Finding a good entry, stop and target is fundamentally the most important aspect of trading and investing in any market, not just Forex. I have found over my years of teaching that when I introduce people to core strategies, they rarely ever want to use any of the other tools along with it because price will tell you all you need to know, if you learn to read it objectively. It will provide you with the clearest picture of the market and allow you to set stop losses, targets and entries without emotion and with controlled discipline. If you can learn to listen to what a price chart is really telling you rather than getting yourself caught up in unprofitable guesswork, you are, without doubt, on the right path to consistency in your trade plan. Learning to listen to price over your gut feelings is always the smartest approach to take.

It is for this reason that the teaching curriculum focuses on core strategies above all else. We look objectively at the price chart to recognize opportunities where imbalances are present between supply and demand. When these imbalances are present, we call this a supply or demand level. More importantly still, is that these levels are typically created by the most profitable banks and institutions so it makes good sense to the look at the market through their eyes and look to buy and sell when they do. The levels give us our entries and risk management parameters of the trades available.

First, we teach about supply and demand zones, above all else we show how to define the entry and what picture we specifically look for on the chart, as well as to identify stop and target exits. As is often the case though, with traders and those who are learning to trade the markets, sometimes people get so caught up in finding an entry that they neglect the exit. Think about this for a second: what is the point of getting into a trade if you have no idea how to get out of it for profit. The stop loss takes care of itself, but the profit target can sometimes be the most challenging aspect of all, which is ironic considering that we are all trading to make money in the first place. When you ask yourself, “Where do I put my profit target?” the answer, as always, is on the price chart itself. The supply and demand levels illuminate your trades and they also help in discovering your targets.

Let’s take a look at a recent example:

You've got your entry and your stop loss, but don't forget to plan your exit.

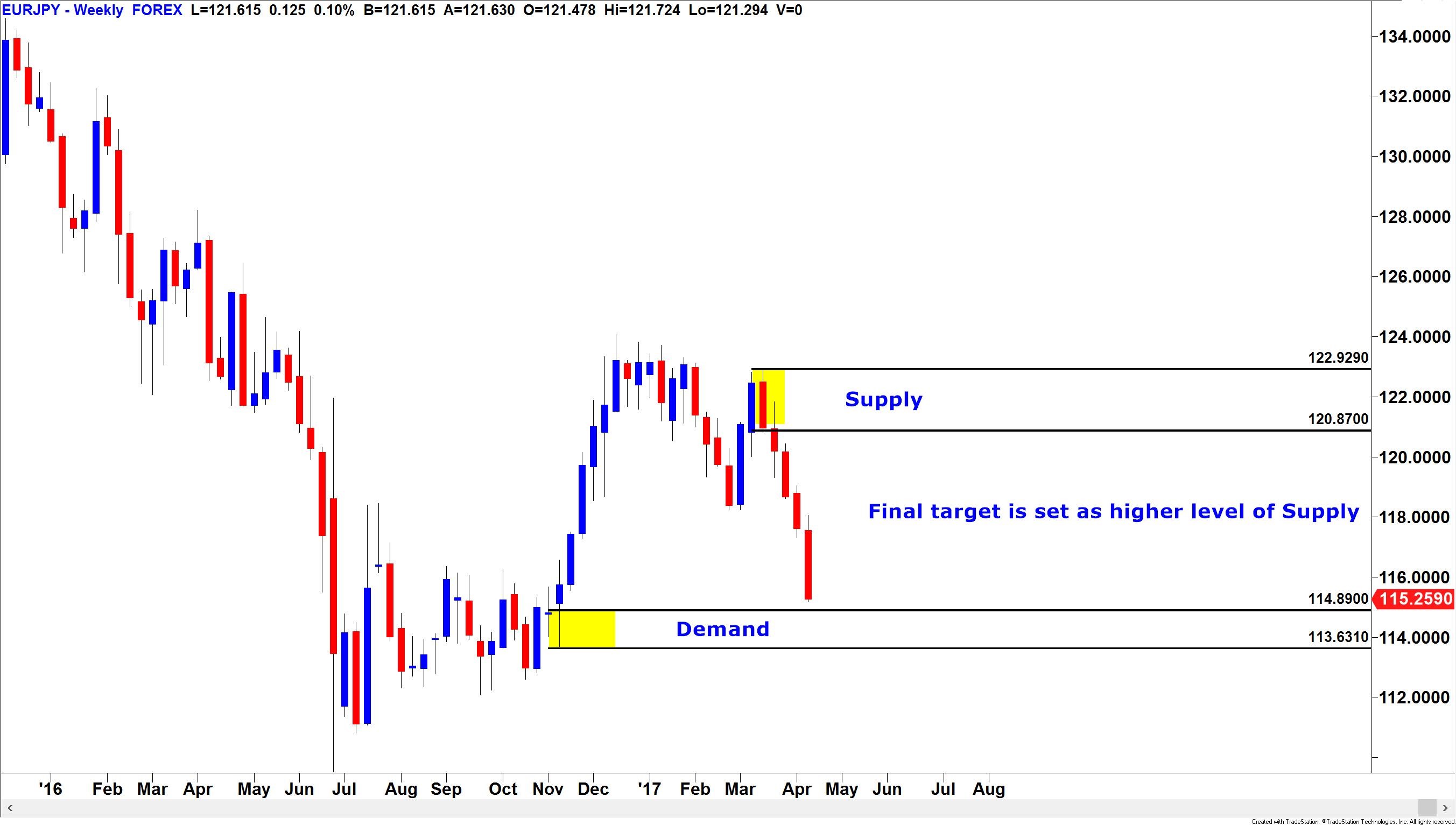

This is a weekly time frame of the EURJPY currency pair. You can see in this example, that we have highlighted a lower area of demand in the price region of around 114.80. This area is attractive to us because there was a large imbalance between the willing buyers and the willing sellers which resulted in a strong move away in price to the upside. Clearly, the big money was trying to buy a lot of Euros at this price.

After seeing this on the chart, I want to be first in the line to buy if the price comes back to that area in the future. I would like to take an entry at the top section of the demand zone and use the lower section as a guide for placing my stop loss in case I am wrong on this buying opportunity. At this point I know where I want to buy and I know where I want to be out if I’m wrong. The only question left unanswered is, what will be my profit target?

Give it some more time and we will know more:

The price chart can tell you all you need to know to plan your trade.

One of the disciplines that a swing trader needs to get used to is having patience. It can often be difficult to wait for a trade to come to you. As you get nearer to the entry, the question is where are you going to get out for profit? Well, let the chart tell you. Notice how there was a very impulsive and strong move to the down side from an area of supply around 120.85? When this drop happened, there were no more pockets of willing sellers left along the way, suggesting that the price should not have too much difficulty eventually getting all the way back up there, assuming the area of demand holds. This trade now offers a very attractive reward to risk ratio profile.

To some, this may look like an ambitious profit target. However, to some traders this is a concept known as the path of least resistance. Some people refer to price as having a memory, and this is that dynamic in play. If the price chart is not telling you that there are any obstacles along the way to stop the market moving in your direction, then simply trust this objectively and trade the market how you find it. The supply zone above highlights where the selling pressure really is. Sure, there is no guarantee that the market will get there, but if you’re working on solid risk to reward ratios during your trade setups then not every single trade has to reach its final target. I always say, “The winners will take care of themselves as will the losers, but only if you use a protective stop order.” You can also have multiple targets and trailing stops if the trade works, to a degree.

Let’s see how things panned out:

The key components to a properly managed trade.

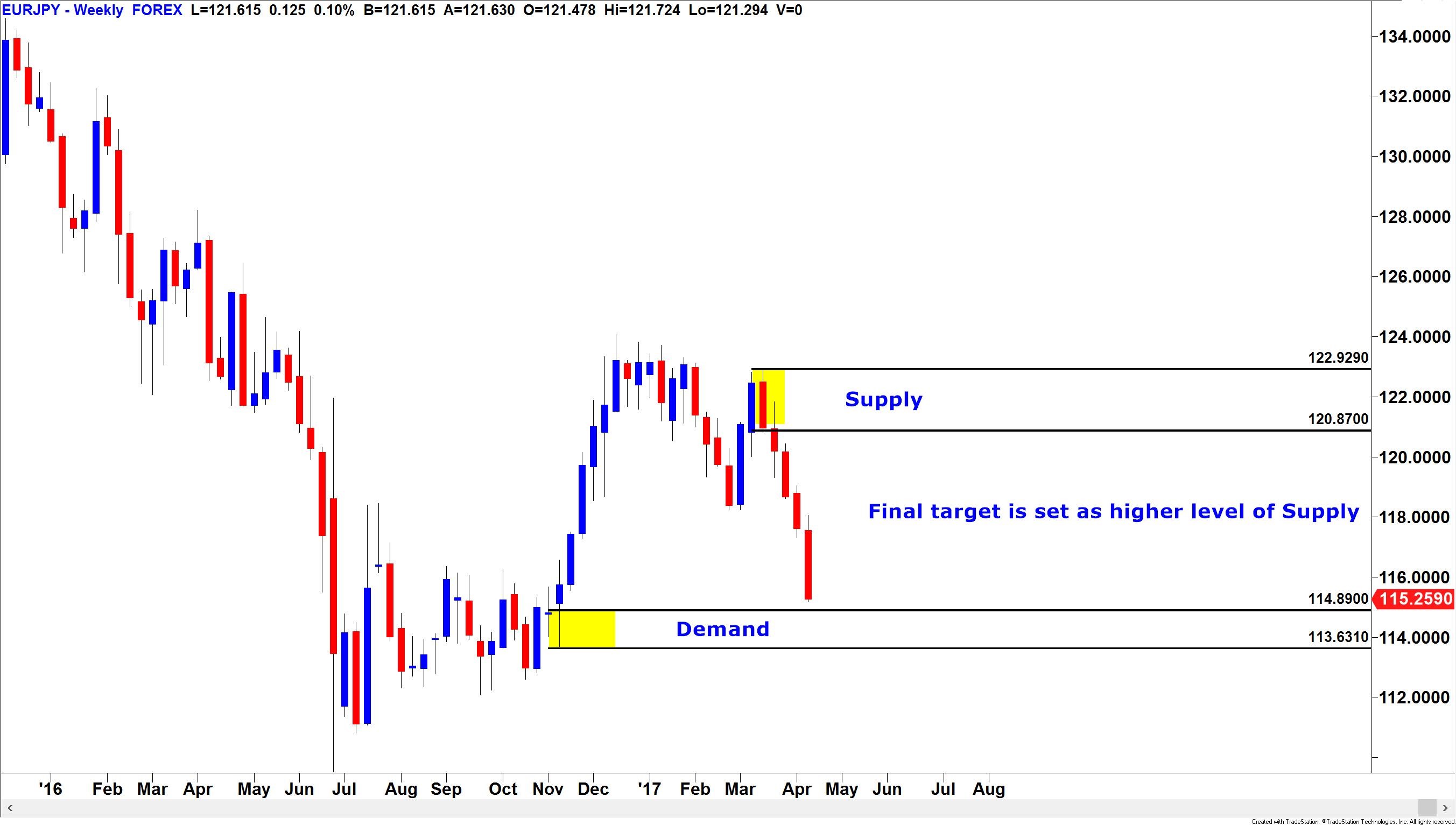

In this final chart snapshot, we can see that as quickly as price fell towards our entry, it pretty much rallied all the way back up to where it came from in the same length of time. As I said before, our core strategy not only tells us when to get in and when to get out for a small loss, but it also tells us when to get out for a profit, but only if we learn to trust the levels we are analyzing.

The more that you learn to set your trades, step away from the charts and allow the market to do its thing, without actually being there to watch it, the more likely you are to have success at trading.

I can put my own hand up and say that I’ve been my greatest enemy in my trading career over the years by taking profits too soon as opposed to trusting the levels which the market is showing me. Build your plan, do your analysis and let the market tell you what to do. That’s the key ingredient to consistency. I hope you found this useful.

Sam Evans can be contacted on this link: Sam Evans

It is for this reason that the teaching curriculum focuses on core strategies above all else. We look objectively at the price chart to recognize opportunities where imbalances are present between supply and demand. When these imbalances are present, we call this a supply or demand level. More importantly still, is that these levels are typically created by the most profitable banks and institutions so it makes good sense to the look at the market through their eyes and look to buy and sell when they do. The levels give us our entries and risk management parameters of the trades available.

First, we teach about supply and demand zones, above all else we show how to define the entry and what picture we specifically look for on the chart, as well as to identify stop and target exits. As is often the case though, with traders and those who are learning to trade the markets, sometimes people get so caught up in finding an entry that they neglect the exit. Think about this for a second: what is the point of getting into a trade if you have no idea how to get out of it for profit. The stop loss takes care of itself, but the profit target can sometimes be the most challenging aspect of all, which is ironic considering that we are all trading to make money in the first place. When you ask yourself, “Where do I put my profit target?” the answer, as always, is on the price chart itself. The supply and demand levels illuminate your trades and they also help in discovering your targets.

Let’s take a look at a recent example:

You've got your entry and your stop loss, but don't forget to plan your exit.

This is a weekly time frame of the EURJPY currency pair. You can see in this example, that we have highlighted a lower area of demand in the price region of around 114.80. This area is attractive to us because there was a large imbalance between the willing buyers and the willing sellers which resulted in a strong move away in price to the upside. Clearly, the big money was trying to buy a lot of Euros at this price.

After seeing this on the chart, I want to be first in the line to buy if the price comes back to that area in the future. I would like to take an entry at the top section of the demand zone and use the lower section as a guide for placing my stop loss in case I am wrong on this buying opportunity. At this point I know where I want to buy and I know where I want to be out if I’m wrong. The only question left unanswered is, what will be my profit target?

Give it some more time and we will know more:

The price chart can tell you all you need to know to plan your trade.

One of the disciplines that a swing trader needs to get used to is having patience. It can often be difficult to wait for a trade to come to you. As you get nearer to the entry, the question is where are you going to get out for profit? Well, let the chart tell you. Notice how there was a very impulsive and strong move to the down side from an area of supply around 120.85? When this drop happened, there were no more pockets of willing sellers left along the way, suggesting that the price should not have too much difficulty eventually getting all the way back up there, assuming the area of demand holds. This trade now offers a very attractive reward to risk ratio profile.

To some, this may look like an ambitious profit target. However, to some traders this is a concept known as the path of least resistance. Some people refer to price as having a memory, and this is that dynamic in play. If the price chart is not telling you that there are any obstacles along the way to stop the market moving in your direction, then simply trust this objectively and trade the market how you find it. The supply zone above highlights where the selling pressure really is. Sure, there is no guarantee that the market will get there, but if you’re working on solid risk to reward ratios during your trade setups then not every single trade has to reach its final target. I always say, “The winners will take care of themselves as will the losers, but only if you use a protective stop order.” You can also have multiple targets and trailing stops if the trade works, to a degree.

Let’s see how things panned out:

The key components to a properly managed trade.

In this final chart snapshot, we can see that as quickly as price fell towards our entry, it pretty much rallied all the way back up to where it came from in the same length of time. As I said before, our core strategy not only tells us when to get in and when to get out for a small loss, but it also tells us when to get out for a profit, but only if we learn to trust the levels we are analyzing.

The more that you learn to set your trades, step away from the charts and allow the market to do its thing, without actually being there to watch it, the more likely you are to have success at trading.

I can put my own hand up and say that I’ve been my greatest enemy in my trading career over the years by taking profits too soon as opposed to trusting the levels which the market is showing me. Build your plan, do your analysis and let the market tell you what to do. That’s the key ingredient to consistency. I hope you found this useful.

Sam Evans can be contacted on this link: Sam Evans

Last edited by a moderator: