You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

P

postman

Your just prognosticating a massive fall in the dow that would make Gold actually worth anything. People have been doing that for the last 10 years without profit.

Whats that I hear you cry "but it's different this time".

Whats that I hear you cry "but it's different this time".

new_trader

Legendary member

- Messages

- 6,770

- Likes

- 1,656

What an odd reply postman👎

I see someone asking if any other trader agrees with their analysis on gold, there is no mention of the DOW. Since gold is now @USD1308 I'd say the OP's anaylsis was good for anyone that traded the move. 👍

I see someone asking if any other trader agrees with their analysis on gold, there is no mention of the DOW. Since gold is now @USD1308 I'd say the OP's anaylsis was good for anyone that traded the move. 👍

P

postman

What an odd reply postman👎

I see someone asking if any other trader agrees with their analysis on gold, there is no mention of the DOW. Since gold is now @USD1308 I'd say the OP's anaylsis was good for anyone that traded the move. 👍

Granted the response was a little terse.

The point of my post was to say that Gold is not a volatile commodity, for the last 5 years its been in a $300 range, the only time its likely to see a significant rise is when a market correction occurs and Gold is bought as a hedge.

The reason for mentioning the Dow was the poster bax699 has only posted on 4 occasions and the most recent one was

"Its posible when gold rises that stocks fall slightly, will the next rise in gold prices make the dow fall? " https://www.trade2win.com/threads/dow-jones.234807/post-3091855

Betting on the dow falling to profit from Gold is a fools errand.

hatemypips

Established member

- Messages

- 697

- Likes

- 62

And what do you think about recent rise in demand from global central banks on gold? They're buying record amount still gold rally seems to be stalling. Are there some hidden factors which restrain its growth?Granted the response was a little terse.

The point of my post was to say that Gold is not a volatile commodity, for the last 5 years its been in a $300 range, the only time its likely to see a significant rise is when a market correction occurs and Gold is bought as a hedge.

The reason for mentioning the Dow was the poster bax699 has only posted on 4 occasions and the most recent one was

"Its posible when gold rises that stocks fall slightly, will the next rise in gold prices make the dow fall? " https://www.trade2win.com/threads/dow-jones.234807/post-3091855

Betting on the dow falling to profit from Gold is a fools errand.

Hi Everyone,

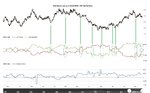

I thought I'll share with you the following finding. I don't know if you follow the cot report or not, but if you do, you might be interested in looking at the options only data, because to me it seems as if there are some "smart people" among commercial participants. Look at the attached chart and it becomes obvious. If this continues, I believe we have a good chance that gold will be headed north in the next couple of days, few weeks.

All the best,

Dunstan

(cot chart from COTbase.com)

I thought I'll share with you the following finding. I don't know if you follow the cot report or not, but if you do, you might be interested in looking at the options only data, because to me it seems as if there are some "smart people" among commercial participants. Look at the attached chart and it becomes obvious. If this continues, I believe we have a good chance that gold will be headed north in the next couple of days, few weeks.

All the best,

Dunstan

(cot chart from COTbase.com)

Attachments

Dunstan, can you pls clarify what you see on the COT screenshot you posted? I would love to know your analysis.

FYI, I bought GCM last Thur at 1285 and closed yesterday at 1310 for a quick profit.

Hi Punjabi,

Sorry, somehow I did not see your remark... So basically on the chart I am indicating all of those large changes in Traders positions that correlate with a move in the market. This is basically analysis of the COT report (Commitments of Traders report) and these are so called cot change signals. I used to have a thread on this, but for some reason it disappeared...

All the best,

Dunstan

Joules MM1

Established member

- Messages

- 648

- Likes

- 142

keep in mind the cot report is out of sync, invariably a week behind, context needs to be with that print, transactions with immediacy of less than a week will be less about concise levels and more to do with luck, if based on the cot, it lifts the risk rather than contains it...

if you want to backtest it timingcharts.com have a good setup for historic pov, or tradingview.com for backtesting nearterm ideas

it is the out of sync-ness that traps most players, or worse, sets up a bias, the correlation quickly falls apart due to the print lag

if you want to backtest it timingcharts.com have a good setup for historic pov, or tradingview.com for backtesting nearterm ideas

it is the out of sync-ness that traps most players, or worse, sets up a bias, the correlation quickly falls apart due to the print lag

Last edited:

Silverston

Junior member

- Messages

- 30

- Likes

- 6

Gold is uncharacteristically active for June, I think it could've turned a corner, I'm long Silver, Gold and $GDXJ and waiting for a legup, could test the patience but seems best set up for some time.

Pat494

Legendary member

- Messages

- 14,614

- Likes

- 1,588

Until they find a solid gold asteroid it will always have a basic upward momentum.Gold is uncharacteristically active for June, I think it could've turned a corner, I'm long Silver, Gold and $GDXJ and waiting for a legup, could test the patience but seems best set up for some time.

Silverston

Junior member

- Messages

- 30

- Likes

- 6

Hi Mike, best take any Gold signals with a pinch of salt - a lot in the Goldbugs community are die hard bulls (since around 1980) and you won't get a very balanced view. Best stick to something simple like buying at 200dma pullbacks into an uptrend or breakout of symmetrical triangles if you like your chart patterns, shouldn't need to be more complicated than that. 321gold.com is good for editorials and some view and I have been reading zealllc.com since 2004, when I was wondering if buying gold at $400 was too high. But again he is a perma-bull so you won't get any reasoned balanced views there.

Saying that on a macro level, at some point on a yearly basis we're likely to see much higher (rather than lower) gold prices purely because it performs well in both an inflationary and deflationary environment and likes negative interest rates too, so there's not much not to like. But again, how long do you want your money tied up in a sideways position?

I read Jim Rogers (another perma-bull) likes Silver but is not buying any more at 'these levels' - the gold/silver ratio is very attractive now. BTW I'm long gold, silver and $GDXJ gold juniors with about a 1/3 position and hope to add another 1/3 at the end of August/start of September depending on whether there is any traction to this uptrend.

Saying that on a macro level, at some point on a yearly basis we're likely to see much higher (rather than lower) gold prices purely because it performs well in both an inflationary and deflationary environment and likes negative interest rates too, so there's not much not to like. But again, how long do you want your money tied up in a sideways position?

I read Jim Rogers (another perma-bull) likes Silver but is not buying any more at 'these levels' - the gold/silver ratio is very attractive now. BTW I'm long gold, silver and $GDXJ gold juniors with about a 1/3 position and hope to add another 1/3 at the end of August/start of September depending on whether there is any traction to this uptrend.

Silverston

Junior member

- Messages

- 30

- Likes

- 6

Not much interest here on the Gold and Silver front? Silver making a move today but I wonder if it is all the money exiting the Bitcoin market, it's got to go somewhere I guess.

Joules MM1

Established member

- Messages

- 648

- Likes

- 142

with the offer

silver has best lead downside

silver has best lead downside

Havent posted here for a while but will continue to do so. Last time i looked at gold (not on here) it was sat at the support area of 1550 area. suggested it could move from there and price has since moved up a couple of hundred pips.

You can see it has bounced from the 0.38 fib a few times, which shows that area is strong on the daily TF.

Whats next? Well i dont know for certain but could we go up to form a triple top? who knows but look out for the top around the 1587 area.

We could then either get a retrace to the 0.38 fib again or even deeper to the 50% rest stop or to meet the .618 and trend for multiple confluences before a gigantic push up. Remember buy low sell high. Look for the spots dont trade in the middle and get caught out

You can see it has bounced from the 0.38 fib a few times, which shows that area is strong on the daily TF.

Whats next? Well i dont know for certain but could we go up to form a triple top? who knows but look out for the top around the 1587 area.

We could then either get a retrace to the 0.38 fib again or even deeper to the 50% rest stop or to meet the .618 and trend for multiple confluences before a gigantic push up. Remember buy low sell high. Look for the spots dont trade in the middle and get caught out

Joules MM1

Established member

- Messages

- 648

- Likes

- 142

$xauusd about to rip 1577's for a minor breakout sig

on the way to attack 1610/11 level

bulls still have it....until they dont ...commercials are historic extreme sell to open, longterm buyer beware

on the way to attack 1610/11 level

bulls still have it....until they dont ...commercials are historic extreme sell to open, longterm buyer beware

Jungletrader

Active member

- Messages

- 145

- Likes

- 23

Looking like a possible triple top or may range for a while before pushing up or more downside to the .618 Fib level. Either ways be ready for the price movement !Havent posted here for a while but will continue to do so. Last time i looked at gold (not on here) it was sat at the support area of 1550 area. suggested it could move from there and price has since moved up a couple of hundred pips.

You can see it has bounced from the 0.38 fib a few times, which shows that area is strong on the daily TF.

Whats next? Well i dont know for certain but could we go up to form a triple top? who knows but look out for the top around the 1587 area.

We could then either get a retrace to the 0.38 fib again or even deeper to the 50% rest stop or to meet the .618 and trend for multiple confluences before a gigantic push up. Remember buy low sell high. Look for the spots dont trade in the middle and get caught outView attachment 274569

Similar threads

- Replies

- 121

- Views

- 34K