neil

Legendary member

- Messages

- 5,169

- Likes

- 754

Hi Traders,

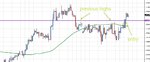

Fortunately I wasn't awake for this one but if I was I would have taken a hit. It triggered during the night and got about 30 pips up and then reversed. Then the Manufacturing PMI sent price a bit crazy. The opportunity seems over for now. 1.5500 would need to be broken to persuade me to think about getting in short.

I attached a 5min chart.

Good trading

Nigel

Is this trade with the 3ducks sytem?

Where is the chart for the other time frames?

Why did you not enter on the first break of the 5 minute 60ema line - can you show where the time frames lined up where you took the trade?