Depth Trade

Experienced member

- Messages

- 1,848

- Likes

- 99

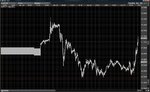

Still holding all four Usd/jpy short positions.

Current open position balance.

+ 14.15 %

Average position price 84.54'4

A Financial Crisis in 2012 is Inevitable! Here’s Why

http://www.munknee.com/2011/04/a-financial-crisis-in-2012-is-inevitable-here’s-why/

2012 is shaping up to be the blockbuster main event of the ongoing financial crisis. Massive amounts of new debt, vast quantities of additional digital dollars and the spark of higher interest rates will set off version 2.0 of the credit-driven financial implosion. Let me explain. Words: 1954

So says Arnold Bock (www.FinancialArticleSummariesToday.com) in an article which Lorimer Wilson, editor of www.munKNEE.com, has edited for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Bock goes on to say:

Why Was Financial Crisis 1.0 Only a First World Crisis?

The original 1.0 version had its origins in the collapse of the US subprime mortgage derivative deck of cards in 2007 before morphing into a broad-based financial crisis in the fall of 2008. It gradually spread to most other first-world advanced economies, but did not wreck havoc on emerging markets and second and third world nations. Most such economies were insulated from the folly of first-world finance – credit, borrowing, overwhelming debt and onerous interest payments – simply because they did not qualify for the intoxicating elixir of credit.

Can the US Government Prevent Another Financial Crisis?

A plethora of fact and opinion has been offered to explain what went wrong – Wall Street greed, crony capitalism, deficient and inadequately administered regulations, a credit and debt engorged consumer-driven economy, imprudent lending standards, negative real interest rates and nonexistent savings. Invariably, all reasons rest on the overwhelming availability and excessive abundance of cheap and easy credit and cash.

The meagre measures that have been designed and implemented since the onset of the Great Recession to mitigate financial risk, such as the Dodd Frank Financial Reform legislation, have merely institutionalized the shortcomings of the regulatory framework. Moreover, the ‘too big to fail’ private financial institutions which qualify for unlimited taxpayer bailouts are even fewer and larger today. Indeed, the supposed solutions to the problem exemplify what the problem really is – government!

Deficits are exploding rapidly leading inexorably to massive debt at all levels of government from federal, to state and into local governments. US sovereign/federal debt is now over $14 Trillion and is expanding in the current fiscal year at over $1.65 Trillion – over three times greater than just three years ago. Currently 37 percent of all federal spending comes from borrowing, which means much more debt…and a veritable fairyland of more magic money created by the FED to service the ballooning beast.

To this cauldron of crud one must add all the unfunded and underfunded obligations of the social safety net represented by Social Security, Medicare and Medicaid, all conveniently excluded from the federal government’s annual operating budget. Depending on what assumptions are made for such factors as future inflation, eligibility criteria, program utilization and related issues, further unfunded liabilities of between $60 Trillion and $110 Trillion must be added to the US federal government’s debt tab.

State and local governments contribute a further $3.87 Trillion in unfunded liabilities attributable to their employee pensions and health insurance benefits. Recent state and municipal employee demonstrations militating for retention of the unsustainable status quo have profiled what clearly are bloated pension and health benefits.

Respected economists Carmen Reinhart and Kenneth Rogoff, in their recent book entitled “This Time is Different” outlined how a debt to GDP ratio of 90 percent is a nation’s tipping point. Their conclusions are based on an analysis several hundred years of economic history. The USA, United Kingdom, Japan and others are lined up to join Greece, Ireland, Portugal among others staring at the looming financial abyss.

Fundamentals are therefore in place for another financial collapse. This time governments will join private financial institutions heading toward the financial debt wall. Government won’t be able to perform its previous role of bailing out ailing financial giants since government itself is now in need of rescuing.

Indeed, the most challenging questions today are how and who will bail out our failing governments? European nations in the EU and those who share the Euro currency can’t help since many of them occupy an equally perilous perch on the financial precipice. It seems all advanced nations not supported by a strong natural resources sector (Canada, Australia) or high productivity manufacturing (Germany) are facing financial catastrophe.

What Will Trigger Financial Crisis 2.0?

Rising interest rates are all that is necessary to trigger the round two collapse of the ongoing financial crisis. It doesn’t take Mensa level intelligence to notice that current interest rates are lower than they have been since the early 1950’s. Real interest rates are also perilously close to being negative, if not already. With rapidly growing price inflation, interest rates will be forced northward.

Until this year foreign purchasers have been the largest buyers of US Treasury debt, with China and Japan in the lead. Japan now has other priorities following its recent highly destructive tsunami. China has already substantially reduced its purchases citing lack of confidence in the declining value of the United States dollar. They have also found that spending their inventory of surplus US dollars by ensuring future supplies of minerals and energy to be much more beneficial to the Chinese economy. Moreover, bond purchasers find sixty year low interest rates on US Treasury bonds, less than the rate of inflation, a very risky and unattractive investment.

In the absence of enough foreign or private sector purchasers, the US central bank, the Federal Reserve Board, has been ‘monetizing’ federal government debt through its purchases of Treasury bonds. The process dubbed Quantitative Easing, by which the FED creates money out of thin air, allows the FED to become the purchaser of last resort of government debt. At the present rate it is expected that the FED will purchase a full 50 percent of all new and maturing Treasury bonds in the current fiscal year. This is necessary simply because there are not enough foreign or domestic, private sector or government buyers to be found at current rates of interest and levels of risk.

The most telling and perhaps scary portent occurred recently when PIMCO, the largest private bond fund, sold its entire US Treasury bond holdings, thereby demonstrating its concern about federal government debt. Reasons cited for the sale by PIMCO head Bill Gross are risks associated with near negative interest rates and the declining value of the US dollar stemming from excessive money creation.

Knowing that institutional money managers representing pension funds and insurance company investment pools frequently follow industry leaders, we can confidently predict that many more Billions and Trillions of Treasury bonds will soon be dumped into the sickly bond market. When this process plays out, FED money creation and debt monetization will go into overdrive, since price inflation will take off as the dollar devalues.

Why America’s Political Process Virtually Guarantees Financial Crisis 2.0?

How can we be so certain that another and more serious financial crisis is on the horizon? Salient factors include:

1.the magnitude and momentum of expanding government deficits, debt and unfunded liabilities,

2.the monetization of Treasury debt by the Federal Reserve Board using manufactured money acquired through the somewhat mystical process labelled ‘Quantitative Easing’,

3. the strong prospect of higher interest rates necessitated by an inflating and devaluing currency followed inevitably by increasing price inflation.

The political process virtually guarantees that no tough, but essential, measures of consequence will be undertaken by political decision makers to stabilize the financial system. Witness the recent embarrassing public tussle between the two parties in Congress over a mere $33 Billion of pocket change in budget reductions when the total shortfall is $1.65 Trillion.

To suggest that strong leadership at this time of looming financial crisis is needed is to state the obvious. However, politicians are like most other people in that they are ambitious careerists who worked hard to secure the jobs they so treasure. Ditto for government bureaucrats who want to preserve their careers and the associated benefits, including the cushiness of defined benefit and inflation protected pensions as well as gilded health insurance. Preservation of the status quo is understandably their top priority.

Voters expect their elected representatives to be active and to ‘do something’ when a crisis strikes them between their eyes. However, there is absolutely no incentive to scan the horizon and to implement tough measures designed to head off a mounting crisis.

Politicians of across the partisan spectrum and range of ideologies have learned, indeed they have thoroughly inculcated, the reality that the voting public does not want to hear about emerging or imminent problems. They want reassurance, not anxiety, but when a crisis blindsides them, they want immediate action from their government.

Until the crisis arrives, politicians who assume leadership roles as educators and disseminators of serious policy options are frequently branded as bad news bears and messengers of mayhem for calling for belt tightening and sacrifice. Instead, voters reflexively point to government waste and to the ‘rich people’ for austerity and additional revenue.

Politicians of vision are invariably chastised by losing their jobs at the next election. Candidates who ignore the storm clouds and who promise good times ahead are most frequently rewarded with the endorsement of a vote. Political will wilts in this kind of hostile electoral environment. Is it any wonder the voting public hears what it wants and gets what it deserves?

Presidential election years are traditionally awash with positive investment environments. Politicians in power know that the public can be bribed with their own money…actually borrowed money. Voters enjoy their apparent prosperity and the general feeling of financial wellbeing. Incumbent Presidents, legislators all, do well in such circumstances.

We will see this scenario play out again in 2012…but only if the persons in power can engineer it yet again. But can they? Will record low interest rates continue? Will the large institutional Treasury bond purchasers such as pension funds and insurance companies follow PIMCO’S Bill Gross out of the Treasuries market? Will the dollar plummet with the excess of FED money printing? Will emerging price inflation in food and energy make for a grouchy voter? Can the government keep the lid on or will the financial pressure cooker explode?

Conclusion: 2012 Will Be the Year of the Perfect Financial Storm…

Buying time by creating ever more magic money, which inevitably results in price inflation, overheated stock and commodities markets and which devalues the currency – will work until it doesn’t.

This analyst sees the perfect storm of converging criteria almost perfectly timed and aligned with the 2012 election cycle. When the moment arrives, the financial earthquake will rapidly demolish the existing highly precarious financial system. Government will stand by helpless, unable to shield itself, much less its vulnerable citizens or private financial institutions from the tsunami of debt and currency destruction.

If starting tomorrow morning our politicians were to act like adults, willing to lead in a pragmatic and focused fashion, free from the concerns of partisan advantage, rancour and rigid ideology, financial collapse could be delayed…perhaps avoided. Unfortunately the challenge seems insurmountable and the political will too feeble.

Current open position balance.

+ 14.15 %

Average position price 84.54'4

A Financial Crisis in 2012 is Inevitable! Here’s Why

http://www.munknee.com/2011/04/a-financial-crisis-in-2012-is-inevitable-here’s-why/

2012 is shaping up to be the blockbuster main event of the ongoing financial crisis. Massive amounts of new debt, vast quantities of additional digital dollars and the spark of higher interest rates will set off version 2.0 of the credit-driven financial implosion. Let me explain. Words: 1954

So says Arnold Bock (www.FinancialArticleSummariesToday.com) in an article which Lorimer Wilson, editor of www.munKNEE.com, has edited for the sake of clarity and brevity to ensure a fast and easy read. Please note that this paragraph must be included in any article re-posting to avoid copyright infringement. Bock goes on to say:

Why Was Financial Crisis 1.0 Only a First World Crisis?

The original 1.0 version had its origins in the collapse of the US subprime mortgage derivative deck of cards in 2007 before morphing into a broad-based financial crisis in the fall of 2008. It gradually spread to most other first-world advanced economies, but did not wreck havoc on emerging markets and second and third world nations. Most such economies were insulated from the folly of first-world finance – credit, borrowing, overwhelming debt and onerous interest payments – simply because they did not qualify for the intoxicating elixir of credit.

Can the US Government Prevent Another Financial Crisis?

A plethora of fact and opinion has been offered to explain what went wrong – Wall Street greed, crony capitalism, deficient and inadequately administered regulations, a credit and debt engorged consumer-driven economy, imprudent lending standards, negative real interest rates and nonexistent savings. Invariably, all reasons rest on the overwhelming availability and excessive abundance of cheap and easy credit and cash.

The meagre measures that have been designed and implemented since the onset of the Great Recession to mitigate financial risk, such as the Dodd Frank Financial Reform legislation, have merely institutionalized the shortcomings of the regulatory framework. Moreover, the ‘too big to fail’ private financial institutions which qualify for unlimited taxpayer bailouts are even fewer and larger today. Indeed, the supposed solutions to the problem exemplify what the problem really is – government!

Deficits are exploding rapidly leading inexorably to massive debt at all levels of government from federal, to state and into local governments. US sovereign/federal debt is now over $14 Trillion and is expanding in the current fiscal year at over $1.65 Trillion – over three times greater than just three years ago. Currently 37 percent of all federal spending comes from borrowing, which means much more debt…and a veritable fairyland of more magic money created by the FED to service the ballooning beast.

To this cauldron of crud one must add all the unfunded and underfunded obligations of the social safety net represented by Social Security, Medicare and Medicaid, all conveniently excluded from the federal government’s annual operating budget. Depending on what assumptions are made for such factors as future inflation, eligibility criteria, program utilization and related issues, further unfunded liabilities of between $60 Trillion and $110 Trillion must be added to the US federal government’s debt tab.

State and local governments contribute a further $3.87 Trillion in unfunded liabilities attributable to their employee pensions and health insurance benefits. Recent state and municipal employee demonstrations militating for retention of the unsustainable status quo have profiled what clearly are bloated pension and health benefits.

Respected economists Carmen Reinhart and Kenneth Rogoff, in their recent book entitled “This Time is Different” outlined how a debt to GDP ratio of 90 percent is a nation’s tipping point. Their conclusions are based on an analysis several hundred years of economic history. The USA, United Kingdom, Japan and others are lined up to join Greece, Ireland, Portugal among others staring at the looming financial abyss.

Fundamentals are therefore in place for another financial collapse. This time governments will join private financial institutions heading toward the financial debt wall. Government won’t be able to perform its previous role of bailing out ailing financial giants since government itself is now in need of rescuing.

Indeed, the most challenging questions today are how and who will bail out our failing governments? European nations in the EU and those who share the Euro currency can’t help since many of them occupy an equally perilous perch on the financial precipice. It seems all advanced nations not supported by a strong natural resources sector (Canada, Australia) or high productivity manufacturing (Germany) are facing financial catastrophe.

What Will Trigger Financial Crisis 2.0?

Rising interest rates are all that is necessary to trigger the round two collapse of the ongoing financial crisis. It doesn’t take Mensa level intelligence to notice that current interest rates are lower than they have been since the early 1950’s. Real interest rates are also perilously close to being negative, if not already. With rapidly growing price inflation, interest rates will be forced northward.

Until this year foreign purchasers have been the largest buyers of US Treasury debt, with China and Japan in the lead. Japan now has other priorities following its recent highly destructive tsunami. China has already substantially reduced its purchases citing lack of confidence in the declining value of the United States dollar. They have also found that spending their inventory of surplus US dollars by ensuring future supplies of minerals and energy to be much more beneficial to the Chinese economy. Moreover, bond purchasers find sixty year low interest rates on US Treasury bonds, less than the rate of inflation, a very risky and unattractive investment.

In the absence of enough foreign or private sector purchasers, the US central bank, the Federal Reserve Board, has been ‘monetizing’ federal government debt through its purchases of Treasury bonds. The process dubbed Quantitative Easing, by which the FED creates money out of thin air, allows the FED to become the purchaser of last resort of government debt. At the present rate it is expected that the FED will purchase a full 50 percent of all new and maturing Treasury bonds in the current fiscal year. This is necessary simply because there are not enough foreign or domestic, private sector or government buyers to be found at current rates of interest and levels of risk.

The most telling and perhaps scary portent occurred recently when PIMCO, the largest private bond fund, sold its entire US Treasury bond holdings, thereby demonstrating its concern about federal government debt. Reasons cited for the sale by PIMCO head Bill Gross are risks associated with near negative interest rates and the declining value of the US dollar stemming from excessive money creation.

Knowing that institutional money managers representing pension funds and insurance company investment pools frequently follow industry leaders, we can confidently predict that many more Billions and Trillions of Treasury bonds will soon be dumped into the sickly bond market. When this process plays out, FED money creation and debt monetization will go into overdrive, since price inflation will take off as the dollar devalues.

Why America’s Political Process Virtually Guarantees Financial Crisis 2.0?

How can we be so certain that another and more serious financial crisis is on the horizon? Salient factors include:

1.the magnitude and momentum of expanding government deficits, debt and unfunded liabilities,

2.the monetization of Treasury debt by the Federal Reserve Board using manufactured money acquired through the somewhat mystical process labelled ‘Quantitative Easing’,

3. the strong prospect of higher interest rates necessitated by an inflating and devaluing currency followed inevitably by increasing price inflation.

The political process virtually guarantees that no tough, but essential, measures of consequence will be undertaken by political decision makers to stabilize the financial system. Witness the recent embarrassing public tussle between the two parties in Congress over a mere $33 Billion of pocket change in budget reductions when the total shortfall is $1.65 Trillion.

To suggest that strong leadership at this time of looming financial crisis is needed is to state the obvious. However, politicians are like most other people in that they are ambitious careerists who worked hard to secure the jobs they so treasure. Ditto for government bureaucrats who want to preserve their careers and the associated benefits, including the cushiness of defined benefit and inflation protected pensions as well as gilded health insurance. Preservation of the status quo is understandably their top priority.

Voters expect their elected representatives to be active and to ‘do something’ when a crisis strikes them between their eyes. However, there is absolutely no incentive to scan the horizon and to implement tough measures designed to head off a mounting crisis.

Politicians of across the partisan spectrum and range of ideologies have learned, indeed they have thoroughly inculcated, the reality that the voting public does not want to hear about emerging or imminent problems. They want reassurance, not anxiety, but when a crisis blindsides them, they want immediate action from their government.

Until the crisis arrives, politicians who assume leadership roles as educators and disseminators of serious policy options are frequently branded as bad news bears and messengers of mayhem for calling for belt tightening and sacrifice. Instead, voters reflexively point to government waste and to the ‘rich people’ for austerity and additional revenue.

Politicians of vision are invariably chastised by losing their jobs at the next election. Candidates who ignore the storm clouds and who promise good times ahead are most frequently rewarded with the endorsement of a vote. Political will wilts in this kind of hostile electoral environment. Is it any wonder the voting public hears what it wants and gets what it deserves?

Presidential election years are traditionally awash with positive investment environments. Politicians in power know that the public can be bribed with their own money…actually borrowed money. Voters enjoy their apparent prosperity and the general feeling of financial wellbeing. Incumbent Presidents, legislators all, do well in such circumstances.

We will see this scenario play out again in 2012…but only if the persons in power can engineer it yet again. But can they? Will record low interest rates continue? Will the large institutional Treasury bond purchasers such as pension funds and insurance companies follow PIMCO’S Bill Gross out of the Treasuries market? Will the dollar plummet with the excess of FED money printing? Will emerging price inflation in food and energy make for a grouchy voter? Can the government keep the lid on or will the financial pressure cooker explode?

Conclusion: 2012 Will Be the Year of the Perfect Financial Storm…

Buying time by creating ever more magic money, which inevitably results in price inflation, overheated stock and commodities markets and which devalues the currency – will work until it doesn’t.

This analyst sees the perfect storm of converging criteria almost perfectly timed and aligned with the 2012 election cycle. When the moment arrives, the financial earthquake will rapidly demolish the existing highly precarious financial system. Government will stand by helpless, unable to shield itself, much less its vulnerable citizens or private financial institutions from the tsunami of debt and currency destruction.

If starting tomorrow morning our politicians were to act like adults, willing to lead in a pragmatic and focused fashion, free from the concerns of partisan advantage, rancour and rigid ideology, financial collapse could be delayed…perhaps avoided. Unfortunately the challenge seems insurmountable and the political will too feeble.