SOLIDECN

Senior member

- Messages

- 3,041

- Likes

- 0

USDCHF market insights by Solid ECN

The US currency received an impetus to grow

The US dollar shows active growth against the Swiss franc during the Asian session, testing 0.927 for a breakout. The day before, the instrument had already attempted a steady growth and even updated local highs from January 31 near the level of 0.93, but the dollar failed to consolidate on new highs.

Considerable support for the US currency is provided by macroeconomic statistics from the US on consumer inflation published the day before. In January, the Consumer Price Index rose by 0.6% in monthly terms and by 7.5% in annual terms, which turned out to be stronger than market forecasts at 0.5% and 7.3%, respectively. Consumer inflation excluding Food and Energy over the same period increased by 0.6% MoM and by 6% YoY, which also turned out to be higher than the growth by 0.1% projected in both cases.

Today, investors are awaiting the publication of Consumer Price Index in Switzerland for January. Market forecasts suggest that the rate of price growth will remain at the level of 1.5%.

Support and resistance

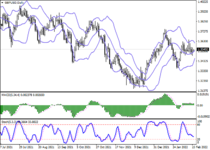

Bollinger Bands on the daily chart show a steady increase. The price range is narrowing, pointing at the ambiguous nature of trading in the short/medium term. MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). Stochastic, approaching the level of "80" reversed into a downward plane and so far practically does not react to the appearance of upward dynamics.

Resistance levels: 0.9276, 0.93, 0.9341, 0.9372.

Support levels: 0.926, 0.922, 0.92, 0.9177.

The US currency received an impetus to grow

The US dollar shows active growth against the Swiss franc during the Asian session, testing 0.927 for a breakout. The day before, the instrument had already attempted a steady growth and even updated local highs from January 31 near the level of 0.93, but the dollar failed to consolidate on new highs.

Considerable support for the US currency is provided by macroeconomic statistics from the US on consumer inflation published the day before. In January, the Consumer Price Index rose by 0.6% in monthly terms and by 7.5% in annual terms, which turned out to be stronger than market forecasts at 0.5% and 7.3%, respectively. Consumer inflation excluding Food and Energy over the same period increased by 0.6% MoM and by 6% YoY, which also turned out to be higher than the growth by 0.1% projected in both cases.

Today, investors are awaiting the publication of Consumer Price Index in Switzerland for January. Market forecasts suggest that the rate of price growth will remain at the level of 1.5%.

Support and resistance

Bollinger Bands on the daily chart show a steady increase. The price range is narrowing, pointing at the ambiguous nature of trading in the short/medium term. MACD indicator is growing, while preserving a rather stable buy signal (located above the signal line). Stochastic, approaching the level of "80" reversed into a downward plane and so far practically does not react to the appearance of upward dynamics.

Resistance levels: 0.9276, 0.93, 0.9341, 0.9372.

Support levels: 0.926, 0.922, 0.92, 0.9177.