breather

Newbie

- Messages

- 9

- Likes

- 1

A place where you are one in the million or you can be one again. :whistling

Welcome to my newly started thread, first I wanted to narrow my field and find the peope who might be interested in my 'case' but in vain so I opened a new thread (after getting encouraged by a nice member). So, I have been trading forex like for 8 months, lost a vast majority of my capital. I do not now personally anybody who can do better, no doubt, there are lot of people who can do it, I am not stubborn or greedy, but I am lack of personal experiences. What you can not experience as an individual, that remains dead, simply dead. I might believe somthing, without individual experience it is cold as stone. You may think, I am exactly in this situation and you are right. I made my mind up and asked myself, why I want to trade forex. Hard to answer when you do not want to deceive yourself! I have a job, have money, not plenty, but enough. I had better financial times too, and I was not satisfied and it had nothing to do with financials. A man has goals in his life, wants to create something that holds, in his belief, for ever. I have a plan and I need more bucks to set it into life and I think forex trading could be the utensil for it. Well, we will see. I will frequently post questions, graphs and opinions, I would like to invite you to share your views. I have choosen the 15min-30min timeframe although it is "well known" that higher time frames are "better". I have traded them and my results were the same, solid loss. Facts are hard to overcome, I am at the moment a massive looser trader who wants to become better, much better. I have good reason to think that the change will not come alone, I need some kind of help, hints from other with personal experience. I hope that everything posted in this thread will be useful for others too who are stumbling over the stones of forex. And at last, I know about my broken english but I believe it will do the job.

I am familiar with "price action", have been never a customer of a "teacher", I have tested some of my ideas but... in vain. It looks like if I had done the opposite what i considered "the right decision" I were a rich man or someone at least with the odour of a rich man. 🙂

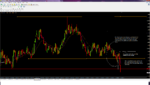

Let me post the first graphs here. I tried to catch range break out price action moments.

On the first one I tired to identify a break out (false), wait a pull back, set my SL at the bottom of the pull back and my entry at the overcoming of the (false) break out high. It turned out to be a looser trade.

On the second one I wonder if the break out is a (false) break out at all, I have waited for a pull back but after that it seemed to me too much messy... After watching Mr. Phil Newton vids it did not resemble his setups. I think my range boundaries might be not genuine.

Please feel free for comment.

Welcome to my newly started thread, first I wanted to narrow my field and find the peope who might be interested in my 'case' but in vain so I opened a new thread (after getting encouraged by a nice member). So, I have been trading forex like for 8 months, lost a vast majority of my capital. I do not now personally anybody who can do better, no doubt, there are lot of people who can do it, I am not stubborn or greedy, but I am lack of personal experiences. What you can not experience as an individual, that remains dead, simply dead. I might believe somthing, without individual experience it is cold as stone. You may think, I am exactly in this situation and you are right. I made my mind up and asked myself, why I want to trade forex. Hard to answer when you do not want to deceive yourself! I have a job, have money, not plenty, but enough. I had better financial times too, and I was not satisfied and it had nothing to do with financials. A man has goals in his life, wants to create something that holds, in his belief, for ever. I have a plan and I need more bucks to set it into life and I think forex trading could be the utensil for it. Well, we will see. I will frequently post questions, graphs and opinions, I would like to invite you to share your views. I have choosen the 15min-30min timeframe although it is "well known" that higher time frames are "better". I have traded them and my results were the same, solid loss. Facts are hard to overcome, I am at the moment a massive looser trader who wants to become better, much better. I have good reason to think that the change will not come alone, I need some kind of help, hints from other with personal experience. I hope that everything posted in this thread will be useful for others too who are stumbling over the stones of forex. And at last, I know about my broken english but I believe it will do the job.

I am familiar with "price action", have been never a customer of a "teacher", I have tested some of my ideas but... in vain. It looks like if I had done the opposite what i considered "the right decision" I were a rich man or someone at least with the odour of a rich man. 🙂

Let me post the first graphs here. I tried to catch range break out price action moments.

On the first one I tired to identify a break out (false), wait a pull back, set my SL at the bottom of the pull back and my entry at the overcoming of the (false) break out high. It turned out to be a looser trade.

On the second one I wonder if the break out is a (false) break out at all, I have waited for a pull back but after that it seemed to me too much messy... After watching Mr. Phil Newton vids it did not resemble his setups. I think my range boundaries might be not genuine.

Please feel free for comment.