bansir

Well-known member

- Messages

- 494

- Likes

- 42

Hi folks,

This thread is a spin off from my demo trades which started on: http://www.trade2win.com/boards/fir...need-trade-horizontal-line-therumpledone.html

I started out testing out the above horizontal line (Buy Zone) strategy using a demonstration account provided by Oanda.

I tested through Feb and March to the begining of this month but I couldn't make it work. I would have a little bit of success but then bad losing days would pop up and kill off any gains.

See the thread if you want to get the full pain 🙂

I did, I think learn a little along the way and now have the beginings of a Squiggly Line (SL) method which I intend to develop over the next couple of months.

All trades are only demo, not real money.

It's just an experiment.

Just trying to learn a bit more about trading and my own psychology.

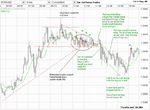

I use Eur-Usd 5min candles with SMA(12) otherwise known as the squiggly line (SL).

Trade London and/or US sessions.

Typical trade duration anything from seconds to an hour or more.

If price is above SL only consider going long.

If price is below SL only consider going short.

Don't go long or short just any place!

Look for some nice reactions of support and resistance.

Maybe even look for a breakout from support/resistance.

Look for a nice slope on (SL), avoid sideways squiggles if you can.

Results so far: Monday was 4 trades for +42 pips. Today was 2 trades for -2 pips.

Here are the charts just to get things rolling:

This thread is a spin off from my demo trades which started on: http://www.trade2win.com/boards/fir...need-trade-horizontal-line-therumpledone.html

I started out testing out the above horizontal line (Buy Zone) strategy using a demonstration account provided by Oanda.

I tested through Feb and March to the begining of this month but I couldn't make it work. I would have a little bit of success but then bad losing days would pop up and kill off any gains.

See the thread if you want to get the full pain 🙂

I did, I think learn a little along the way and now have the beginings of a Squiggly Line (SL) method which I intend to develop over the next couple of months.

All trades are only demo, not real money.

It's just an experiment.

Just trying to learn a bit more about trading and my own psychology.

I use Eur-Usd 5min candles with SMA(12) otherwise known as the squiggly line (SL).

Trade London and/or US sessions.

Typical trade duration anything from seconds to an hour or more.

If price is above SL only consider going long.

If price is below SL only consider going short.

Don't go long or short just any place!

Look for some nice reactions of support and resistance.

Maybe even look for a breakout from support/resistance.

Look for a nice slope on (SL), avoid sideways squiggles if you can.

Results so far: Monday was 4 trades for +42 pips. Today was 2 trades for -2 pips.

Here are the charts just to get things rolling: