barjon

Legendary member

- Messages

- 10,752

- Likes

- 1,863

I'm going to try a variation on the old Wot Happened Next? threads, but I hope it doesn't fall into the same disarray as those.

This time it's about trade management - it doesn't really matter if you recognise the instrument but try not to track it down - and how one goes about doing that as the story unfolds. It doesn't matter whether you agree with the entry tactics or not - just take it that you're in and have to manage it from there.

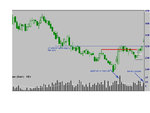

Right, the scenario is that this instrument has been in downtrend for some time but you like the apparently strong upward move that takes the price above the last swing high resistance level (which itself stalled at the level of nine candles earlier). You resolve to buy any pullback and enter at 292 (white line) with a stoploss at 272 (black line).

The price progresses and then prints a shooting star - the last candle.

So how's your thinking? Gonna take your profit and run, or part of it, lift your stop (to where), set any limit targets, or what.

Over to you - Wot Next?

Wot Next?

This time it's about trade management - it doesn't really matter if you recognise the instrument but try not to track it down - and how one goes about doing that as the story unfolds. It doesn't matter whether you agree with the entry tactics or not - just take it that you're in and have to manage it from there.

Right, the scenario is that this instrument has been in downtrend for some time but you like the apparently strong upward move that takes the price above the last swing high resistance level (which itself stalled at the level of nine candles earlier). You resolve to buy any pullback and enter at 292 (white line) with a stoploss at 272 (black line).

The price progresses and then prints a shooting star - the last candle.

So how's your thinking? Gonna take your profit and run, or part of it, lift your stop (to where), set any limit targets, or what.

Over to you - Wot Next?

Wot Next?