http://en.wikipedia.org/wiki/U.S._Dollar_Index

http://en.wikipedia.org/wiki/U.S._Dollar_Index

I am thinking hard on how to use the DX on my automated systems because that may very well be my only way out of the banking job that I have.

I've talked more about it here:

http://www.trade2win.com/boards/trading-journals/85510-my-journal-2-a-18.html#post1050056

http://www.trade2win.com/boards/trading-journals/85510-my-journal-2-a-20.html#post1051292

http://www.trade2win.com/boards/trading-journals/85510-my-journal-2-a-22.html#post1052392

Another thing I noticed is that in the past few years the EUR has been rising much more slowly than falling. That explains why my systems made less money than they later lost (when the EUR was falling).

Now I am thinking of reversing those systems, and the problem is: do I tie them to past week's results and reverse the signals if it was negative? Or do I tie them to the DX?

Tying them to the DX would solve many technical problems in my forward testing data. On the other hand reversing the signals based on last week's performance produces better results (by 20%) and is a more adaptive rule: we don't care why exactly the systems lost, or rather we care, but we want signals reversed even before we find out why. Because the reason could change but we still want to make money even without understanding it.

So I set out to tie systems to the past week's performance. This is all on excel. Now the problem here is that if I have a cell that says "reverse signal if last week unprofitable", this is what happens, week after week:

1) normal system makes money

2) normal system gets traded again (no problem so far)

3) normal system loses money

4) normal system gets reversed and loses money

5) normal system gets reversed again

even though it was the reversed system which lost money (problem)

6) say now that #5's reversed system made money: normal system will get used (problem) despite the fact that it was the reversed system that made money

This means that the cell which worked correctly in keeping the system from trading when it lost money, does not work to reverse signals. Furthermore, if I reverse signals, I will have all my results screwed up, because I won't know in the future which system produced what results.

These are just technical problems and not related to trading, but I am not capable of solving them neatly. I could solve them roughly but I would screw up my work and records.

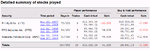

Maybe I'll just use the regular system for now, and keep it from trading after a red week. But also add an extra filter, that keeps it from trading when the DX is above its 40-day average, like right now:

http://futuresource.quote.com/chart...=D&z=800x550&d=HIGH&b=CANDLE&st=MA(40,40,40);

When and if my cousin (the physics student) will join my efforts, I will finish this work, or maybe I'll ask help to one of my programmer friends.

Great steps ahead have been made thanks to forward testing and to the chart above (DX or EUR is the same concept). Until now the typical situation was that, while the dollar was coming down my systems were making almost 100% return a month and I was treating all my colleagues to the restaurant. But I didn't know why. Then each time the dollar started going up (and I didn't know why nor when because I didn't even have any forward testing in place), I'd ask the same colleagues to treat me to the vending machines. Another thing that happened was that suddenly I noticed that from 30k i was starting to come down... and I'd repay my debt to the bank very quickly (done it twice), just in time before losing the rest of my capital partly thanks to the dollar going up but even more thanks to my discretionary trading, which I used to try and help my systems, but disastrously.

Now at least I should be done with disastrous discretionary trading, and I definitely won't resume automated trading with real money (paper trading always) until I see the dollar crossing below that 40-day average (see pic above). But that might not happen for another year, so I'll have to come up with something. Probably within two days I'll have found a trick to reverse the systems without screwing up my forward testing.