Recently, I encountered what I would call a "shady" situation involving a Forex Broker. If you dont trade OANDA, then chances are you may have missed something very unusual. On Sunday, June 20th at around 1715 hrs. the GBPAUD spiked up approximately 1000 pips. As a result of this spike I was subsequently stopped out of four trades. Trades I had set up for about a month from now because the GBPAUD just doesn't spike like this.

First thing I did was ask other traders what they thought? "OMG" was one answer, but apart from that I had several answers in which the person "shot from the hip" so to speak. "Well, these things happen" or "probably a data problem" said a prominent OTA instructor. My point being traders who generally don't trade Forex Pairs, seem to have this defensive attitude if/when you say anything about the Brokers. We seem to forget the "Brokers" are not doing this to help us. They are there to take our money.

When I contacted OANDA, I was told they were investigating it. They later said they had an issue with all GBP pairs. But what was odd was I was also in the GBPUSD and the GBPJPY at the same time. No spikes there, at least not 1000 pips.

They did reimburse me, but I still have questions as to why and how - if as we are taught- the market truly moves on supply and demand (as well as geographical events) how and why did the market decide to do its own thing that Sunday evening? What this suggests to me is Brokers have much more lead-way then we can imagine. Why don't they do it more often? Because people would leave by the thousands. Who would trade something if they knew it was being corrupted? So the Brokers "accommodate" our trading desires.

If I had a nickel for every time someone defends the Forex Brokers when they say "nobody stop hunted you" or there is no such thing as a stop hunt" I would be rich. (Again, a defense made on behalf of people who do not exclusively trade Forex pairs) This event shows they have the ability, independently, to move the charts on their own. And because of this "license to adjust" they do not have to honor supply and demand, trendlines, or any type of TA. No centralized price means you trade what THEY offer you, not the market.

On the other hand, "what if" someone, a friend of a friend of a friend, had an order at 1.95 area and was able to ride it down? "O that can't happen" says the same person who believe Currencies are not manipulated. If the event is never investigated by the right people, then who will know either way?

What I hope to get across to the reader is the Forex Brokers can act as criminals with badges. I have often said, most of the traders who say they make all kinds of money on Forex; 1) do not exclusively trade Forex but also trade other assets or 2) sell Forex "education" or 3) sell Forex indicators. In other words their income is based on other opportunities. If there are traders who make money from Forex pairs, I would submit to you THEY do not get margin calls from trading 50-1 (thank you OANDA) and/or they have sufficient drawdown to accommodate remaining in the trade. But, for the little guys like my family, we often times watch as we get stopped out only to see the trade go in the direction we had anticipated and hit the target we also anticipated.

If they can move a market 1000 pips with not one word of criticism or ridicule or enforcement, why cant they take out trades by means of stopping us out? Someone may ask "why take out our trades?" So they can collect more and move more. It is all about the money for them. And what they cant get the first round, they will pick up shortly after that. Do we really think they are happy with moving 50, 000 when they can take another 20,000 by simply stopping us out and inheriting ours at a better price?

As I usually do, I want to end with something an acquaintance told me. He said

"A very well know futures trader told me many years ago don't trade Forex for these reasons:

1) It's a dishonest market

2) No centralized exchange

3) It's not regulated

4) If the dealer/broker goes out of business, you can lose everything in your account

3) Dealers/brokers trade against you

4) The dealer gets to see your cards (they see the complete order book and you don't). This is like playing poker with someone that gets to see your cards but you cannot see there cards."

All I can say is I cannot wait to start trading Stocks and Futures. Isn't it nice that an asset traded by someone in England has the same price as someone trading in Thailand, is the same price as someone trading in the USA? I think so. And this centralized pricing sort of helps ensure TA, supply and demand and trendlines are respected. Not so in Forex. Forex Brokers create the prices.

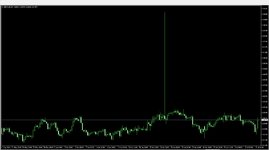

I attached a copy of the spike for your viewing pleasure.

First thing I did was ask other traders what they thought? "OMG" was one answer, but apart from that I had several answers in which the person "shot from the hip" so to speak. "Well, these things happen" or "probably a data problem" said a prominent OTA instructor. My point being traders who generally don't trade Forex Pairs, seem to have this defensive attitude if/when you say anything about the Brokers. We seem to forget the "Brokers" are not doing this to help us. They are there to take our money.

When I contacted OANDA, I was told they were investigating it. They later said they had an issue with all GBP pairs. But what was odd was I was also in the GBPUSD and the GBPJPY at the same time. No spikes there, at least not 1000 pips.

They did reimburse me, but I still have questions as to why and how - if as we are taught- the market truly moves on supply and demand (as well as geographical events) how and why did the market decide to do its own thing that Sunday evening? What this suggests to me is Brokers have much more lead-way then we can imagine. Why don't they do it more often? Because people would leave by the thousands. Who would trade something if they knew it was being corrupted? So the Brokers "accommodate" our trading desires.

If I had a nickel for every time someone defends the Forex Brokers when they say "nobody stop hunted you" or there is no such thing as a stop hunt" I would be rich. (Again, a defense made on behalf of people who do not exclusively trade Forex pairs) This event shows they have the ability, independently, to move the charts on their own. And because of this "license to adjust" they do not have to honor supply and demand, trendlines, or any type of TA. No centralized price means you trade what THEY offer you, not the market.

On the other hand, "what if" someone, a friend of a friend of a friend, had an order at 1.95 area and was able to ride it down? "O that can't happen" says the same person who believe Currencies are not manipulated. If the event is never investigated by the right people, then who will know either way?

What I hope to get across to the reader is the Forex Brokers can act as criminals with badges. I have often said, most of the traders who say they make all kinds of money on Forex; 1) do not exclusively trade Forex but also trade other assets or 2) sell Forex "education" or 3) sell Forex indicators. In other words their income is based on other opportunities. If there are traders who make money from Forex pairs, I would submit to you THEY do not get margin calls from trading 50-1 (thank you OANDA) and/or they have sufficient drawdown to accommodate remaining in the trade. But, for the little guys like my family, we often times watch as we get stopped out only to see the trade go in the direction we had anticipated and hit the target we also anticipated.

If they can move a market 1000 pips with not one word of criticism or ridicule or enforcement, why cant they take out trades by means of stopping us out? Someone may ask "why take out our trades?" So they can collect more and move more. It is all about the money for them. And what they cant get the first round, they will pick up shortly after that. Do we really think they are happy with moving 50, 000 when they can take another 20,000 by simply stopping us out and inheriting ours at a better price?

As I usually do, I want to end with something an acquaintance told me. He said

"A very well know futures trader told me many years ago don't trade Forex for these reasons:

1) It's a dishonest market

2) No centralized exchange

3) It's not regulated

4) If the dealer/broker goes out of business, you can lose everything in your account

3) Dealers/brokers trade against you

4) The dealer gets to see your cards (they see the complete order book and you don't). This is like playing poker with someone that gets to see your cards but you cannot see there cards."

All I can say is I cannot wait to start trading Stocks and Futures. Isn't it nice that an asset traded by someone in England has the same price as someone trading in Thailand, is the same price as someone trading in the USA? I think so. And this centralized pricing sort of helps ensure TA, supply and demand and trendlines are respected. Not so in Forex. Forex Brokers create the prices.

I attached a copy of the spike for your viewing pleasure.

Attachments

Last edited: