You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

heres the goldmeter - available free below in the links

its not rocket science ..treat Gold like a currency (XAUUSD) and watch for divergence on USD and GOLD indexes

recently its been as easy as pie to sell XAUUSD..........the usd is strong strong strong so always pressure on the XAUUSD to fall ..........just wait for GOLD index (violet) to fall as well and you have a win win

more recently we see the gold index coming north into USD territory .....so no trading at present ...............

unless usd takes a real hit I can only see this as a temporary respite before we get the chance to dump XAUUSD again 👍

N

its not rocket science ..treat Gold like a currency (XAUUSD) and watch for divergence on USD and GOLD indexes

recently its been as easy as pie to sell XAUUSD..........the usd is strong strong strong so always pressure on the XAUUSD to fall ..........just wait for GOLD index (violet) to fall as well and you have a win win

more recently we see the gold index coming north into USD territory .....so no trading at present ...............

unless usd takes a real hit I can only see this as a temporary respite before we get the chance to dump XAUUSD again 👍

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

heres the goldmeter - available free below in the links

its not rocket science ..treat Gold like a currency (XAUUSD) and watch for divergence on USD and GOLD indexes

recently its been as easy as pie to sell XAUUSD..........the usd is strong strong strong so always pressure on the XAUUSD to fall ..........just wait for GOLD index (violet) to fall as well and you have a win win

more recently we see the gold index coming north into USD territory .....so no trading at present ...............

unless usd takes a real hit I can only see this as a temporary respite before we get the chance to dump XAUUSD again 👍

N

see below ?................heres the continuation from post above ................

despite the Gold (violet) presence above the zero ........theres NO WAY that this chart is going further north............

look at the aggressive bull usd index (green)........its driving the chart price south south south ! 👍

not a perfect signal as I need the violet line ideally below the zero and preferably the most diverged line ............but no way should you be risking/buying XAUUSD as I warned last week in previous post

this indicator is available free below in the links

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

struggling with trading gold ?...............despite the rise of the usd - relative gold (against a basket of currencies) has also been strong...........2 half decent sells on the daily below in recent weeks ............otherwise those guys are far to closely correlated to trade

see my goldmeter rules and free indicator in the signature links below

N

http://www.trade2win.com/boards/for...-basic-ideas-strategies-1596.html#post2450938

see my goldmeter rules and free indicator in the signature links below

N

http://www.trade2win.com/boards/for...-basic-ideas-strategies-1596.html#post2450938

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

the goldmeter (available free below in signature links) is for me my most successful indicator ......................its simple .........

only trade XAUUSD when absolute gold is moving in opposite direction to usd index (using the Zero line as differentiator........) green is usd , violet is absolute Gold

simples !!

N

only trade XAUUSD when absolute gold is moving in opposite direction to usd index (using the Zero line as differentiator........) green is usd , violet is absolute Gold

simples !!

N

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

morning all

in truth I hav'nt the time or the inclination to continue to swop banter / insults with the next in line new resident comedian on T2Win........

jees....... .ive been there and done that far to many times now over the years at this excellent forum.....and tired/bored of it .........seen them all come and go......and would continue to do so if I was bothered .........but I have been around the block a lot here and its always good to make changes .....so time for a break

allocating my daily/weekly T2win time now back on my consultancy work and my trading .......time is always valuable to me .........nothing left to prove here at T2win .........

my signature area and links will remain and I will keep an eye out here from time to time plus keep in touch with Forexperian and a few others

always contactable via my home page here or [email protected]

Cheers all

N

in truth I hav'nt the time or the inclination to continue to swop banter / insults with the next in line new resident comedian on T2Win........

jees....... .ive been there and done that far to many times now over the years at this excellent forum.....and tired/bored of it .........seen them all come and go......and would continue to do so if I was bothered .........but I have been around the block a lot here and its always good to make changes .....so time for a break

allocating my daily/weekly T2win time now back on my consultancy work and my trading .......time is always valuable to me .........nothing left to prove here at T2win .........

my signature area and links will remain and I will keep an eye out here from time to time plus keep in touch with Forexperian and a few others

always contactable via my home page here or [email protected]

Cheers all

N

MajorMagnuM

Legendary member

- Messages

- 9,284

- Likes

- 888

morning all

in truth I hav'nt the time or the inclination to continue to swop banter / insults with the next in line new resident comedian on T2Win........

jees....... .ive been there and done that far to many times now over the years at this excellent forum.....and tired/bored of it .........seen them all come and go......and would continue to do so if I was bothered .........but I have been around the block a lot here and its always good to make changes .....so time for a break

allocating my daily/weekly T2win time now back on my consultancy work and my trading .......time is always valuable to me .........nothing left to prove here at T2win .........

my signature area and links will remain and I will keep an eye out here from time to time plus keep in touch with Forexperian and a few others

always contactable via my home page here or [email protected]

Cheers all

N

great shame and understandable

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

Has N gone?

Who said he could go?

NVP kindly get your ass back in here.

Don't make me visit you in sunny Chichester 😉

Who said he could go?

NVP kindly get your ass back in here.

Don't make me visit you in sunny Chichester 😉

Yes, N get back here at once and kick the @ss out of....... the market. 😛

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

DISCLAIMER

the information I share here (linked in my signature area) re my indicators, documents, comments and my youtube videos are all provided free and in good faith

https://www.youtube.com/user/FXCORRELATOR

My own forex trading approach is strengthmeter based and my aim is to share BASIC principles and ideas around the use of forex strengthmeters in trading to an audience that is perhaps not aware of its uses and advantages

My basic systems invite research and exploration .....they are not 100% flawless trading systems .......they are merely there to offer an Introduction to the principles....that's it .......these indicators are MA based and therefore have lagging issues in their raw state (alongside most other indicators😎)

So please view all the material with an open mind and if you want to learn more about this fascinating area of trading go online and google it + perhaps take a look through my stuff :smart:

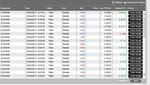

the technology behind the scalping results I publish here from time to time is strengthmeter based (see example attached) - but my own scalping techniques are not using the basic indicators provided here for free ....😏

I have been lucky enough over the years to collaborate with some genius programmers and traders that have provided me with some very slick indicators indeed ..........

I am able to tune them as I need based on market conditions and combined with a few years practice, sweat and focus they pay me well when I let them loose on the markets 👍

so please don't expect my freebees to make you a millionaire.......but they might put you on the path 😛

Cheers

N

the information I share here (linked in my signature area) re my indicators, documents, comments and my youtube videos are all provided free and in good faith

https://www.youtube.com/user/FXCORRELATOR

My own forex trading approach is strengthmeter based and my aim is to share BASIC principles and ideas around the use of forex strengthmeters in trading to an audience that is perhaps not aware of its uses and advantages

My basic systems invite research and exploration .....they are not 100% flawless trading systems .......they are merely there to offer an Introduction to the principles....that's it .......these indicators are MA based and therefore have lagging issues in their raw state (alongside most other indicators😎)

So please view all the material with an open mind and if you want to learn more about this fascinating area of trading go online and google it + perhaps take a look through my stuff :smart:

the technology behind the scalping results I publish here from time to time is strengthmeter based (see example attached) - but my own scalping techniques are not using the basic indicators provided here for free ....😏

I have been lucky enough over the years to collaborate with some genius programmers and traders that have provided me with some very slick indicators indeed ..........

I am able to tune them as I need based on market conditions and combined with a few years practice, sweat and focus they pay me well when I let them loose on the markets 👍

so please don't expect my freebees to make you a millionaire.......but they might put you on the path 😛

Cheers

N

Attachments

davidwebbthegreat

Junior member

- Messages

- 22

- Likes

- 0

What's great thred.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

trading my goldmeter indicator (in free links below)...........its simple really

I am looking for a weak usd and then I attack a rising Gold index

or vice versa

in a perfect world I look for the gold index (violet) to actualy breach above or below all the other grey lines (which represent the G7 currency indexes) .........this means that gold is being traded very aggressively and moving with much more momentum than the fiat currencies

a few buys and sells

N

I am looking for a weak usd and then I attack a rising Gold index

or vice versa

in a perfect world I look for the gold index (violet) to actualy breach above or below all the other grey lines (which represent the G7 currency indexes) .........this means that gold is being traded very aggressively and moving with much more momentum than the fiat currencies

a few buys and sells

N

Attachments

Atilla

Legendary member

- Messages

- 21,035

- Likes

- 4,207

trading my goldmeter indicator (in free links below)...........its simple really

I am looking for a weak usd and then I attack a rising Gold index

or vice versa

in a perfect world I look for the gold index (violet) to actualy breach above or below all the other grey lines (which represent the G7 currency indexes) .........this means that gold is being traded very aggressively and moving with much more momentum than the fiat currencies

a few buys and sells

N

Like that and use something similar my self.

I would add following indexes into that mix, should you choose to accept;

oil, treasury yields, stock, dollar and inflation.

Understanding their relationship coupled with time-lags is key imo.

Moreover, as Yellen set 2% inflation as a key target for raising rates, that's going to have a DIRECT knock on effect to all those parameters... :idea:

👍

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Like that and use something similar my self.

I would add following indexes into that mix, should you choose to accept;

oil, treasury yields, stock, dollar and inflation.

Understanding their relationship coupled with time-lags is key imo.

Moreover, as Yellen set 2% inflation as a key target for raising rates, that's going to have a DIRECT knock on effect to all those parameters... :idea:

👍

Agreed.....I used to factor more variables into my trading but not so fussed now

N

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

interesting triad signals on those 3 indexes on 1hour .............??

euro , usd , gold indexes

I have spent over 15 years now looking at forex correlation and in truth 99% of patterns break down over time and are just fleeting coincidence more than enduring and profitable systems

but 1% do stick

N

euro , usd , gold indexes

I have spent over 15 years now looking at forex correlation and in truth 99% of patterns break down over time and are just fleeting coincidence more than enduring and profitable systems

but 1% do stick

N