Mr Flibble

Well-known member

- Messages

- 371

- Likes

- 20

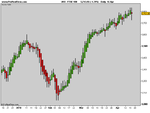

Yes its in a nice channel ideal for me boring for the chaps playing it long. Price is now sitting just above resistance based on that channel. Its pretty much make or break now if we go down again then I'll make some more money. Wall, are you talking about the MA crossover? Would this be the signal for the longs here to think about reversing their positions?