trendie

Legendary member

- Messages

- 6,875

- Likes

- 1,433

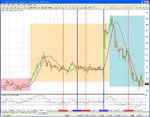

I am an ardent follower and supporter of bansirs RSI thread, whereby he searches for potential reversals using RSI-14 via divergences. (ie, prices print higher-high while the indicator prints a lower-high, and vice versa)

Being a dyed-in-the-wool trend-follower, (I dont want to stand in the way of the hurtling train hoping I can change its direction; rather, I prefer to watch as others get mown down, and only jump on-board once the train is already moving in the new direction) I mused over using RSI as a simple trading system.

I am using RSI-7 (just to get more OB(80) and OS(20) signals per day) *

Now, being a trendie, rather than a reversie, I knocked this trnd-continuation idea up.

When RSI-7 breaches the 50-line you are on ready.

Let it fall back towards the 50-line, you are on aim.

When it finally hooks back once more, you fire.

I am using bansirs 12-SMA. along with 36-Hull-MA as comparison. (I like the switching of colours when up/down, as well as the smoother shifts with Hulls)

I will use these MAs to give me a trend-direction. (only take hooks in its direction)

5 charts attached illustrating the ideas. I have cherry-picked the better ones. No doubt there are some duff signals. But you get the idea.

I dont use this (yet), but was curious at how simple it all felt.

Profit targets yet to be defined.

Stop-losses, as always for me, the previous high/low plus about 5 pips, so you can gauge whther you want to take it.

It seems to get on board on the momentum.

* when trying out new systems, I ask myself how many signals would I prefer per day, and set my parameters by eyeballing how many signals it would trigger per 7-am-4pm sessions. this way I get good sized bites out of the day. I normally look for parameter settings that give 2-3 singals per chart per 7-am-4pm sessions.

NB: the red-line on the RSI is a 7-SMA on the RSI-7 itself. I am working out how to deal with chop, so its a work in progress.

NB2: no doubt this technique has already been described elsewhere, in which case apologies for copying.

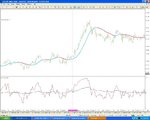

Being a dyed-in-the-wool trend-follower, (I dont want to stand in the way of the hurtling train hoping I can change its direction; rather, I prefer to watch as others get mown down, and only jump on-board once the train is already moving in the new direction) I mused over using RSI as a simple trading system.

I am using RSI-7 (just to get more OB(80) and OS(20) signals per day) *

Now, being a trendie, rather than a reversie, I knocked this trnd-continuation idea up.

When RSI-7 breaches the 50-line you are on ready.

Let it fall back towards the 50-line, you are on aim.

When it finally hooks back once more, you fire.

I am using bansirs 12-SMA. along with 36-Hull-MA as comparison. (I like the switching of colours when up/down, as well as the smoother shifts with Hulls)

I will use these MAs to give me a trend-direction. (only take hooks in its direction)

5 charts attached illustrating the ideas. I have cherry-picked the better ones. No doubt there are some duff signals. But you get the idea.

I dont use this (yet), but was curious at how simple it all felt.

Profit targets yet to be defined.

Stop-losses, as always for me, the previous high/low plus about 5 pips, so you can gauge whther you want to take it.

It seems to get on board on the momentum.

* when trying out new systems, I ask myself how many signals would I prefer per day, and set my parameters by eyeballing how many signals it would trigger per 7-am-4pm sessions. this way I get good sized bites out of the day. I normally look for parameter settings that give 2-3 singals per chart per 7-am-4pm sessions.

NB: the red-line on the RSI is a 7-SMA on the RSI-7 itself. I am working out how to deal with chop, so its a work in progress.

NB2: no doubt this technique has already been described elsewhere, in which case apologies for copying.