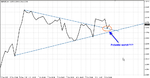

Cable Short Term Analysis - w/c Oct. 8th 2007

2.0680 looks like a good place to aim for jacinto, if we get the wind behind us this week, but there's not a clear mandate for either Bulls or Bears at the moment, just a slightly higher probability for a move upwards.

Potentially significant Support at 2.0356. Getting there looks like we may have minor Supports at 0418, 0393, 0386, 0377.

After 0356, it's minor supports at 0346, 0333, 0310, 0300. Next biggie Support after that lot is 0283.

To the upside the Biggie Resistance is 2.0525. A bunch of smaller ones on the way up at 0431, 0445, 0467, 0499 and 0506.

Long and intermediate are up while short term is unconvincingly down to sideways.

So, I’ll have Bullish intent and I’ll be taking longer term plays to the upside, but I’ll need all the normal confirmations to do so.

Some additional confidence to that Bullish scenario if we see the Frankfurt and London opens carry out a minor stop sweep ahead of any expected upwards action.

If the shorter-term develops into a more pronounced Bear move, I’ll see no problem in taking much shorter-term Bear plays while waiting for either the intermediate and longer term to turn down, or the short-term to turn up. My metaphorical money is on the shorter-term turning up.