Grey1

Senior member

- Messages

- 2,190

- Likes

- 210

I do a lot of gap trading and 8 out of 10 I make money . I think i have posted the results of my gap trades in the past.

Gap trading is a dangerous play for amateur and the danger only comes from the postion sizing . Trader donot know how to postion size them selves so in a worse case scenario they ar still within their risk tolerance.

lets say I am wrong and trader DO know how to adjust risk . What are the best techniques for gap trades?

Well 10 years ago I could have given you few basic stratgeis but the rules of the game has changed with the introduction of internet and direct access which has made the game even more efficient ( difficult ) .

saying that there are few foot prints one can see just before market closes to ( 5 min before market close ) to help him out to gap trade.

Rule1

if STOCK Z HAS MACCI ( 1 min ) > 100 and MACCI ( 3 min ) > 100 and MACCI ( 5 min ) > 100

and DOW ( Daily ) > 100

Then Short STOCK Z ( reverse for Long )

Rule 2

IF STOCK Z CLOSES NEAR HIGH OF THE DAY

THEN LONG STOCK Z JUST BEFORE CLOSE ( reverse for short )

Example GENZ yesterday

Gap trading is a dangerous play for amateur and the danger only comes from the postion sizing . Trader donot know how to postion size them selves so in a worse case scenario they ar still within their risk tolerance.

lets say I am wrong and trader DO know how to adjust risk . What are the best techniques for gap trades?

Well 10 years ago I could have given you few basic stratgeis but the rules of the game has changed with the introduction of internet and direct access which has made the game even more efficient ( difficult ) .

saying that there are few foot prints one can see just before market closes to ( 5 min before market close ) to help him out to gap trade.

Rule1

if STOCK Z HAS MACCI ( 1 min ) > 100 and MACCI ( 3 min ) > 100 and MACCI ( 5 min ) > 100

and DOW ( Daily ) > 100

Then Short STOCK Z ( reverse for Long )

Rule 2

IF STOCK Z CLOSES NEAR HIGH OF THE DAY

THEN LONG STOCK Z JUST BEFORE CLOSE ( reverse for short )

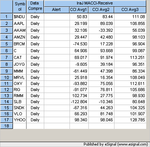

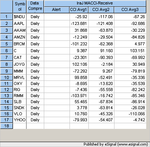

Example GENZ yesterday