which stock would you long? This is the screen shot of the exhaustion engine before market open

Grey1

Hi My Man

If i understand correctly then Id be going long AAPL.[/QUOTE]

AAAAAAAAPLLLLLLLLLLLLLLLLLLLLLLLL as jerry would shout AAAPLLLLLLLLLLL

watch apply flying to day

grey1