You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best Thread Correlation Trading - Basic Ideas and Strategies

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

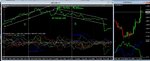

heres the week ...........

tale of 2 halfs for usd (as they say in the soccer business)

strong first half ..............untouchable to Wednesday and all other currencies were worth selling into it at some point - especially the blue euro on Tuesday (see right chart)

Wednesday was changeover day ....the usd hit a high early high in London session and never looked back...........see my later comment on changeovers

then blam.........the usd is on a roll south thurs and then Friday with NFP mega-kicker .............on thursday the euro really got a nice run up north (see right chart)

so there you have it ...........the usd week

N

changeover/transition periods

for me this is the hardest part of trading.....whatever timeframe.......where to call the change in direction.......go too early and you are slammed on the retrace back into trend .......too late and you've missed the party ............holy grail stuff.......

tale of 2 halfs for usd (as they say in the soccer business)

strong first half ..............untouchable to Wednesday and all other currencies were worth selling into it at some point - especially the blue euro on Tuesday (see right chart)

Wednesday was changeover day ....the usd hit a high early high in London session and never looked back...........see my later comment on changeovers

then blam.........the usd is on a roll south thurs and then Friday with NFP mega-kicker .............on thursday the euro really got a nice run up north (see right chart)

so there you have it ...........the usd week

N

changeover/transition periods

for me this is the hardest part of trading.....whatever timeframe.......where to call the change in direction.......go too early and you are slammed on the retrace back into trend .......too late and you've missed the party ............holy grail stuff.......

Attachments

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

I will be tied up from next tuesday in a new role ..........will be more a forex commentator at weekends and cheering forexperian and the gang on from the sidelines ..

this is not retirement though...........just a respite before returning to the scalping arena in future.....I will go pro one day .............just running the other income options for a little while yet and topping up pension pots

so always around here if needed re questions

N

this is not retirement though...........just a respite before returning to the scalping arena in future.....I will go pro one day .............just running the other income options for a little while yet and topping up pension pots

so always around here if needed re questions

N

Forexmospherian

Legendary member

- Messages

- 39,928

- Likes

- 3,306

I will be tied up from next tuesday in a new role ..........will be more a forex commentator at weekends and cheering forexperian and the gang on from the sidelines ..

this is not retirement though...........just a respite before returning to the scalping arena in future.....I will go pro one day .............just running the other income options for a little while yet and topping up pension pots

so always around here if needed re questions

N

Hi N

GL in the new role and i wish you well

Look forward to seeing you some early morning sessions and any days you have some time off

Off for a bit in April - but sure to see you around

All the very best

Regards

F

Webforecast

Newbie

- Messages

- 9

- Likes

- 0

Link not working

Hi.

Thanks for thinking about newbies but your llink sent me to a Nonfound page, can you give meanother link or place to read correlation newbie info?

Thanks again.

Hi NVP

This link may help to introduce newbies to what corelation is, and which pairs it affects.

For example, if you are position sizing using 2% of your account, you would not want to be long the EURUSD and at the same time short the GBPUSD.

Nor would you want to be long or short both pairs simultaneously.

In the first scenario, you are negating your bet.

In the second scenario. you are doubling your bet.

There are other pairs notable for the same behaviour (ie: correlation).

Lately the EURUSD and USDCHF have been mirror images of each other - anti-correlation, if you like.

Correlation is something every FX trader needs to be aware of, to avoid such clashing, unless trading in a more sophisticated manner.

As for the interesting points you have raised ... speed on!

Currency Pairs Correlation in Forex Market: Cross Currency Pairs

There are possibly other good sites discussing correlation - I would love to have an opportunity to visit some of them, if anyone has links.

Hi.

Thanks for thinking about newbies but your llink sent me to a Nonfound page, can you give meanother link or place to read correlation newbie info?

Thanks again.

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

Hi NVP,

Hope you are well. Thank you for sharing your expertise and experiences I am going through your analysis, I will be communicating with yourself going forward. Thank you again.

Kind regards

Gurpal

no worries - thanks 👍

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

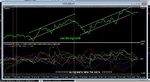

usd finally came back north ......calls here

N

http://www.trade2win.com/boards/dis...ert-retail-forex-trader-4189.html#post2524994

N

http://www.trade2win.com/boards/dis...ert-retail-forex-trader-4189.html#post2524994

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

more pips gang .............sorry I call the live ones at Forexperieans thread

N

http://www.trade2win.com/boards/dis...ert-retail-forex-trader-4193.html#post2525126

N

http://www.trade2win.com/boards/dis...ert-retail-forex-trader-4193.html#post2525126

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

hey all ..........and a warm welcome from me if you are new to T2Win or my thread

I note plenty of people online .........

all my indicators are in the links area below in signature area

heres my youtube channel

https://www.youtube.com/channel/UCm5NlcxCBQKNcCIRirHarzA

i'm a part time scalper using strengthmeter based systems ........been involved in gambling since the 60's and trading since the 1980's ....went to forex in early 2000's ........since the 80's I have been a qualified accountant who consults in corporate business, specialising in finance and commercial side ...........I will go pro one day and always happy to answer questions on strengthmeters here

N

I note plenty of people online .........

all my indicators are in the links area below in signature area

heres my youtube channel

https://www.youtube.com/channel/UCm5NlcxCBQKNcCIRirHarzA

i'm a part time scalper using strengthmeter based systems ........been involved in gambling since the 60's and trading since the 1980's ....went to forex in early 2000's ........since the 80's I have been a qualified accountant who consults in corporate business, specialising in finance and commercial side ...........I will go pro one day and always happy to answer questions on strengthmeters here

N

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

usd finally came back north ......calls here

N

http://www.trade2win.com/boards/dis...ert-retail-forex-trader-4189.html#post2524994

the usd has been pretty bull today London session .......and still going

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

more pips gang .............sorry I call the live ones at Forexperieans thread

N

http://www.trade2win.com/boards/dis...ert-retail-forex-trader-4193.html#post2525126

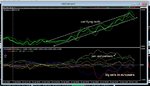

usd STILL coming north .............all you have to do is find the usd retrace sweet spots and jump in on a suitable usd pair to trade the run ...........Europeans have been weak (sell) and notice how the yellow yen has run north as well................that's GOOD KARMA for running a usd extended buy

Eu and GU sells have yielded BIG pip gains this morning

sure its hard and takes practice .............what doesn't in life ? :smart:

N

Attachments

Last edited:

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

NVP

Guest Author

- Messages

- 37,966

- Likes

- 2,158

all novice and intermediate traders need to realise that trading is not just a few rules cobbled together ..........its so much more than that ...its about the completeness of your trading process from A-Z...........

without going all Zen on people it indeed is about being in the Zone with every part of your game organised and solid and on form........there is not one part of the process that can be missing to get those pips...everything matters ........everything !

like a soccer team you have to have everything working together to be the best ..........its no use having a great striker scoring a lot of goals whilst your defence and goalie lets in hatful's at the back !..............all has to be up to par

its having a solid proven system that works for you (research/experiment/adapt/improve) and then the experience of executing thousands of trades .............experience is all (as in most things in life)

N

without going all Zen on people it indeed is about being in the Zone with every part of your game organised and solid and on form........there is not one part of the process that can be missing to get those pips...everything matters ........everything !

like a soccer team you have to have everything working together to be the best ..........its no use having a great striker scoring a lot of goals whilst your defence and goalie lets in hatful's at the back !..............all has to be up to par

its having a solid proven system that works for you (research/experiment/adapt/improve) and then the experience of executing thousands of trades .............experience is all (as in most things in life)

N

Similar threads

- Replies

- 0

- Views

- 3K