My buddy was working at a hedge fund that was into very weird special unique trades. He told me about bank TARP warrants that trade on the NYSE and I noticed they were trading with no time premium and just at intrinsic value. They had 4 years to expiration so this made no sense to me. I figured there was a way to take advantage of this.

This is an investment idea/trade that took me a while to develop. I have gone over 6 years of data to see how I could get a great return.

The trade ended up profitable for me, and there is a good potential of the stars aligning again to re-execute it. Hopefully I am able to explain my thoughts clearly as I think it is a great trade that is likely to repeat.

I wanted to share this with you guys to see what you think. Hopefully you find value in this post as it is a great risk/reward trade. I wanted to see if anyone had any additional input on my analysis. Maybe you option traders might have some thoughts!

My Risk Exposure: 1%

Total Gain on Trade: 10%

The risk/return ratio is amazing on this trade but the catch is you have to put up quite a bit of capital to make anything worthwhile.

It took me a while to figure this out but I love talking about this stuff and figured I’d like to share my thoughts. I talked with another trader friend and both of us couldn’t find any flaw with it. The basics are I risked 1% to make ~10%, but the return could actually be much higher depending on volatility in the markets.

It’s kind of like an “arbitrage” type trade although it’s not RISKLESS but rather extremely very little risk.

It involves TARP warrants which were created in 2008 during the crisis. I went over 6 years of data from inception of the warrants and this opportunity has never come up until December 2014 for the first time and then only 2 more times after that (near August 2015 and just recently when bank stocks had a rough start in Jan 2016.

Here is my position for the strategy:

1) Short JPM Stock

2) Buy an equal amount* of JPM TARP Warrants

*By amount I mean quantity and not market value. I.e. if you short 10 shares of JPM stock, you would buy 10 warrants.

I will demonstrate the effects if someone shorted one share of JPM and bought one JPM warrant for simplicity. Note both trade on the NYSE.

I am going to use rounded figures to make this easier to explain high level. This is roughly what happened when I entered the positions - JPM stock is trading at $60, the warrants are trading at $20 with a strike of $40. This means, the warrants are trading at their intrinsic value of $20 (i.e. $60 - $40 strike = $20). Normally I would expect the warrants to trade at a higher price to account for the time premium because there was an additional 4 years until they expire. Investors typically pay more for an option/warrant above intrinsic when they know there is more time until expiration.

I still don’t know why, but they were actually trading at intrinsic meaning investors are only paying for the amount that is “in-the-money” and not paying any premium on top of it even though expiry is in 4 years. This has happened only a handful of times but this is exactly the moment to execute the trade. Why?

Because at this point when you go long the stock and short the warrant, your exposure to the stock movement is zero (you are in effect both long and short the stock).

If the stock goes up $1 you gain at least $1 dollar on the warrant and lose $1 on your short. The warrant gains $1 because it will never trade below intrinsic; i.e. If Stock is $61, Warrant is then $21 as $61 stock price - $40 strike = $21. \

If on the other hand the stock goes down $1, you make $1 on your short position but lose $1 on the warrants. So essentially you are hedged for the price movement in JPM.

However, you do have exposure, and that exposure is the amount you pay for the warrant above intrinsic. The warrants have never traded at exactly intrinsic (always a little above) but that time premium has been as low as 1% - which is the entry you want to make.

For example, stock is $60, then intrinsic value of warrant should be $20 ($60 - $40 strike = $20), but the warrant is trading at $20.50 or so. Therefore if the warrant were to expire, you would at least get intrinsic value for it, but you would lose out on the $0.50 premium you paid above intrinsic.

So when I entered the trade I paid about 1% premium for the time (3 years until expiry) and this is what I stood to lose – along with any borrow costs I have to pay for shorting JPM. Important to keep this in mind but shorting JPM isn’t hard; it’s super liquid so it is very cheap (brokers charge a lot less for shorting liquid stocks versus illiquid ones)

I stress tested this position to see what would happen in extreme cases such as i) JPM going so low that the warrants expire totally worthless or ii) the stock price goes unrealistically high but the warrant time premium goes to zero.

Assume the following entry point on the strategy (when time premium on warrant is 1%):

Enter when time premium is 1%:

Entered on: 12/30/2014

a) JPM Price: 63.15 (on NYSE)

b) Strike: 42.377

c) JPM.WS Price; 20.99 (on NYSE)

d) Intrinsic: 20.773 (a-b)

e) Time Premium 1.0% (c/d)

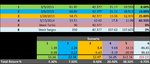

Attached in a jpg are the various scenarios I planned out. The first three are based on actual historic prices that have occurred. Scenario 5 and 6 are my hypothetical scenarios to stress test the strategy.

If you entered the strategy on Dec 31, 2014 the time premium was 1%, then by Jan 28, 2015 it was 25.8%. That is a 9% return. The premium had shot up due to large volatility in the market – it was when the Swiss Franc was unpegged from the Euro.

Detail on how I calculated 9% if you care:

You gain $8.40 on the short because the stock went down to $54.75 but then you lose $5.43 on the warrant for total gain of $2.97. Capital that you need for this strategy is $31.58 – basically when you short one share you get $63.15 in cash in your account per entry data above. To hold the short, usually broker would make you at least hold 50% of cash for the position. So you really only need to dedicate ~$32 of cash in the account to the position. The remaining money from the short you can use to buy the warrants and you still have some left over to reduce risk of a margin call.

Scenario 5 – if the stock tanks and goes to $30, your warrant is worthless and you lose entire value ($20.99) but your short position would have made $33 so net you actually made $12. Surprisingly it is best case scenario.

Scenario 6 - The only scenario where you LOSE money. Any time the time premium goes to zero is when you lose money. So for example if the stock goes up a lot but the warrant actually goes down to trade at intrinsic value, you would lose on the trade, but it would be less than 1%.

Let me know if you can poke any holes in this strategy but I was not able to. The only thing I can think of is if I enter the strategy and not much volatility happens in the near term. I would I have to hold my JPM short position too long which would cause borrow costs to add up and decrease my return. Or if the time premium goes to zero (but if I enter when the time premium is super low then the loss is minimal.

Cheers,

Sai

This is an investment idea/trade that took me a while to develop. I have gone over 6 years of data to see how I could get a great return.

The trade ended up profitable for me, and there is a good potential of the stars aligning again to re-execute it. Hopefully I am able to explain my thoughts clearly as I think it is a great trade that is likely to repeat.

I wanted to share this with you guys to see what you think. Hopefully you find value in this post as it is a great risk/reward trade. I wanted to see if anyone had any additional input on my analysis. Maybe you option traders might have some thoughts!

My Risk Exposure: 1%

Total Gain on Trade: 10%

The risk/return ratio is amazing on this trade but the catch is you have to put up quite a bit of capital to make anything worthwhile.

It took me a while to figure this out but I love talking about this stuff and figured I’d like to share my thoughts. I talked with another trader friend and both of us couldn’t find any flaw with it. The basics are I risked 1% to make ~10%, but the return could actually be much higher depending on volatility in the markets.

It’s kind of like an “arbitrage” type trade although it’s not RISKLESS but rather extremely very little risk.

It involves TARP warrants which were created in 2008 during the crisis. I went over 6 years of data from inception of the warrants and this opportunity has never come up until December 2014 for the first time and then only 2 more times after that (near August 2015 and just recently when bank stocks had a rough start in Jan 2016.

Here is my position for the strategy:

1) Short JPM Stock

2) Buy an equal amount* of JPM TARP Warrants

*By amount I mean quantity and not market value. I.e. if you short 10 shares of JPM stock, you would buy 10 warrants.

I will demonstrate the effects if someone shorted one share of JPM and bought one JPM warrant for simplicity. Note both trade on the NYSE.

I am going to use rounded figures to make this easier to explain high level. This is roughly what happened when I entered the positions - JPM stock is trading at $60, the warrants are trading at $20 with a strike of $40. This means, the warrants are trading at their intrinsic value of $20 (i.e. $60 - $40 strike = $20). Normally I would expect the warrants to trade at a higher price to account for the time premium because there was an additional 4 years until they expire. Investors typically pay more for an option/warrant above intrinsic when they know there is more time until expiration.

I still don’t know why, but they were actually trading at intrinsic meaning investors are only paying for the amount that is “in-the-money” and not paying any premium on top of it even though expiry is in 4 years. This has happened only a handful of times but this is exactly the moment to execute the trade. Why?

Because at this point when you go long the stock and short the warrant, your exposure to the stock movement is zero (you are in effect both long and short the stock).

If the stock goes up $1 you gain at least $1 dollar on the warrant and lose $1 on your short. The warrant gains $1 because it will never trade below intrinsic; i.e. If Stock is $61, Warrant is then $21 as $61 stock price - $40 strike = $21. \

If on the other hand the stock goes down $1, you make $1 on your short position but lose $1 on the warrants. So essentially you are hedged for the price movement in JPM.

However, you do have exposure, and that exposure is the amount you pay for the warrant above intrinsic. The warrants have never traded at exactly intrinsic (always a little above) but that time premium has been as low as 1% - which is the entry you want to make.

For example, stock is $60, then intrinsic value of warrant should be $20 ($60 - $40 strike = $20), but the warrant is trading at $20.50 or so. Therefore if the warrant were to expire, you would at least get intrinsic value for it, but you would lose out on the $0.50 premium you paid above intrinsic.

So when I entered the trade I paid about 1% premium for the time (3 years until expiry) and this is what I stood to lose – along with any borrow costs I have to pay for shorting JPM. Important to keep this in mind but shorting JPM isn’t hard; it’s super liquid so it is very cheap (brokers charge a lot less for shorting liquid stocks versus illiquid ones)

I stress tested this position to see what would happen in extreme cases such as i) JPM going so low that the warrants expire totally worthless or ii) the stock price goes unrealistically high but the warrant time premium goes to zero.

Assume the following entry point on the strategy (when time premium on warrant is 1%):

Enter when time premium is 1%:

Entered on: 12/30/2014

a) JPM Price: 63.15 (on NYSE)

b) Strike: 42.377

c) JPM.WS Price; 20.99 (on NYSE)

d) Intrinsic: 20.773 (a-b)

e) Time Premium 1.0% (c/d)

Attached in a jpg are the various scenarios I planned out. The first three are based on actual historic prices that have occurred. Scenario 5 and 6 are my hypothetical scenarios to stress test the strategy.

If you entered the strategy on Dec 31, 2014 the time premium was 1%, then by Jan 28, 2015 it was 25.8%. That is a 9% return. The premium had shot up due to large volatility in the market – it was when the Swiss Franc was unpegged from the Euro.

Detail on how I calculated 9% if you care:

You gain $8.40 on the short because the stock went down to $54.75 but then you lose $5.43 on the warrant for total gain of $2.97. Capital that you need for this strategy is $31.58 – basically when you short one share you get $63.15 in cash in your account per entry data above. To hold the short, usually broker would make you at least hold 50% of cash for the position. So you really only need to dedicate ~$32 of cash in the account to the position. The remaining money from the short you can use to buy the warrants and you still have some left over to reduce risk of a margin call.

Scenario 5 – if the stock tanks and goes to $30, your warrant is worthless and you lose entire value ($20.99) but your short position would have made $33 so net you actually made $12. Surprisingly it is best case scenario.

Scenario 6 - The only scenario where you LOSE money. Any time the time premium goes to zero is when you lose money. So for example if the stock goes up a lot but the warrant actually goes down to trade at intrinsic value, you would lose on the trade, but it would be less than 1%.

Let me know if you can poke any holes in this strategy but I was not able to. The only thing I can think of is if I enter the strategy and not much volatility happens in the near term. I would I have to hold my JPM short position too long which would cause borrow costs to add up and decrease my return. Or if the time premium goes to zero (but if I enter when the time premium is super low then the loss is minimal.

Cheers,

Sai