wallstreetwarrior87

Senior member

- Messages

- 2,068

- Likes

- 389

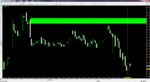

I think this was related to when McDonald's was closed for trading during the trading day yesterday and as such the spreadbettors were quoting prices that didn't actually occur in the real Dow.

An unusual situation for sure but as always it is a lesson to remember when using s'bettors that they only mimic the market and it is not in fact real, though mostly smart arbers keep them in line it can still happen that they take the mick out of their punters when they should be content with winning every day.

When the offer of a big mac comes up, sometimes you cant resist:cheesy:

Having said that, I didnt get to each much of it:whistling