2be

Senior member

- Messages

- 2,083

- Likes

- 370

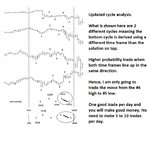

Thank you, as usual you have put a good amount of work and thoughts in working out the cycle solution.Here is cycle analysis for the next 30 days. Looking for up move for next week as a general bias.

I was mainly shorting DOW today, and have been very conservative with the PT.

Posted some trades today, and tried to explain the reasons for entries and exits, otherwise posts are less useful.

Actually IMHO posting while trading is adding more stress to myself, and I would not encourage others to do so.

Occasional live call is ok, but I do not expect other traders to spend so much effort which IMHO is , or can be distraction.

I find it difficult to explain it all on this forum, and certainly more difficult to do it while actively trading.

Some parts are less likely to be of use to others, and other details might be more problematic, but rest assured I do NOT claim to have some special tool, indicator or knowledge, apart of what is publicly available in books, articles and the like.

Good preparation before the session is very important, just as being calm, generally rested and well focused during trading is also essential.

It is impossible to eliminate the risk however much effort one is prepared to waste on trying to do so, but it does not mean that the risk is not to be managed.

Posted S&P and DOW after US session close, with some levels for Monday.

Good weekend to all,

"be

Attachments

Last edited: