barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

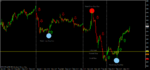

A "Wot Happened Next" with a difference.

The scenario is that you are a breakout trader. You have entered at the black line with a stoploss at the white line. It's gone really well with great momentum, but now that's stalled.

You are in clear air with no previous price action up at this level, so how would you plan to play it from here?

The scenario is that you are a breakout trader. You have entered at the black line with a stoploss at the white line. It's gone really well with great momentum, but now that's stalled.

You are in clear air with no previous price action up at this level, so how would you plan to play it from here?

Attachments

Last edited: