Joules MM1

Established member

- Messages

- 648

- Likes

- 142

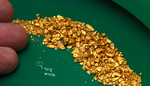

Nothing to do, the resistance of 1300 is confirmed as an insurmountable barrier for the gold. It 'obvious that a new liquidity outlook is needed in the market to push the quotes above resistances.

the liquidity outlook is a sell-the-trend liquidity....money managers being trend followers are now (likely) in the mode of open selling the trend while Commercials are holding the price up with their sizable open (interest) buy positions....the weekly build in their contract size is bearing this out......

a local cfd provider today shows 73% of common accounts are nett long clearly dsiplaying that the long-side mentality for retailers is alive and kicking....until this thread basically dies from a lack of interest we're likely to head lower...although a long period of attempted consolidation is due....

Futures Gold Chart Weekly

silver is even less likely for an immediate upswing

imo, of course