trendie

Legendary member

- Messages

- 6,875

- Likes

- 1,433

I have, probably against my better judgement, re-ignited my interest in Delta, and all things mystical and nebulous.

How do you "prove" something?

I suppose its by stating a proposition, and then proving it as being true, according to some pre-determined parameters.

for example, that patterns repeat themselves after every 4 lunar months.

but what if the patterns dont arrive on time?

how much wiggle room do you allow?

if a pattern is supposed to arrive every 10 days, for example, the more days you give it for wiggle, the more likely you are allowing for noise.

eg;

10 day pattern start: 0 days.

next pattern: 10 days.

next pattern: 20 days.

if you allow 1 day grace either side, thats 3 days variability for a pattern that supposedly repeats every 10 days.

you could make excuses such as: oh, its trading days, not calendar days (this time), or holidays. (actually, for FX, what if the US has a holiday, eg July 4th, but we in the UK dont have a holiday, then is this a holiday, or not a holiday?)

One alternative method is to start with no preconceptions, and see if swings happen with any regularity. here, to avoid too many close calls, ie, every 2 or 3 days, you can use an objective method of determining swings. And then count the days that elapse between them, and determine some pattern. If some pattern appears, but not always, you can explore further.

this prevents self-delusion, ie, a commitment to an unproven concept and massaging of figures to re-interpret the data to a pre-determined conclusion.

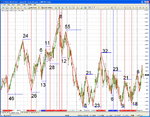

I have posted a swing map of GBPUSD using zig-zag set to "8,5,3".

rather than say "I believe that patterns repeat every 4 lunar months", it makes more sense to say "I see swings being 21 days more often than chance would allow".

there again, how would be determine what chance would allow?

when using Fib-counts, for MarketMatrix, for example, what if days 8,13,21 and 34 dont "hit", why would you therefore expect day 55 to hit? wouldnt you abandon it as being not valid?

How do you "prove" something?

I suppose its by stating a proposition, and then proving it as being true, according to some pre-determined parameters.

for example, that patterns repeat themselves after every 4 lunar months.

but what if the patterns dont arrive on time?

how much wiggle room do you allow?

if a pattern is supposed to arrive every 10 days, for example, the more days you give it for wiggle, the more likely you are allowing for noise.

eg;

10 day pattern start: 0 days.

next pattern: 10 days.

next pattern: 20 days.

if you allow 1 day grace either side, thats 3 days variability for a pattern that supposedly repeats every 10 days.

you could make excuses such as: oh, its trading days, not calendar days (this time), or holidays. (actually, for FX, what if the US has a holiday, eg July 4th, but we in the UK dont have a holiday, then is this a holiday, or not a holiday?)

One alternative method is to start with no preconceptions, and see if swings happen with any regularity. here, to avoid too many close calls, ie, every 2 or 3 days, you can use an objective method of determining swings. And then count the days that elapse between them, and determine some pattern. If some pattern appears, but not always, you can explore further.

this prevents self-delusion, ie, a commitment to an unproven concept and massaging of figures to re-interpret the data to a pre-determined conclusion.

I have posted a swing map of GBPUSD using zig-zag set to "8,5,3".

rather than say "I believe that patterns repeat every 4 lunar months", it makes more sense to say "I see swings being 21 days more often than chance would allow".

there again, how would be determine what chance would allow?

when using Fib-counts, for MarketMatrix, for example, what if days 8,13,21 and 34 dont "hit", why would you therefore expect day 55 to hit? wouldnt you abandon it as being not valid?