I funded my Nadex account with a little bit of money and look to trade stock indexes using my cycle analysis. Already 2 good trades today.

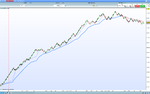

Here is my cycle work right now. Looking for a slight down move mid week, but most money will be made on the long side I believe.

Here is my cycle work right now. Looking for a slight down move mid week, but most money will be made on the long side I believe.

Attachments

Last edited: