4 point trend definition

hi there

do you have a description of the 4 point trend definition anywhere, to go with the pictorial you included in your post?

I'd find it helpful to understand it better

thanks

hi there

do you have a description of the 4 point trend definition anywhere, to go with the pictorial you included in your post?

I'd find it helpful to understand it better

thanks

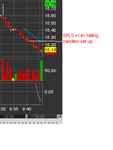

Here's a brief analysis of a trade today using the method in this thread.

The stock was ANF and I found it pre-market from two sources:

1) it was a gapper,

2) the mixed Q3 guidance ahead of analyst day.

Market open and after a few minutes it created a high 'a' , then a low 'b', then a lower high 'c' , then a lower low 'd'.

This action constituted a classic four point trend definition.

This could have then moved anywhere and after that long one candle (3 minutes) plunge it was reasonable to expect some sort of bounce so I was looking for a convincing fall below 'd' with falling candles (as described many times on this thread).

When that occurred I shorted and exited as shown on the screen grab for 64c per share profit.

I traded ANF again a little later and lost 7c, again following my methodology of keeping any losers small.

This method (and most of the other ones I use) are applicable with only slight modifications to most trading instruments, FX, indices, whatever and also across most time frames so hopefully some people might find this post useful.