A Google search on VIX yields some unexpected pages: the name of a Czech rock band, a swim wear catalog and the Vienna Internet Exchange. Interesting stuff, but not quite what we had in mind. The CBOE's VIX is a popular market-timing indicator. Let's take a look at how VIX is constructed and how investors can use it to evaluate U.S. equity markets.

What Is the VIX?

VIX is the symbol for the Chicago Board Options Exchange's volatility index. It is a measure of the level of implied volatility, not historical or statistical volatility, of a wide range of options, based on the S&P 500. This indicator is known as the "investor fear gauge," because it reflects investors' best predictions of near-term market volatility , or risk. In general, VIX starts to rise during times of financial stress and lessens as investors become complacent. It is the market's best prediction of near-term market volatility.

Implied volatility is the expected volatility of the underlying, in this case a wide range of options on the S&P 500 Index. It represents the level of price volatility implied by the option markets, not the actual or historical volatility of the index itself. If implied volatility is high, the premium on options will be high and vice versa. Generally speaking, rising option premiums, if we assume all other variables remain constant, reflect rising expectation of future volatility of the underlying stock index, which represents higher implied volatility levels.

VIX and Stock Market Behavior

While there are other factors at work, in most cases, a high VIX reflects increased investor fear and a low VIX suggests complacency. Historically, this pattern in the relationship between the VIX and the behavior of the stock market, has repeated itself in bull and bear cycles, patterns we will look at in more detail below. During periods of market turmoil, the VIX spikes higher, largely reflecting the panic demand for OEX puts as a hedge against further declines in stock portfolios. During bullish periods, there is less fear and, therefore, less need for portfolio managers to purchase puts.

By measuring investor fear levels tick by tick, and day by day, the VIX, like many emotional gauges such as put/call ratio and sentiment surveys, can be used as a contrary opinion tool in attempting to pinpoint market tops and bottoms on a medium-term basis. There are two ways to use the VIX in this manner: The first is to look at the actual level of the VIX to determine its stock-market implications. Another approach involves looking at ratios comparing the current level to the long-term moving average of the VIX. This second method, known as de-trending, helps to remove long-term trends in the VIX, providing a more stable reading in the form of an oscillator.

When the Measures of Fear Show No Investor Fear

Let's take a closer look at some numbers for the VIX, to see what the option markets tell us about the stock market and mood of the investing crowd.

Figure 1 - Daily VIX Oscillator with S&P500

Source: MetaStock Professional.

Although Figure 1 is from several years ago it shows the VIX in the summer months flirting with extreme lows, dipping to near or below 20 (arrow 1). A look at Figure 2 should be an eye opener, as it shows that each time the VIX has declined below 20, a major sell-off has taken place shortly after. Whenever the VIX dips below 20, the stock market marks a medium-term top. As the VIX is breaking below 20 in Figure 1, it indicates that the investment crowd is extremely complacent about the current outlook, having little reason to worry.

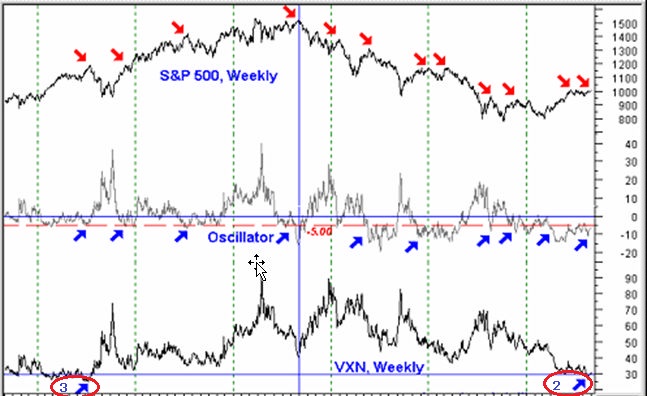

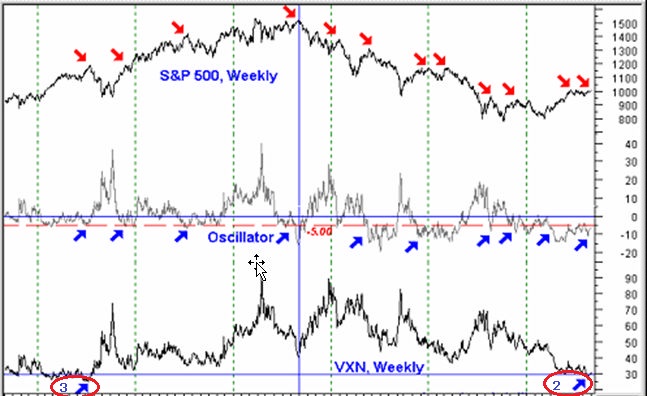

Figure 2 - Daily VXN Oscillator with S&P500

Source: MetaStock Professional.

It's interesting to note that the VXN, which is the symbol for the implied volatility index of the Nasdaq 100 index, is even more bearish at the end of the summer marked by the far right arrow 2. In Figure 2, the VXN, which is calculated the same way as the VIX, dropped to levels not seen since the complacent summer of 5 years earlier marked by the left arrow 3, when the VXN was below 29.5. A major sell-off had ensued almost immediately.

Moreover, de-trended oscillator levels below -5.00 (same for the VIX), generally precede a sell-off, although sometimes this indication of the sell-off may be early, which might have been the case for the arrow 3 readings. In fact, the stock indexes appeared to be levitating, given the low readings on the VIX and VXN at that time, as seen in the bear-like S&P pattern on the charts in Figures 1 and 2.

At that time it was certainly reasonable to expect stock averages to move higher still, but also for them to be accompanied by even lower VXN and VIX levels. History shows, however, that complacent investors may be punished with falling prices, unless they heed the warnings of this quite reliable indicator.

In Summary

Remember, there is a risk of loss with trading options and futures, so trade with risk capital only and that past performance does not guarantee future results.

Dr John Summa can be contacted at OptionsNerd LLC

What Is the VIX?

VIX is the symbol for the Chicago Board Options Exchange's volatility index. It is a measure of the level of implied volatility, not historical or statistical volatility, of a wide range of options, based on the S&P 500. This indicator is known as the "investor fear gauge," because it reflects investors' best predictions of near-term market volatility , or risk. In general, VIX starts to rise during times of financial stress and lessens as investors become complacent. It is the market's best prediction of near-term market volatility.

Implied volatility is the expected volatility of the underlying, in this case a wide range of options on the S&P 500 Index. It represents the level of price volatility implied by the option markets, not the actual or historical volatility of the index itself. If implied volatility is high, the premium on options will be high and vice versa. Generally speaking, rising option premiums, if we assume all other variables remain constant, reflect rising expectation of future volatility of the underlying stock index, which represents higher implied volatility levels.

VIX and Stock Market Behavior

While there are other factors at work, in most cases, a high VIX reflects increased investor fear and a low VIX suggests complacency. Historically, this pattern in the relationship between the VIX and the behavior of the stock market, has repeated itself in bull and bear cycles, patterns we will look at in more detail below. During periods of market turmoil, the VIX spikes higher, largely reflecting the panic demand for OEX puts as a hedge against further declines in stock portfolios. During bullish periods, there is less fear and, therefore, less need for portfolio managers to purchase puts.

By measuring investor fear levels tick by tick, and day by day, the VIX, like many emotional gauges such as put/call ratio and sentiment surveys, can be used as a contrary opinion tool in attempting to pinpoint market tops and bottoms on a medium-term basis. There are two ways to use the VIX in this manner: The first is to look at the actual level of the VIX to determine its stock-market implications. Another approach involves looking at ratios comparing the current level to the long-term moving average of the VIX. This second method, known as de-trending, helps to remove long-term trends in the VIX, providing a more stable reading in the form of an oscillator.

When the Measures of Fear Show No Investor Fear

Let's take a closer look at some numbers for the VIX, to see what the option markets tell us about the stock market and mood of the investing crowd.

Figure 1 - Daily VIX Oscillator with S&P500

Source: MetaStock Professional.

Although Figure 1 is from several years ago it shows the VIX in the summer months flirting with extreme lows, dipping to near or below 20 (arrow 1). A look at Figure 2 should be an eye opener, as it shows that each time the VIX has declined below 20, a major sell-off has taken place shortly after. Whenever the VIX dips below 20, the stock market marks a medium-term top. As the VIX is breaking below 20 in Figure 1, it indicates that the investment crowd is extremely complacent about the current outlook, having little reason to worry.

Figure 2 - Daily VXN Oscillator with S&P500

Source: MetaStock Professional.

It's interesting to note that the VXN, which is the symbol for the implied volatility index of the Nasdaq 100 index, is even more bearish at the end of the summer marked by the far right arrow 2. In Figure 2, the VXN, which is calculated the same way as the VIX, dropped to levels not seen since the complacent summer of 5 years earlier marked by the left arrow 3, when the VXN was below 29.5. A major sell-off had ensued almost immediately.

Moreover, de-trended oscillator levels below -5.00 (same for the VIX), generally precede a sell-off, although sometimes this indication of the sell-off may be early, which might have been the case for the arrow 3 readings. In fact, the stock indexes appeared to be levitating, given the low readings on the VIX and VXN at that time, as seen in the bear-like S&P pattern on the charts in Figures 1 and 2.

At that time it was certainly reasonable to expect stock averages to move higher still, but also for them to be accompanied by even lower VXN and VIX levels. History shows, however, that complacent investors may be punished with falling prices, unless they heed the warnings of this quite reliable indicator.

In Summary

Remember, there is a risk of loss with trading options and futures, so trade with risk capital only and that past performance does not guarantee future results.

Dr John Summa can be contacted at OptionsNerd LLC

Last edited by a moderator: