You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

1647 for me please, and a belated congratulations to the Q2 winners.

1543 for me please.

Forgot that it was 4th of July last week which meant a short trading week. 😴

Last weeks move has come on the back of some very low volume, thanks to the independence day holiday, I will be looking for a retest of the 1620 level, to see if we have any support for a move higher.

If it holds we could close the week above the 1650 area, if it doesn't could head back to the recent lows under 1600

So I'm gonna split the difference on this one, 1620.👎

Last weeks move has come on the back of some very low volume, thanks to the independence day holiday, I will be looking for a retest of the 1620 level, to see if we have any support for a move higher.

If it holds we could close the week above the 1650 area, if it doesn't could head back to the recent lows under 1600

So I'm gonna split the difference on this one, 1620.👎

samspade79

Established member

- Messages

- 576

- Likes

- 25

1651

samspade79

Established member

- Messages

- 576

- Likes

- 25

Can I change mine to 1681

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Spot gold fell 0.3 percent to $1,219.31 an ounce by 0004 GMT following a 2 percent decline on Friday.

* Comex gold was higher by about $6 at $1,218.30.

* U.S. employers added 195,000 new jobs to their payrolls last month, exceeding expectations of 165,000, the Labor Department said on Friday, cementing expectations the Fed will start winding down its $85 billion monthly bond purchases.

* The Fed is likely to begin shrinking the size of its debt purchase program, intended to prop up economic growth and support the labor market, by September, according to the majority of economists at large Wall Street firms.

* Gold posted its biggest quarterly loss on record, down 23 percent for April-June and hit a near 3-year low of $1,180.71 last month, after Fed Chairman Ben Bernanke said the economy was recovering strongly enough for the bank to begin tapering.

* SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, said its holdings fell 0.28 percent to 961.99 tonnes on Friday.

* China's May gold imports from Hong Kong jumped more than a third from the previous month as lower prices attracted buyers in the world's second biggest bullion consumer.

* Jewellers in India are banking on a growing appetite for diamonds in the country and resilient demand for gold among its non-residents to offset a slowdown caused by a government clampdown on imports of the precious metal.

MARKET NEWS

* The U.S. dollar hit a fresh three-year high against a basket of major currencies in Asia on Monday as market expectations grew that the Fed will scale back stimulus as early as September following solid jobs growth. (USD/)

* Comex gold was higher by about $6 at $1,218.30.

* U.S. employers added 195,000 new jobs to their payrolls last month, exceeding expectations of 165,000, the Labor Department said on Friday, cementing expectations the Fed will start winding down its $85 billion monthly bond purchases.

* The Fed is likely to begin shrinking the size of its debt purchase program, intended to prop up economic growth and support the labor market, by September, according to the majority of economists at large Wall Street firms.

* Gold posted its biggest quarterly loss on record, down 23 percent for April-June and hit a near 3-year low of $1,180.71 last month, after Fed Chairman Ben Bernanke said the economy was recovering strongly enough for the bank to begin tapering.

* SPDR Gold Trust, the world's largest gold-backed exchange-traded fund, said its holdings fell 0.28 percent to 961.99 tonnes on Friday.

* China's May gold imports from Hong Kong jumped more than a third from the previous month as lower prices attracted buyers in the world's second biggest bullion consumer.

* Jewellers in India are banking on a growing appetite for diamonds in the country and resilient demand for gold among its non-residents to offset a slowdown caused by a government clampdown on imports of the precious metal.

MARKET NEWS

* The U.S. dollar hit a fresh three-year high against a basket of major currencies in Asia on Monday as market expectations grew that the Fed will scale back stimulus as early as September following solid jobs growth. (USD/)

samspade79

Established member

- Messages

- 576

- Likes

- 25

as long as we don't sell off tomorrow I got this in the bag.

Atilla

Legendary member

- Messages

- 21,038

- Likes

- 4,209

as long as we don't sell off tomorrow I got this in the bag.

I think that's called counting chickens before something or other... 😉

In the last quarter if I went by Thursday's closing numbers I would have had about 5 gold medallions dangling round my neck. How sad is that 🙁

samspade79

Established member

- Messages

- 576

- Likes

- 25

Market is bull**** now. That's why I went for my outlandish 1680. Bet that seemed insane on Monday.

Atilla

Legendary member

- Messages

- 21,038

- Likes

- 4,209

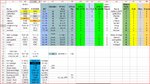

samspade79 amazingly takes 2nd consequitive gold of the first quarter and is remarkably on .81 of a tick away from weekly close. Pat takes silver and ibetyou takes bronze. :clap::clap::clap:

Well done samspade79. 👍

Bulls are having a picnic 🙂

.........Pat.............samspade79.........ibetyou

Well done samspade79. 👍

Bulls are having a picnic 🙂

.........Pat.............samspade79.........ibetyou

Attachments

samspade79

Established member

- Messages

- 576

- Likes

- 25

Not bad that. I'm gonna wait and see how bad Chinese GDP is before I decide whether we're going up 50pts or 150pts next week.

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Not bad that. I'm gonna wait and see how bad Chinese GDP is before I decide whether we're going up 50pts or 150pts next week.

Really flying now Sam - congrats :idea:

samspade79

Established member

- Messages

- 576

- Likes

- 25

1668 for me please Atilla.

You know that's UNDER the current level right ?

mike.

Senior member

- Messages

- 2,101

- Likes

- 709

You know that's UNDER the current level right ?

yeah, its gunna tank this week, ill put the house on it 😆

Similar threads

- Replies

- 1K

- Views

- 185K

- Replies

- 1K

- Views

- 158K

- Replies

- 908

- Views

- 133K

- Replies

- 989

- Views

- 134K