Preparation for 24-11-2016

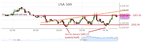

Took one trade and it worked out fine but not sure if I'm going to document it. Price broke out of the range and I thought a trend was forming because price retraced but then continued upwards, so I took a long position. I was right but my feeling is that this was just gambling... was there any reason to believe price would continue to go up or was there just as much chance of it going down? Not sure, my knowledge of trends is still limited

Okay just a crude result then on the 5m chart:

I did not tighten stoploss so it resulted in a 0.14 point profit. Green arrow is where previous chart ends.

I just noticed a triple top and that was probably a sign to tighten the SL

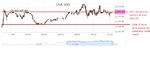

Took one trade and it worked out fine but not sure if I'm going to document it. Price broke out of the range and I thought a trend was forming because price retraced but then continued upwards, so I took a long position. I was right but my feeling is that this was just gambling... was there any reason to believe price would continue to go up or was there just as much chance of it going down? Not sure, my knowledge of trends is still limited

Okay just a crude result then on the 5m chart:

I did not tighten stoploss so it resulted in a 0.14 point profit. Green arrow is where previous chart ends.

I just noticed a triple top and that was probably a sign to tighten the SL

Last edited: