Chris_Shaw

Active member

- Messages

- 121

- Likes

- 1

08/31/15 Morning Update.

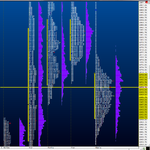

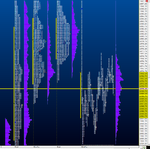

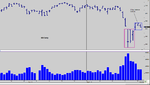

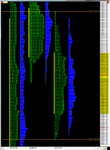

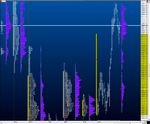

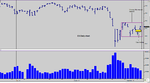

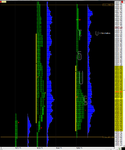

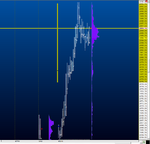

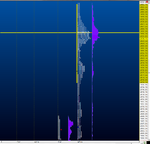

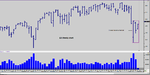

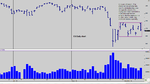

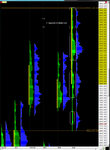

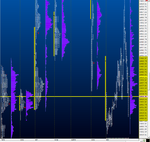

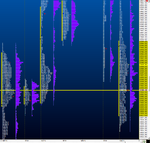

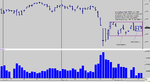

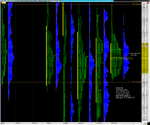

O/N volume is 242K as of 0545am PST. Overnight inventory presents itself as short. But when viewed on an expanded profile, we can see that the majority of the trade has been higher. These situations are difficult to distinguish. Currently a handle of gap to the downside. I doubt that will be the case come open. If we do open within Friday's range, balance rules apply. They are posted in Friday' Morning Update post.

O/N high 1977.25

O/N low 1959.25

Friday's pit high 2112

Friday's pit low 1971.5

Settle 1988.75

O/N volume is 242K as of 0545am PST. Overnight inventory presents itself as short. But when viewed on an expanded profile, we can see that the majority of the trade has been higher. These situations are difficult to distinguish. Currently a handle of gap to the downside. I doubt that will be the case come open. If we do open within Friday's range, balance rules apply. They are posted in Friday' Morning Update post.

O/N high 1977.25

O/N low 1959.25

Friday's pit high 2112

Friday's pit low 1971.5

Settle 1988.75