alexwinkler

Experienced member

- Messages

- 1,308

- Likes

- 17

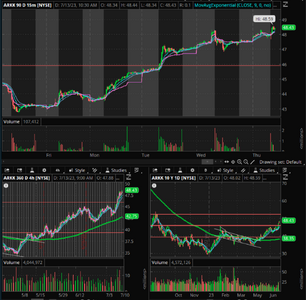

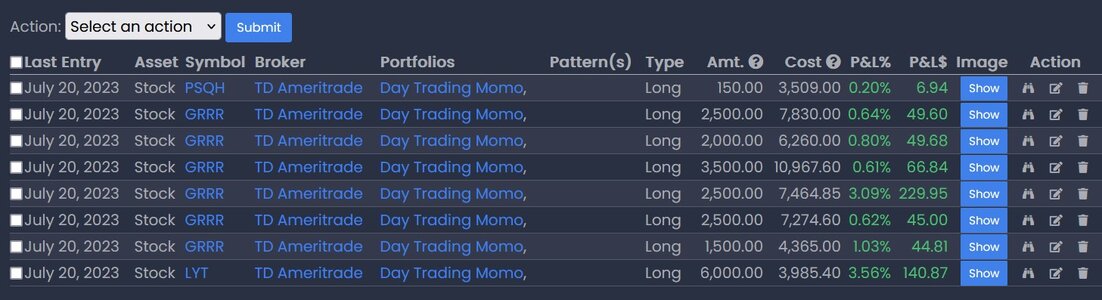

Indexes / Top Gainers: $SPY rallies strong on #inflation and #CPI numbers coming in below estimates then holds its highs well Extended Hours. Putting the SPY at roughly 16% to 447.13, remember 479.98 is all-time highs (ATH). $RUT also broke out major from the 1900 ceiling it's been consolidating under. Today #PPI MoM drops at 8:30 AM EST. No larges get me too excited, you'd be buying very high. This PM, $SXTP 38% pharma, 6m SO, 26m MC, new #IPO with a 120% rally from open. Could be something not sure..

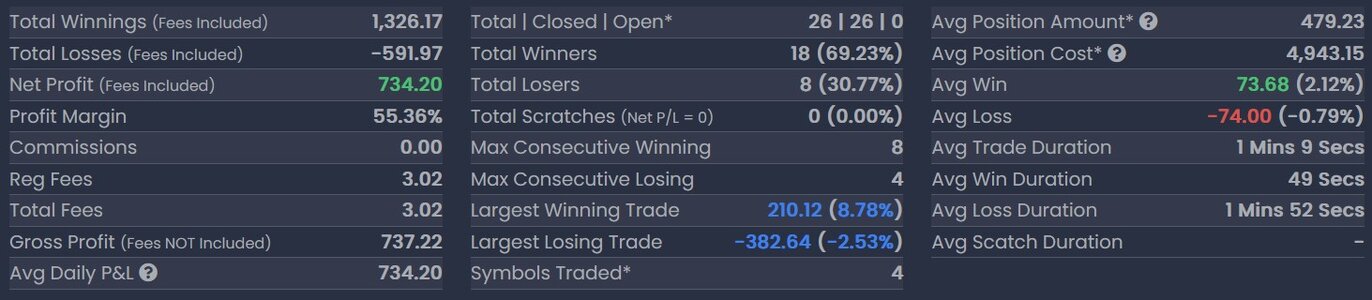

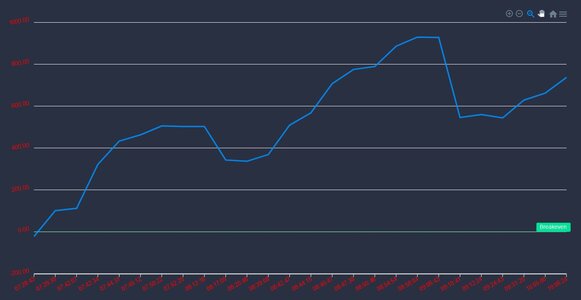

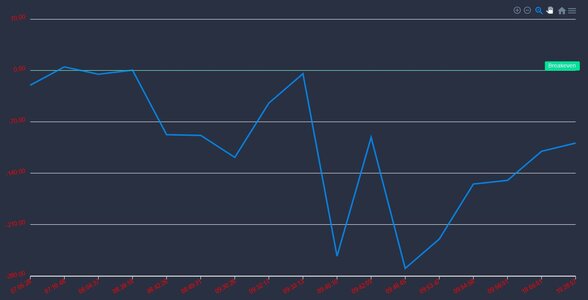

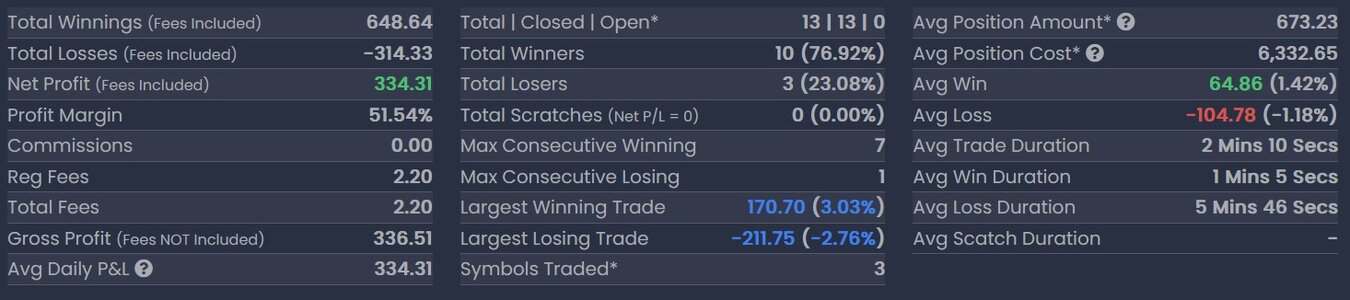

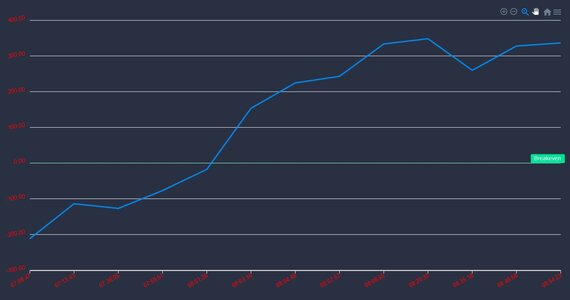

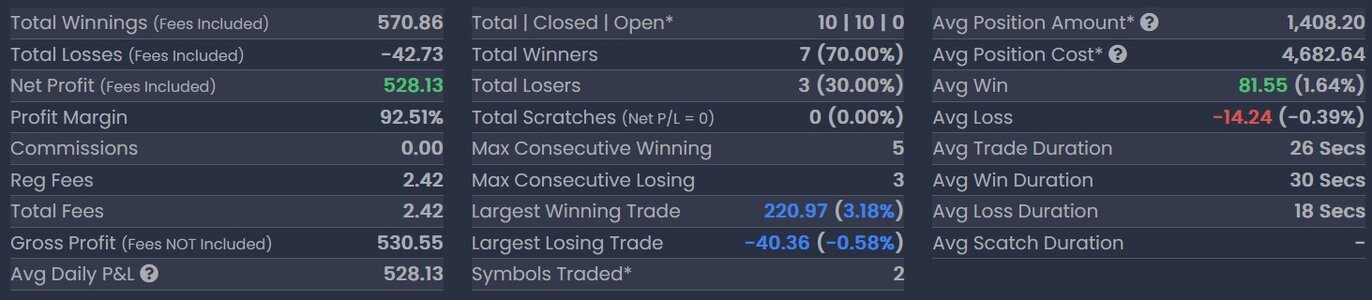

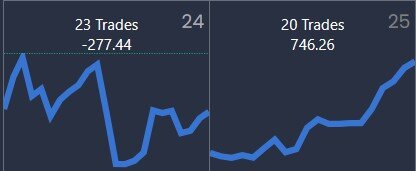

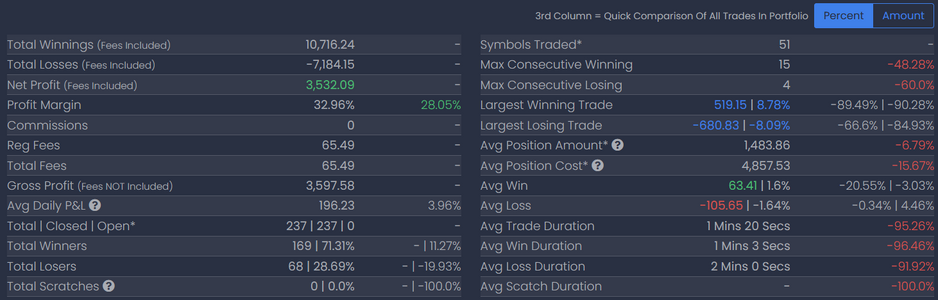

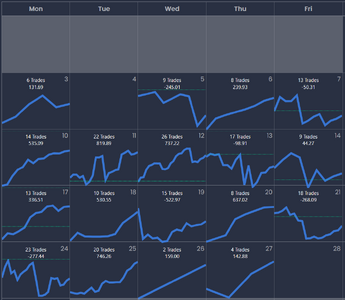

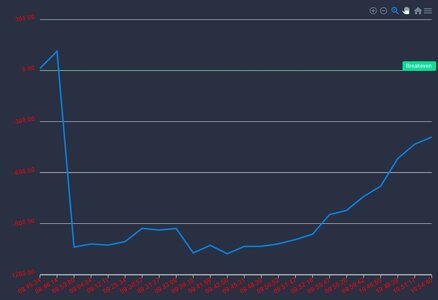

My running P&L / State of Mind: Yesterday I did okay, biggest issue was too big size on my losers: $ R:R was 1:1 while % R:R was 1:3. No major expectations after 3 amazing days. Lock in profits today early if possible. Want to finish a video as well.

My running P&L / State of Mind: Yesterday I did okay, biggest issue was too big size on my losers: $ R:R was 1:1 while % R:R was 1:3. No major expectations after 3 amazing days. Lock in profits today early if possible. Want to finish a video as well.