During my time on the floor of the Chicago Mercantile Exchange, I noticed many things that helped shape my thought process and strategy that I still employ today. I started on a very busy trading desk right next to the trading pits and my job was to facilitate institutional order flow. One of the many things I noticed was that most of the trading action happened very early in the day. Furthermore, institutional profits and retail trader losses happened at that same time, very early in the day. I realized that most of the time, when an institution was buying, there was a retail sell order on the other side of that trade and vice versa when the institution was selling, it would be to a retail buy order. This was clear insight into the fact that this whole trading game is a massive transfer of accounts each day from the people who don't know what they are doing (retail traders), into the accounts of those who do (institutions). I started to think... If I could just learn to identify where institutions were buying and selling in a market by looking at price charts, wow, this could be a really nice way to earn a very healthy living. Just working two hours a day early in the morning was icing on the cake and I love icing. This is exactly what I taught myself to do.

Let me explain how this works... Most people are told not to trade the open of a market. They are told to let the market open and let it settle down for a bit before taking a trade. This is good advice if you are a novice trader but if you do know what you're doing, you absolutely want to trade at and around the open as this is where the most predictable profits are for the day trader or "two hour morning trader." Institutions have big buy and sell orders in the market at specific price levels and although most people think you can't figure out where those buy and sell orders are, think again...

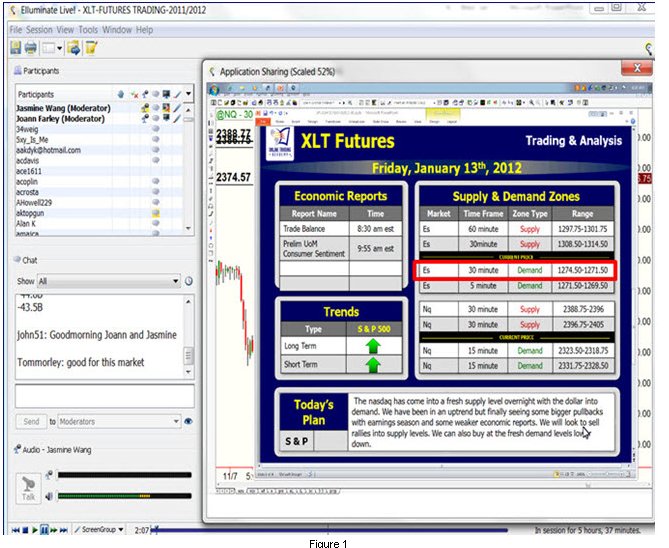

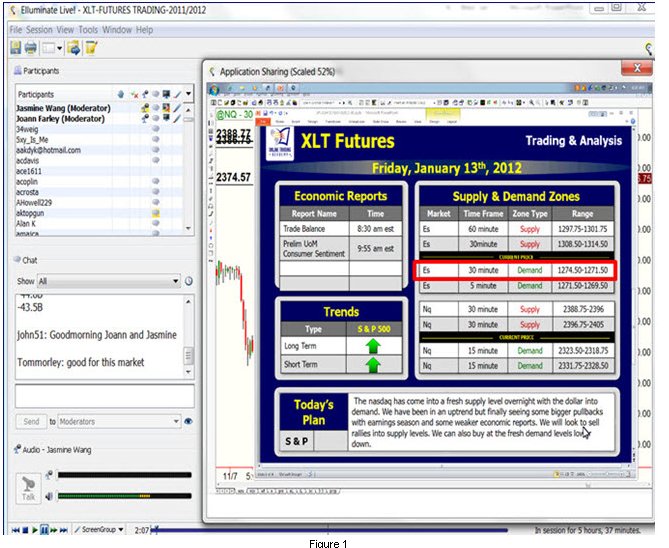

The screen shot you see below is of one of our live trading sessions that I gave as a lead instructor with our students. There are short term and long term trading sessions and this one was a short term day trading session. The day trading sessions begin at 8:30 AM EST, an hour before the New York open. We start out each session by going over the supply and demand levels that you see below. Keep in mind that when I say supply and demand levels, I mean "institutional" supply and demand, not retail supply and demand, as there is a big difference. The key is knowing what that picture looks like on a price chart and that all comes down to the "Odds Enhancers" we use on our program

On a typical morning, it takes me about two hours to analyze the markets we trade, identify the institutional demand and supply levels, and put the buy and sell orders into the market. After that, there is no reason to spend time in front of the trading screens. After all, these days, you can put your entire order into the market and leave it alone and we call this "set and forget". During the session shown in this piece, we identified that a big bank or institution was a willing buyer in the 1271.50 - 1274.50 price level (demand).

Figure 2

As you can see, price declined back to our predetermined demand level where students were instructed to buy. At the point of entry however, there was no reason to be in front of the computer screen if you put your entire order into the market. The demand level is over to the left. You may be asking yourself, what is so special about that area, that picture... The odds enhancers tell us that there was plenty of willing demand in that area. Could the trade have not worked out? Sure, but that's okay because the loss would have been very small.

How do the profits work? Let me explain... Let's start with the demand level on the left, where the two black demand lines begin. Price rallies from that level because demand exceeds supply. Do you or anyone you know have an account size to create a demand level like that in the S&P, one of the biggest equity index markets in the world? Probably not. So, if it's not your demand, whose demand is it? It's a big bank or institution's demand. Next, let's focus on the circled area on the chart, when price declines back to the area which is where we are buyers according to our rule based strategy. Let's specifically focus on the sellers. Who is selling in the circled area when we are buying? Is it a consistently profitable seller or a novice seller? Only a novice seller would sell after a decline in price like that and into a price level where demand exceeded supply. So, what you have at that moment is a novice seller selling against an institution's buy order. Really think about that for a moment. At that moment, it's like the Patriots against the Colts (no offense Colts fans), the Redwings against the Mighty Ducks (no offense Ducks fans), Ali against my 94 year old grandmother (she is tough but not that tough), I think you get the point. You have the smartest most profitable buyer buying when the most novice seller is selling, and the outcome of that battle is VERY predictable. This very unbalanced equation or battle almost always takes place in the first two hours of a trading day.

This strategy takes about two hours a day to employ, in the early morning, if you have the time. The key is knowing what the picture of institutional demand and supply looks like on a price chart, understanding the simple rules of the strategy, and having two hours in the morning to execute the analysis and strategy.

Let me explain how this works... Most people are told not to trade the open of a market. They are told to let the market open and let it settle down for a bit before taking a trade. This is good advice if you are a novice trader but if you do know what you're doing, you absolutely want to trade at and around the open as this is where the most predictable profits are for the day trader or "two hour morning trader." Institutions have big buy and sell orders in the market at specific price levels and although most people think you can't figure out where those buy and sell orders are, think again...

The screen shot you see below is of one of our live trading sessions that I gave as a lead instructor with our students. There are short term and long term trading sessions and this one was a short term day trading session. The day trading sessions begin at 8:30 AM EST, an hour before the New York open. We start out each session by going over the supply and demand levels that you see below. Keep in mind that when I say supply and demand levels, I mean "institutional" supply and demand, not retail supply and demand, as there is a big difference. The key is knowing what that picture looks like on a price chart and that all comes down to the "Odds Enhancers" we use on our program

On a typical morning, it takes me about two hours to analyze the markets we trade, identify the institutional demand and supply levels, and put the buy and sell orders into the market. After that, there is no reason to spend time in front of the trading screens. After all, these days, you can put your entire order into the market and leave it alone and we call this "set and forget". During the session shown in this piece, we identified that a big bank or institution was a willing buyer in the 1271.50 - 1274.50 price level (demand).

Figure 2

As you can see, price declined back to our predetermined demand level where students were instructed to buy. At the point of entry however, there was no reason to be in front of the computer screen if you put your entire order into the market. The demand level is over to the left. You may be asking yourself, what is so special about that area, that picture... The odds enhancers tell us that there was plenty of willing demand in that area. Could the trade have not worked out? Sure, but that's okay because the loss would have been very small.

How do the profits work? Let me explain... Let's start with the demand level on the left, where the two black demand lines begin. Price rallies from that level because demand exceeds supply. Do you or anyone you know have an account size to create a demand level like that in the S&P, one of the biggest equity index markets in the world? Probably not. So, if it's not your demand, whose demand is it? It's a big bank or institution's demand. Next, let's focus on the circled area on the chart, when price declines back to the area which is where we are buyers according to our rule based strategy. Let's specifically focus on the sellers. Who is selling in the circled area when we are buying? Is it a consistently profitable seller or a novice seller? Only a novice seller would sell after a decline in price like that and into a price level where demand exceeded supply. So, what you have at that moment is a novice seller selling against an institution's buy order. Really think about that for a moment. At that moment, it's like the Patriots against the Colts (no offense Colts fans), the Redwings against the Mighty Ducks (no offense Ducks fans), Ali against my 94 year old grandmother (she is tough but not that tough), I think you get the point. You have the smartest most profitable buyer buying when the most novice seller is selling, and the outcome of that battle is VERY predictable. This very unbalanced equation or battle almost always takes place in the first two hours of a trading day.

This strategy takes about two hours a day to employ, in the early morning, if you have the time. The key is knowing what the picture of institutional demand and supply looks like on a price chart, understanding the simple rules of the strategy, and having two hours in the morning to execute the analysis and strategy.

Last edited by a moderator: