bbmac

Veteren member

- Messages

- 3,584

- Likes

- 789

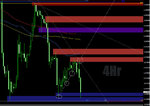

Cable has given back 50% of the 6409-6077 fall having found support at the prev daily swing hi=prev res=potential rbs zone discussed and shown in post above..1hr is in an uptrend now but has found supply at the 100sma on the 1hr chart, ( similarly the 6409 Hi was the 100sma on the daily chart.) and this is back in the previous 4hr congestion channel.

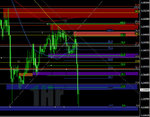

The current 1hr chart in respect of potential near-term obvious supp/res factors is below: Not shown on this chart are the unbreeched fibs of the 6876 and 6720 - 6077 swings with 23.6% of the larger 6876-6077 swing nearest, above current price @ 6264. The fibs shown relate to the 6409-6077 swing.

G/L

The current 1hr chart in respect of potential near-term obvious supp/res factors is below: Not shown on this chart are the unbreeched fibs of the 6876 and 6720 - 6077 swings with 23.6% of the larger 6876-6077 swing nearest, above current price @ 6264. The fibs shown relate to the 6409-6077 swing.

G/L