You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hi milt,

Not tested that one but I beleive there is a commercial system based on it...

Think its at www.bluewavetrading.com

JonnyT

Not tested that one but I beleive there is a commercial system based on it...

Think its at www.bluewavetrading.com

JonnyT

I put jpwone's Dow96 strategy through TradeStation to get some intraday results. The results are attached here...

http://www.trade2win.co.uk/files/Dow96.zip

(this is nearly 700k, and nearly 3Mb when unzipped).

The only modification made to the strategy was to add a 50 point stop. I ran the strategy from 1-Jan-1999 to present. It trades on $1 per point. 5 min bars. No slippage or commission.

It's been pointed out before but with this strategy you get periods with an excellent equity curve and then extended flat periods (I actually ran it back to 1997 and got the same/similar results). Whilst looking at the past is good, looking at now is more important. This system is currently not making any money. And if you compare the equity curve with a chart of the Dow it is pretty obvious why. This system thrives on volatility and this year there has been precious little of that.

Overall though the system is profitable. But... 🙄 it has a big flaw. The main problem (as I see it) is this…

Avg. Trade Net Profit $8.26

This means the system is only making, on average, 8 points per trade. The argument between Cash and Futures could be academic if the average profit per trade weren’t so small. However, just adding a couple of points slippage per trade will drastically reduce profits. Adding any more will turn this system into a big loser.

I’ve played around with the entries and exits. You can get it to make more profit, smooth out the equity curve etc, but essentially it produces the same results – and if you have to tweak a system too much you know it isn’t going to work in the real world.

IMHO this is not a full strategy as such, but it is an extremely important observation on the market. It is a valuable piece of information that needs to be incorporated into other trading systems. If the Dow is up 100 points or more, selling it because it is ‘overbought’ is a dangerous thing to do. The same is true for other markets.

I have attached the TradeStation code if anyone would like to knock holes in it, improve its efficiency, or make (constructive) suggestions on my coding.

Cheers

mmillar

http://www.trade2win.co.uk/files/Dow96.zip

(this is nearly 700k, and nearly 3Mb when unzipped).

The only modification made to the strategy was to add a 50 point stop. I ran the strategy from 1-Jan-1999 to present. It trades on $1 per point. 5 min bars. No slippage or commission.

It's been pointed out before but with this strategy you get periods with an excellent equity curve and then extended flat periods (I actually ran it back to 1997 and got the same/similar results). Whilst looking at the past is good, looking at now is more important. This system is currently not making any money. And if you compare the equity curve with a chart of the Dow it is pretty obvious why. This system thrives on volatility and this year there has been precious little of that.

Overall though the system is profitable. But... 🙄 it has a big flaw. The main problem (as I see it) is this…

Avg. Trade Net Profit $8.26

This means the system is only making, on average, 8 points per trade. The argument between Cash and Futures could be academic if the average profit per trade weren’t so small. However, just adding a couple of points slippage per trade will drastically reduce profits. Adding any more will turn this system into a big loser.

I’ve played around with the entries and exits. You can get it to make more profit, smooth out the equity curve etc, but essentially it produces the same results – and if you have to tweak a system too much you know it isn’t going to work in the real world.

IMHO this is not a full strategy as such, but it is an extremely important observation on the market. It is a valuable piece of information that needs to be incorporated into other trading systems. If the Dow is up 100 points or more, selling it because it is ‘overbought’ is a dangerous thing to do. The same is true for other markets.

I have attached the TradeStation code if anyone would like to knock holes in it, improve its efficiency, or make (constructive) suggestions on my coding.

Cheers

mmillar

Attachments

Last edited:

Bigbusiness

Experienced member

- Messages

- 1,408

- Likes

- 23

What if you measure volatility and only trade periods when it is higher than average? It has been such a long time since we had a few 200 point days on the Dow I can hardly remember what it was like 🙂.

The General

Active member

- Messages

- 199

- Likes

- 16

All,

Would it not be more prudent to set the triggers as a % rather than an absolute point ?

After all, at the risk of sounding obvious, the avge daily mvmt in the Nasdaq when it was around 5000 would be more than it is now.

Sure, you will still get some discrepancy with the % basis, but at least it self adapts to the current level.

Good thread btw.

The General.

Would it not be more prudent to set the triggers as a % rather than an absolute point ?

After all, at the risk of sounding obvious, the avge daily mvmt in the Nasdaq when it was around 5000 would be more than it is now.

Sure, you will still get some discrepancy with the % basis, but at least it self adapts to the current level.

Good thread btw.

The General.

sidinuk said:Did you run the system without any stoploss at all?

Hi,

The system has an automatic stop as it closes out at the end of every day. jpwone also had a stop at yesterday's close. I haven't run the system without any stops at all.

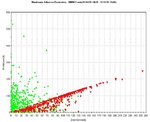

TradeStation produces a report called the 'Maximum Adverse Excursion'. It is an excellent way of showing where to put your stops. I have attached the MAE chart for the Dow96 strategy without the 50 point stop. The green triangles are trades that ended up being profitable, the red triangles are trades that lost money. The idea is to cut off the chart at a point on the horizontal axis where you stop the red triangles going too far to the right (cut your losses) without stopping out too many green triangles (run your profits). I chose a 50 point stop as it best seems to fit this criteria (visually at least). Of course you can do the same thing by optimizing the stop (30 points, 40, 50 etc) until you get the best results.

Cheers

Attachments

Last edited:

Bigbusiness said:What if you measure volatility and only trade periods when it is higher than average?

TheGeneral said:Would it not be more prudent to set the triggers as a % rather than an absolute point ?

This system does take a measure of volatility and changes its entry accordingly. However, there does appear to be a point (like now) when the volatility is so low nothing you do can make the system work. I don't know at what level of volatility the system switches between profitability and drawdown.

The best entry criteria was using a 100 day average of open to close.

BB - if we get back to the days of 200 point moves on the Dow I'll be buying the bubbly.

General - I agree this is a great thread. It would be good if more people would post system ideas.

Cheers

stevecartwright

Member

- Messages

- 51

- Likes

- 1

Note to JPone. have you found a broker with online limit orders and stops

<b> Update </b>

Not done anything with this since the last post.

For clarification the 75 point entry is based on the overall average minus half the 100 day average ie. 96 - 40/2. This allowed more recent data to have some effect on the levels.

If the 100 day average had been higher then we would add half the difference between the overall and 100 day average.

I rounded the figures and should say that this is a finger in the air method of providing more relevance to the more immediate data whilst not losing the core underlying average.

Recent trading would have worked very well with this trigger level with each triggered trade generating a profit. It is fair to say that this should not in any way be assumed to be representative of the longer term system performance as it is far too small a sample period.

I have not been actively looking for a broker to facilitate these trades. It suspect that it will be difficult to strictly trade automatically as we are using actual Dow values for the entry triggers and stops but would be opening and stopping out at the SB companies prices. The entries I have checked recently could all have been hit on the SB price as well as the actual by watching for opportune moments once the actual is in range of the entry.

Not done anything with this since the last post.

For clarification the 75 point entry is based on the overall average minus half the 100 day average ie. 96 - 40/2. This allowed more recent data to have some effect on the levels.

If the 100 day average had been higher then we would add half the difference between the overall and 100 day average.

I rounded the figures and should say that this is a finger in the air method of providing more relevance to the more immediate data whilst not losing the core underlying average.

Recent trading would have worked very well with this trigger level with each triggered trade generating a profit. It is fair to say that this should not in any way be assumed to be representative of the longer term system performance as it is far too small a sample period.

I have not been actively looking for a broker to facilitate these trades. It suspect that it will be difficult to strictly trade automatically as we are using actual Dow values for the entry triggers and stops but would be opening and stopping out at the SB companies prices. The entries I have checked recently could all have been hit on the SB price as well as the actual by watching for opportune moments once the actual is in range of the entry.

stevecartwright

Member

- Messages

- 51

- Likes

- 1

I could agree with you given the last few trades I have made. Whats the best way to trade the FTSE and DOW and who would you recommend I look at. I have read most of the reviews but can't find anyone better than ODL and IGIndex. The former only trade FTSE futures online and not the DOW. I prefer online trading

I recommend www.interactivebrokers.com

Cheap, decent trading platform, financially judged to be the USA's most stable broker.

JonnyT

Cheap, decent trading platform, financially judged to be the USA's most stable broker.

JonnyT

I do have a mechanical system and made $475 per contract last week

Jonnyt

forgive my ignorance, but how many eur/usd points/pips does that equate to?

It's $12.5 per pip.

This week hasn't been so good. I altered my software to implement an enhancement and after two days a bug surfaced that cost be $387 per contract. The bug has now been fixed.

A bad execution then cost me over $450 per contract. The system is in development so I have been using Market Orders, now going to enter/exit on Stop Limits which should reduce slippage even in fast moving markets.

JonnyT

This week hasn't been so good. I altered my software to implement an enhancement and after two days a bug surfaced that cost be $387 per contract. The bug has now been fixed.

A bad execution then cost me over $450 per contract. The system is in development so I have been using Market Orders, now going to enter/exit on Stop Limits which should reduce slippage even in fast moving markets.

JonnyT

Hi JonnyT

Okay, how does using IB compare to using a spread bet company where (say) entry spread is 5 points and closed out at the end of the day at the mid point ?

Do IB offer daily trades that expire at the end of the day?

What are the level of spreads?

If a limit buy is set and triggered, is there an option to get an alert of trade opened emailed to you?

I suppose this is a long winded way of asking why a futures broker is better than a spread bet company?

Whilst I’m here – I’ve read at lot of your posts and I’m interested in learning to trade the currency markets; any pointers/threads you’d suggest? I’d heard the EUR/USD was a good place to start…would applying (with tweaks as appropriate) JPWone’s system to the forex markets work, for example?

Thanks for your help

75

andAny futures broker offer limit orders, stop orders, stop limiot orders etc etc.

Spreadbets are for mug punters.

recommend www.interactivebrokers.com

Cheap, decent trading platform, financially judged to be the USA's most stable broker.

Okay, how does using IB compare to using a spread bet company where (say) entry spread is 5 points and closed out at the end of the day at the mid point ?

Do IB offer daily trades that expire at the end of the day?

What are the level of spreads?

If a limit buy is set and triggered, is there an option to get an alert of trade opened emailed to you?

I suppose this is a long winded way of asking why a futures broker is better than a spread bet company?

Whilst I’m here – I’ve read at lot of your posts and I’m interested in learning to trade the currency markets; any pointers/threads you’d suggest? I’d heard the EUR/USD was a good place to start…would applying (with tweaks as appropriate) JPWone’s system to the forex markets work, for example?

Thanks for your help

75

Hi 75,

With a futures broker the spread is generally 1 and there are no games played like the SBs do. So you do get the market price at the time not some false price that may not be to your advantage.

Different brokers offer different types of orders, go to www.interactivebrokers.com and have a look at what they offer.

JPWones system with minor tweaks does work on Forex.

I trade the EUR/USD using two systems. One has a 30 point stop, one has a 5 point stop. Both trail the market with 30 points.

Average for both systems is around 11 points per trade net.

JonnyT

With a futures broker the spread is generally 1 and there are no games played like the SBs do. So you do get the market price at the time not some false price that may not be to your advantage.

Different brokers offer different types of orders, go to www.interactivebrokers.com and have a look at what they offer.

JPWones system with minor tweaks does work on Forex.

I trade the EUR/USD using two systems. One has a 30 point stop, one has a 5 point stop. Both trail the market with 30 points.

Average for both systems is around 11 points per trade net.

JonnyT

Thanks, JonnyT, for your reply.

I like what you say about the spread and lack of bias.

I have popped over to IB and will consider opening an account with them, instead of switching from D4F to e.g. capital spreads; but can I trade the daily DOW cash with them? Or is it trading the DOW futures (apologies for my ignorance). I have heard there is something called the mini DOW…?

I have downloaded the spreadsheets earlier in this thread, but there didn't seem to be any difference in the cash index OHLC (from JPWone) and the futures OHLC (after Mombassa, JonnyT)...am I missing something here? Hence I have been playing around with the JPWone data...please tell me if this is wrong if about to switch to use IB.

This is slightly off topic (hope you don’t mind, JPWone – great thread, btw) but where can I get OHLC data for the forex markets from?

I hear that these markets ‘trend’ better, and hence my interest in seeing if a break out system would be better suited to them.

Okay, you lost me here. How do both trail the market with 30 points if one of them has a 5 point stop??

Apologies for the rambling and cheers Jonny.

Kind regards

75

I like what you say about the spread and lack of bias.

I have popped over to IB and will consider opening an account with them, instead of switching from D4F to e.g. capital spreads; but can I trade the daily DOW cash with them? Or is it trading the DOW futures (apologies for my ignorance). I have heard there is something called the mini DOW…?

I have downloaded the spreadsheets earlier in this thread, but there didn't seem to be any difference in the cash index OHLC (from JPWone) and the futures OHLC (after Mombassa, JonnyT)...am I missing something here? Hence I have been playing around with the JPWone data...please tell me if this is wrong if about to switch to use IB.

This is slightly off topic (hope you don’t mind, JPWone – great thread, btw) but where can I get OHLC data for the forex markets from?

I hear that these markets ‘trend’ better, and hence my interest in seeing if a break out system would be better suited to them.

I trade the EUR/USD using two systems. One has a 30 point stop, one has a 5 point stop. Both trail the market with 30 points.

Okay, you lost me here. How do both trail the market with 30 points if one of them has a 5 point stop??

Apologies for the rambling and cheers Jonny.

Kind regards

75

Similar threads

- Replies

- 25

- Views

- 7K