SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

Brent Crude Oil market insight by Solid ECN Securities

Oil awaiting the US inventory statistics

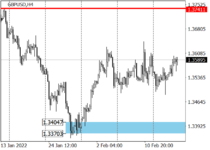

Benchmark Brent Crude Oil prices are correcting downwards after closing at more than seven-year highs on Monday, retreating from a yearly high of $95 per barrel and currently trading just above $91. The correction in the asset is supported by reports about the withdrawal of part of the Russian troops from the border with Ukraine.

Also, investors are awaiting statistics on weekly inventories from the Energy Information Administration (EIA) after the American Petroleum Institute (API) reported a reduction in the figure by 1.076M barrels, which was below the expected value. According to preliminary forecasts, the EIA will record a decrease in inventories, which may increase pressure on asset quotes.

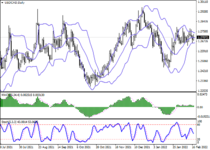

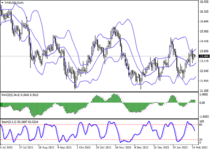

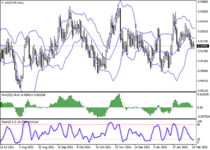

Support and resistance

The instrument moves within the Expanding formation global pattern on the global chart, having reached the resistance line. Technical indicators hold a weakening buy signal: indicator Alligator's EMA fluctuations range narrows, and the AO oscillator histogram forms local bars with a downward trend in the buy zone.

Resistance levels: 93, 95.38.

Support levels: 89.72, 85.32.

Oil awaiting the US inventory statistics

Benchmark Brent Crude Oil prices are correcting downwards after closing at more than seven-year highs on Monday, retreating from a yearly high of $95 per barrel and currently trading just above $91. The correction in the asset is supported by reports about the withdrawal of part of the Russian troops from the border with Ukraine.

Also, investors are awaiting statistics on weekly inventories from the Energy Information Administration (EIA) after the American Petroleum Institute (API) reported a reduction in the figure by 1.076M barrels, which was below the expected value. According to preliminary forecasts, the EIA will record a decrease in inventories, which may increase pressure on asset quotes.

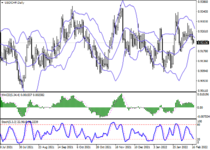

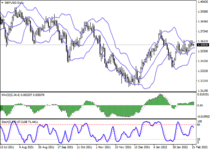

Support and resistance

The instrument moves within the Expanding formation global pattern on the global chart, having reached the resistance line. Technical indicators hold a weakening buy signal: indicator Alligator's EMA fluctuations range narrows, and the AO oscillator histogram forms local bars with a downward trend in the buy zone.

Resistance levels: 93, 95.38.

Support levels: 89.72, 85.32.