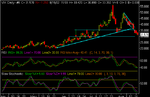

Just updating the chart really, nothing much changed, VIX ended the day only slightly lower -0.25 at 32.82 while indices closing mixed; dow -ve but well off lows indeed half way between hod and lod, nasdaq well +ve though...

So overall a whipsawing and boring day with little intraday TA to guide and double witching adding more to the whipsaw plus being friday putting investors off taking positon over the w/e...

Considering the bad data, fed comments, bankruptcy and war news, market held very well this week unlike a few weeks ago when not only bad news even not enough good news would start a tank...

Market still resisting the downside pressure and signalling it wants to go up first, dow consolidation at highs plus todays vix intraday consolidation at lows suggesting we're getting closer and closer to a break of at least 400 points, the question is which way...my reading is up, this market saying it wants to try up first, thats of course barring extreme bad news...still its a bear market and they tend to have crazy moves, one can never be sure..

In the mean time I'd better add that in spite of trying to read the market on this thread, I still dont take medium or long term position and trade only intraday...I dont trade in anticipation of market direction but only the moves I see occurring...therefore my comments here should be treated as exercise of thoughts and nothing to do with trading or investing advice...

Riz