alexwinkler

Experienced member

- Messages

- 1,308

- Likes

- 17

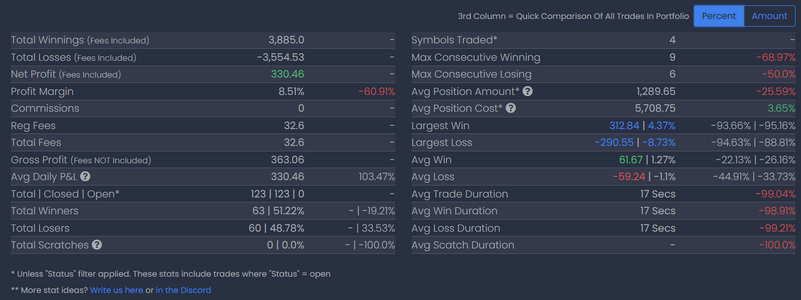

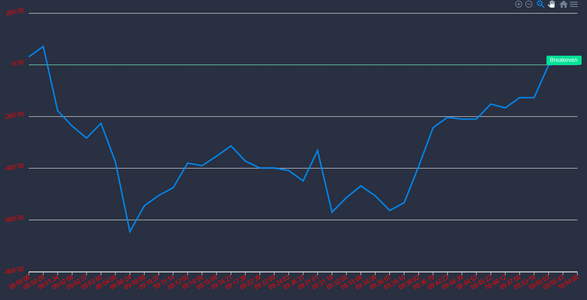

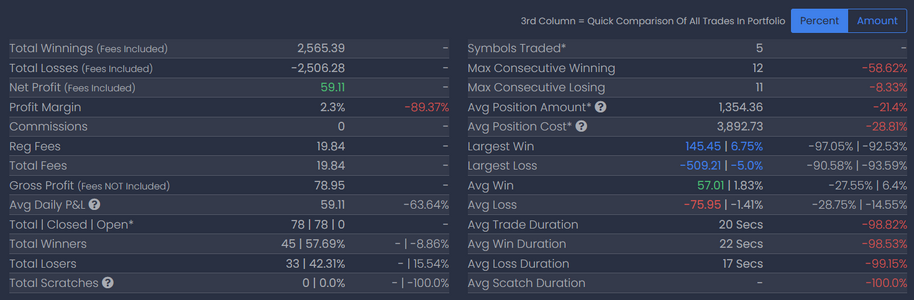

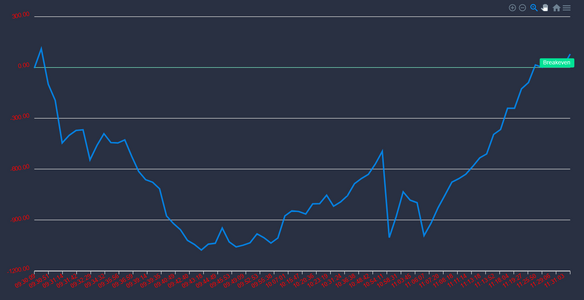

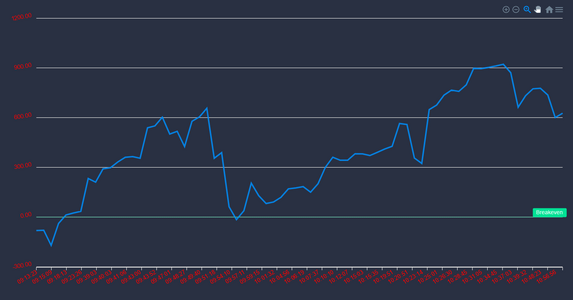

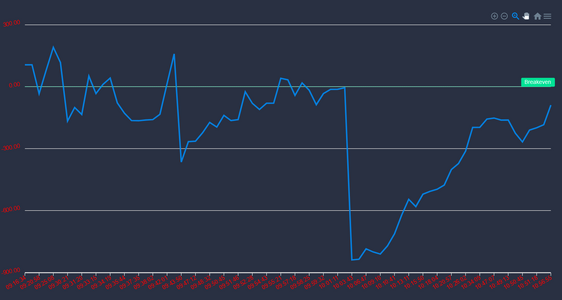

Rough end to the week for me. I’ve felt a little under the weather for the last 2 days. Maybe that messed up my trading. I was slow to place orders and often missed fills by just a hair. You see it in my replays very clearly.

That often put me on tilt. Which caused me to chase where I would have been selling, often resulting in getting stuck in a flush.

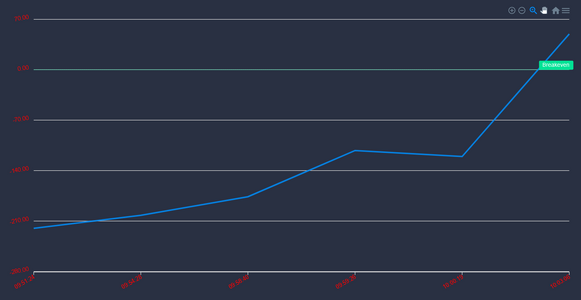

The opportunities were there this week although it was choppy. Definitely could have done better but I could make back this week's losses in one solid trade or 2 base hits. Clearing my mind this weekend and coming back feeling fresh will be important.

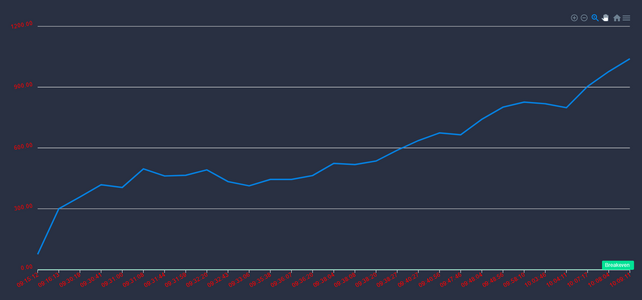

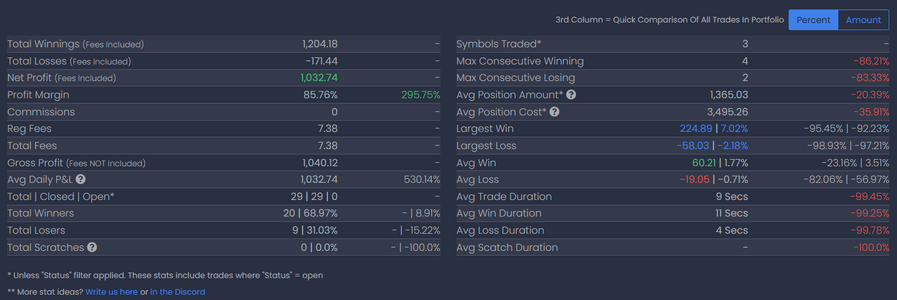

All it takes is 1 week or 1-3 days per month to make the whole month. Got to focus on the good:

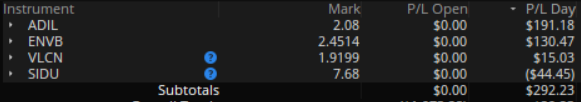

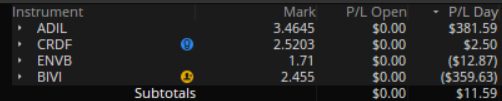

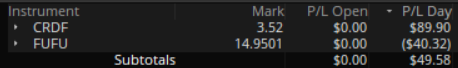

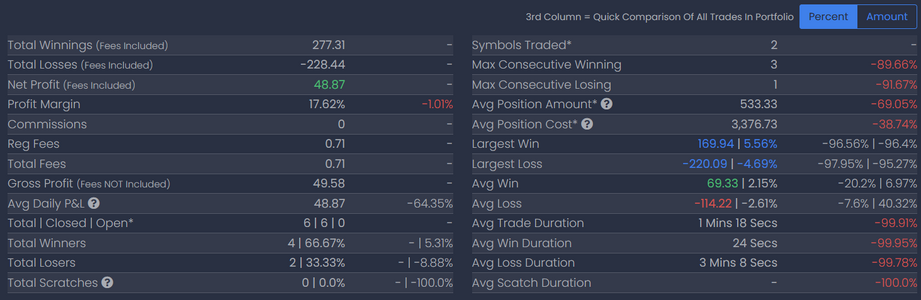

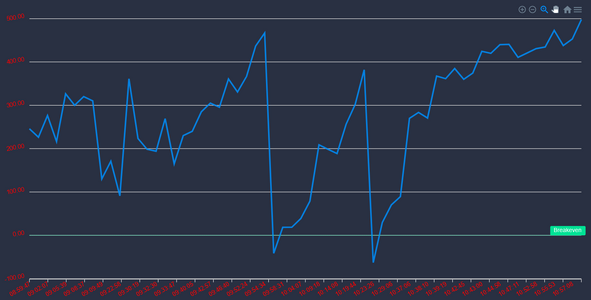

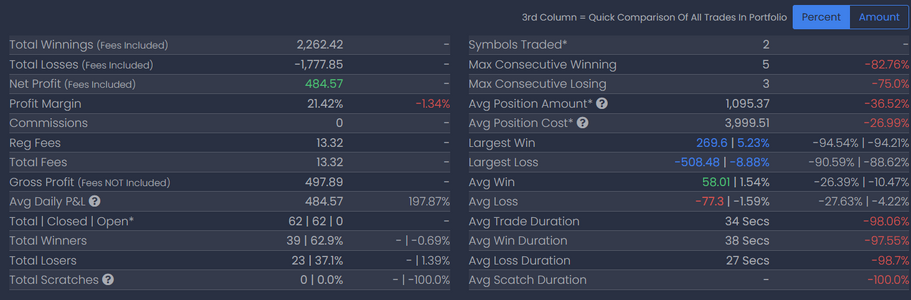

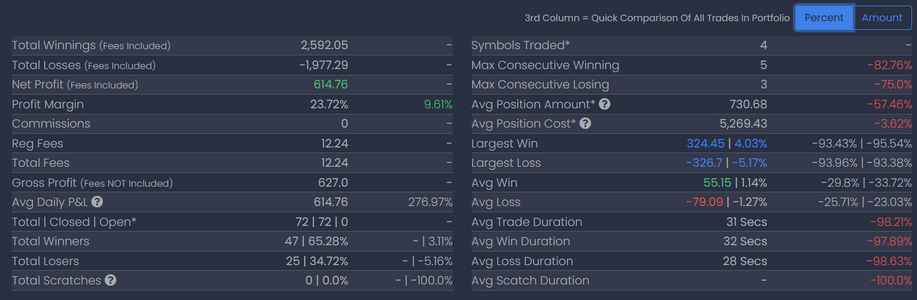

- Still green on the month

- 22.38% Inc. of my portfolio Avg Position Cost

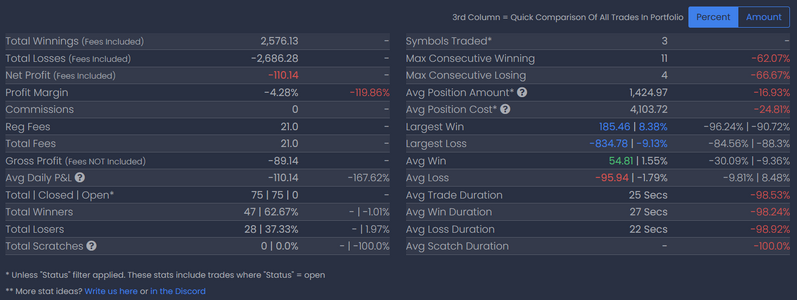

-- I'm sizing more; experiencing growing pains

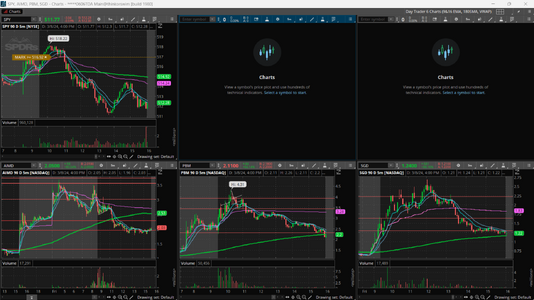

In today's recap. I'll keep it simple. Want to show what not to do on a RTG move / Morning Panic 😅

#TopGainers

$TOP $SUNW $INBS $NSTG

That often put me on tilt. Which caused me to chase where I would have been selling, often resulting in getting stuck in a flush.

The opportunities were there this week although it was choppy. Definitely could have done better but I could make back this week's losses in one solid trade or 2 base hits. Clearing my mind this weekend and coming back feeling fresh will be important.

All it takes is 1 week or 1-3 days per month to make the whole month. Got to focus on the good:

- Still green on the month

- 22.38% Inc. of my portfolio Avg Position Cost

-- I'm sizing more; experiencing growing pains

In today's recap. I'll keep it simple. Want to show what not to do on a RTG move / Morning Panic 😅

#TopGainers

$TOP $SUNW $INBS $NSTG