-oo0(GoldTrader)

Well-known member

- Messages

- 345

- Likes

- 5

Pavel,Pavel said:Hi GoldTrader,

I found information on the usenet that you may have read the book by Nicolas Darvas "How I made $2,000,000 in the stock market". Please tell me about your experience: do you actually make money with the Darvas box breakout strategy?

I did some research on the Web, and most traders say that Darvas'es trading methods can still be used in today's market. Let me know how this book has worked for you.

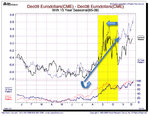

This is an example of how we are using Darvas box today trading Seasonal Spreads. The below chart is a Meal spread. From November thru the end of February the difference between the contracts bounced between –6 and –10. This was the box. Whenever prices got near –10 buying pressure provides support. Whenever they got near –6. Selling pressure prevented prices from escaping the box.

At this time of year we are already in a Meal spread, expecting to add a different combination of contracts the first week in March. A few days after this spread broke out. Spread traders do not have the advantage of using volume as Darvas does with stocks. But none the less. This is a box, and this is an example of a box break out near a seasonal window.

For four months (November thru February), traders shorted the top of the box and bought the bottom. Once short, they would have put orders to buy back there shorts when prices broke above the top just in case. When prices did break out, all of these traders covered there shorts by buying them back. Many also went long. All of this happened at about the same time, causing prices to spurt out of the box.

If the margin on this spread was about $400, and it paid $100.00 a point. Then catching ten points would have returned about 250% on margin.