Blimey!! The sun is shining 😱

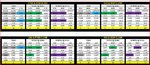

At the end of 2011 FTSE stood at 5572 when DOW stood at 12298

At the end of 2012 FTSE 5898 (+326) and DOW 12930 (+632) so FTSE finished up marginally better than holding its own against DOW - 632/2 = 316 - which is some going since on 1 October 2012 FTSE was -400 weak against DOW and should have been standing at 6219 instead of 5819 had it been matching DOW performance.

Looks like FTSE more or less ignored the "fiscal cliff" DOW effect since you'd be hard pressed to put it down to a burgeoning UK economy, lol. Now that the US have papered over the cracks the DOW may move forward quite strongly and although it will drag FTSE behind it I doubt FTSE will go at the same pace since it already seems to have anticipated the "solution". Thus you'll get more bang for your buck with DOW longs and if working a pair it will be short FTSE/long DOW.

Alternatively, if the DOW doesn't like the solution it will likely tank some and FTSE will follow at a faster pace since it will likely wake up to the wider implications. In that scenario you'll get more bang for your buck with FTSE shorts, but the pair remains the same at short FTSE/ long DOW.