Scotty2Cues

Established member

- Messages

- 737

- Likes

- 33

My first live trade! (sort of)

I have lost my virginity!!

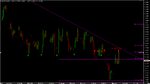

Activated at 1.3680, currently at 1.3685 and I wanna move my stop to BE 😆

Im not happy though as it was a big sell off leading up to it i think

I have lost my virginity!!

Activated at 1.3680, currently at 1.3685 and I wanna move my stop to BE 😆

Im not happy though as it was a big sell off leading up to it i think