From birth, we are conditioned to trade incorrectly. We naturally run from things we are fearful of and are drawn to things that make us feel good. If you take this action in trading, you are headed for trouble which in the trading world means losses. For example, if your invitation to buy into a market comes only after an uptrend is well underway, all the indicators are pointed up, and the news is good on that market, where do you think price is in that market? Yep, it's likely very high. To buy here completely goes against how you make money buying and selling anything and is very high risk. Never forget, when you buy, many people have to buy after you and at higher prices or there is no chance you will profit in your trade. To obtain an entry that allows you to buy before others and at price levels where the risk is low, most of the time (if not all the time) you are buying at the end of a downtrend, when most indicators are pointing down, and when the news is bad. This action is completely against our mental make-up.

As I said before, we are conditioned from birth to trade incorrectly. That action or belief system is often reinforced during the many years of traditional finance/economics high school and college education. For example, most college courses on markets teach to us to do plenty of research on a stock before buying into that market. The general rule is to make sure the company has good earnings, good management, is a leader in its industry, and has a stock price that is in an uptrend. Again I ask you, where do you think the price of the stock is when all this criteria is true? Almost always, the stock price is very high when this criteria is true which ensures that if you buy now, you are simply paying everyone else who bought before you.

In my opinion, there are two things that you must have if you are to succeed at trading for a career. First, you must have a solid understanding of how the market really works and a rule-based strategy based on the objective laws of supply and demand. Due to very little regulation in the trading/investing education industry, most people learn to trade completely wrong from someone who is good at marketing but not so good at trading. This ensures that perhaps as much as 80% of people who attempt to trade will fail as they never learn how a market really works and instead, are poisoned with trading education and information that has them buying high and selling low. This path is fraught with lagging indicators and oscillators and conventional technical analysis information that leads to high risk, low reward trading and investing. Second, you must have the discipline to follow your rule-based strategy. So, of the roughly 20% of hopeful traders who actually obtain proper trading education, the lack of discipline factor likely eliminates 80% of them which adds up to a select few that ever make it. Before you stop reading this piece and throw it into your fireplace because it is so negative, sit tight and read on; help is on the way?

I am the head trader/trainer for the Extended Learning Track (XLT) Futures and Forex classes. I have been trading Stocks, Futures, Forex, and Options for many years and being around new traders in the XLT, I see so many people come into the program not having the two most important pieces of the trading puzzle mentioned above. Let's go over some very recent trades in the XLT program in hopes that you will get closer to having a solid understanding of how a market works and then I will show you how we handle the discipline issues that can be so challenging for new traders in the XLT.

Here are two typical day trades in the NASDAQ (or S&P) that we pre-planned and took. Before the opening of the market, we simply marked off the demand (support) level below where the market was trading in the pre-market which is before the opening of the U.S. Stock market. At the same time, we marked off the supply (resistance) level above. Once the Stock market opened, we were very happy to buy from someone who wanted to sell after a decline in price and at our pre-determined demand level as that is the low risk / high reward / high probability time to buy. Understand that the laws of supply and demand ensure that the seller who sells after a decline in price and at price levels where demand exceeds supply will most often lose so we use our rule-based strategy to make sure we are there to take the other side of that trade and buy from the ill-informed seller. Next, as price rallied to our pre-determined supply level above, some XLT traders sold their long position or initiated a short position. Who did we sell to? We sold to the trader who is making the same two mistakes every consistent losing buyer and seller of anything makes. First they are buying after a big rally in price, mistake number one. Second, they are buying at a price level where the chart is suggesting that supply exceeds demand (more sellers than buyers). Why would someone buy at that price level? They would buy because they are conditioned to buy when the news is good, a solid uptrend is underway, and simply because the basic human brain is wired to buy when everyone else is buying.

On the previous page is a chart of Crude Oil futures. We first identified the demand level, drew our lines on the chart, and then planned our trade. Notice how price arrived at our demand level. The decline that preceded our entry was severe. Price falls with big red candles, likely associated with bad news, and declining indicators. Most traders and investors are invited to sell when price declines, especially as it did with Crude Oil in the chart above. These realities of declining prices can make it very scary for the new trader to push the buy button where we did at demand.

The Answer

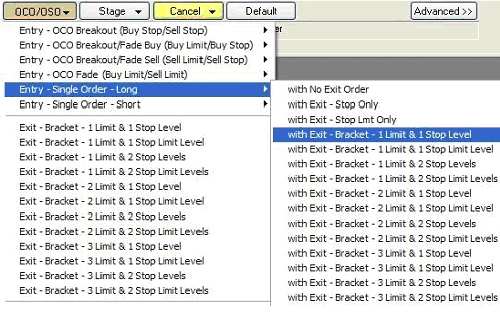

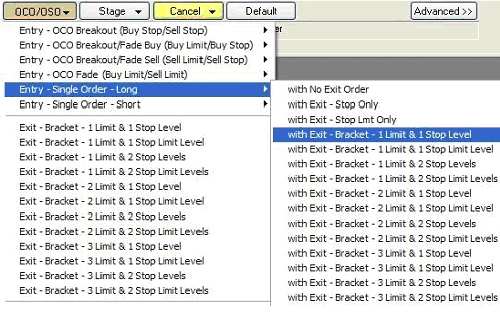

If you think I or members of the XLT are able to take these trades because we have somehow de-humanized our brains and have some super powers that only successful traders have, think again. We think and feel much of the same things everyone else thinks and feels. The key is that I realized years ago that my human brain is flawed when it comes to proper trading and has the potential to be my own worst enemy so I make sure I do my objective rule-based analysis based on the laws of supply and demand and then take full advantage of today's fantastic order execution capabilities to make sure emotion never even has a chance to come into my trading world. Below, I have taken a picture of what type of order I would use in a trade like the NASDAQ and the Crude Oil buying opportunities. By selecting the "OCO" (order cancels order) order below, I am able to enter an order to buy at demand (support), enter a protective sell stop order to limit the risk because you (and I) will have losses from time to time, and also enter a sell limit order to take profits, all at the same time. Once I set up that order and execute it, I am hands-off for that entire trade from start to completion. This accomplishes two things for me and people in the XLT. First, it takes care of the emotions and second, it means we don't have to sit in front of the computer screen all day, life is way too short to do that anymore! I call this "set it and forget it" trading.

Today, just about any type of order you can think of is available. I use a custom API which is a custom version of what you see above from Tradestation. I encourage you to begin to take advantage of the opportunity to set and forget your day, swing, and position trades. There are too many types of orders and features to share in this article so email if you have questions.

As always, never forget that those who know what they are doing in the markets simply get paid from those who don't so make sure you have the two issues discussed in this piece figured out before you put your hard-earned money at risk.

Lastly, for more information on the supply and demand concepts, please review some of my prior articles which can be found on our website.

Have a great day.

As I said before, we are conditioned from birth to trade incorrectly. That action or belief system is often reinforced during the many years of traditional finance/economics high school and college education. For example, most college courses on markets teach to us to do plenty of research on a stock before buying into that market. The general rule is to make sure the company has good earnings, good management, is a leader in its industry, and has a stock price that is in an uptrend. Again I ask you, where do you think the price of the stock is when all this criteria is true? Almost always, the stock price is very high when this criteria is true which ensures that if you buy now, you are simply paying everyone else who bought before you.

In my opinion, there are two things that you must have if you are to succeed at trading for a career. First, you must have a solid understanding of how the market really works and a rule-based strategy based on the objective laws of supply and demand. Due to very little regulation in the trading/investing education industry, most people learn to trade completely wrong from someone who is good at marketing but not so good at trading. This ensures that perhaps as much as 80% of people who attempt to trade will fail as they never learn how a market really works and instead, are poisoned with trading education and information that has them buying high and selling low. This path is fraught with lagging indicators and oscillators and conventional technical analysis information that leads to high risk, low reward trading and investing. Second, you must have the discipline to follow your rule-based strategy. So, of the roughly 20% of hopeful traders who actually obtain proper trading education, the lack of discipline factor likely eliminates 80% of them which adds up to a select few that ever make it. Before you stop reading this piece and throw it into your fireplace because it is so negative, sit tight and read on; help is on the way?

I am the head trader/trainer for the Extended Learning Track (XLT) Futures and Forex classes. I have been trading Stocks, Futures, Forex, and Options for many years and being around new traders in the XLT, I see so many people come into the program not having the two most important pieces of the trading puzzle mentioned above. Let's go over some very recent trades in the XLT program in hopes that you will get closer to having a solid understanding of how a market works and then I will show you how we handle the discipline issues that can be so challenging for new traders in the XLT.

Here are two typical day trades in the NASDAQ (or S&P) that we pre-planned and took. Before the opening of the market, we simply marked off the demand (support) level below where the market was trading in the pre-market which is before the opening of the U.S. Stock market. At the same time, we marked off the supply (resistance) level above. Once the Stock market opened, we were very happy to buy from someone who wanted to sell after a decline in price and at our pre-determined demand level as that is the low risk / high reward / high probability time to buy. Understand that the laws of supply and demand ensure that the seller who sells after a decline in price and at price levels where demand exceeds supply will most often lose so we use our rule-based strategy to make sure we are there to take the other side of that trade and buy from the ill-informed seller. Next, as price rallied to our pre-determined supply level above, some XLT traders sold their long position or initiated a short position. Who did we sell to? We sold to the trader who is making the same two mistakes every consistent losing buyer and seller of anything makes. First they are buying after a big rally in price, mistake number one. Second, they are buying at a price level where the chart is suggesting that supply exceeds demand (more sellers than buyers). Why would someone buy at that price level? They would buy because they are conditioned to buy when the news is good, a solid uptrend is underway, and simply because the basic human brain is wired to buy when everyone else is buying.

On the previous page is a chart of Crude Oil futures. We first identified the demand level, drew our lines on the chart, and then planned our trade. Notice how price arrived at our demand level. The decline that preceded our entry was severe. Price falls with big red candles, likely associated with bad news, and declining indicators. Most traders and investors are invited to sell when price declines, especially as it did with Crude Oil in the chart above. These realities of declining prices can make it very scary for the new trader to push the buy button where we did at demand.

The Answer

If you think I or members of the XLT are able to take these trades because we have somehow de-humanized our brains and have some super powers that only successful traders have, think again. We think and feel much of the same things everyone else thinks and feels. The key is that I realized years ago that my human brain is flawed when it comes to proper trading and has the potential to be my own worst enemy so I make sure I do my objective rule-based analysis based on the laws of supply and demand and then take full advantage of today's fantastic order execution capabilities to make sure emotion never even has a chance to come into my trading world. Below, I have taken a picture of what type of order I would use in a trade like the NASDAQ and the Crude Oil buying opportunities. By selecting the "OCO" (order cancels order) order below, I am able to enter an order to buy at demand (support), enter a protective sell stop order to limit the risk because you (and I) will have losses from time to time, and also enter a sell limit order to take profits, all at the same time. Once I set up that order and execute it, I am hands-off for that entire trade from start to completion. This accomplishes two things for me and people in the XLT. First, it takes care of the emotions and second, it means we don't have to sit in front of the computer screen all day, life is way too short to do that anymore! I call this "set it and forget it" trading.

Today, just about any type of order you can think of is available. I use a custom API which is a custom version of what you see above from Tradestation. I encourage you to begin to take advantage of the opportunity to set and forget your day, swing, and position trades. There are too many types of orders and features to share in this article so email if you have questions.

As always, never forget that those who know what they are doing in the markets simply get paid from those who don't so make sure you have the two issues discussed in this piece figured out before you put your hard-earned money at risk.

Lastly, for more information on the supply and demand concepts, please review some of my prior articles which can be found on our website.

Have a great day.

Last edited by a moderator: