You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anyone expecting the EUR to dip aggressively this week?

p-lab

Active member

- Messages

- 189

- Likes

- 12

Yes - Any levy out of Cyprus is so bearish on EU or EUR on any cross in fact. Could Be USD and GBP leading the party in the longer term. I am horrified at this potential cash raid that is about to happen in the Beautiful country that is Cyprus. The focus seems to be on private clients but surely the real issue are the business clients - Bang there's 20% off your working capital for the week

BigBootyBabe

Newbie

- Messages

- 0

- Likes

- 10

Yes - Any levy out of Cyprus is so bearish on EU or EUR on any cross in fact. Could Be USD and GBP leading the party in the longer term. I am horrified at this potential cash raid that is about to happen in the Beautiful country that is Cyprus. The focus seems to be on private clients but surely the real issue are the business clients - Bang there's 20% off your working capital for the week

Only an idiot fool would sell euro still.

You missed the boat when it was at 1.36/37, so dont chase now that its at 1.29!! :whistling

Instead sell AUD/CHF at around the 0.9886 level. 😎

Aud will follow euro, and in panic money will flood out of aussie and into swiss franc,

however look at chart of aud/chf and you will see that it still has a huge downside potential compared to the euro (which has already crashed huge amount).

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

Wouldnt a decision from Cyprus this weekend be positive for the eur? At open I would expect the eur to climb if Cyprus reach a decision today..

will probably gap open a touch,then anything can happen

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

Ok.. I went a bit risky and put on a position before close on Friday thinking that a decision will be made over weekend.. I will have to watch it carefully

thats gambling,not trading, hope it works for you

Could be many scenarios, ie: Cyprus leaves the EURO (bullish long term for the EUR in my point of view, after an initial quick negative reaction though). But also could happen that the ECB has to do a unlimited LTRO to stop contagion. This will be bearish for the EUR long term.

In my point of view too risky to take positions in EUR in the next days. Anything can happen. More than risky I would say cloudy, as it is impossible to see clearly what the future holds.

The most I would risk is positions with options in both directions. But this is more a gamble than a strategy, so it really needs to be almost no risk with a huge reward potential.

But if we behave like sensible people we should just wait a couple of days to see what is the outcome. If it is a movement down it will be violent so there is no problem to miss the first part and enter in a retracement. If it is a movement up I believe it will be sustained in time, so again there will be a chance to enter at some stage.

Otherwise we better dedicate to gambling. There are so many variables which make this situation impossible to predict.

In my point of view too risky to take positions in EUR in the next days. Anything can happen. More than risky I would say cloudy, as it is impossible to see clearly what the future holds.

The most I would risk is positions with options in both directions. But this is more a gamble than a strategy, so it really needs to be almost no risk with a huge reward potential.

But if we behave like sensible people we should just wait a couple of days to see what is the outcome. If it is a movement down it will be violent so there is no problem to miss the first part and enter in a retracement. If it is a movement up I believe it will be sustained in time, so again there will be a chance to enter at some stage.

Otherwise we better dedicate to gambling. There are so many variables which make this situation impossible to predict.

spreader_legger

Well-known member

- Messages

- 447

- Likes

- 38

Could be many scenarios, ie: Cyprus leaves the EURO (bullish long term for the EUR in my point of view, after an initial quick negative reaction though). But also could happen that the ECB has to do a unlimited LTRO to stop contagion. This will be bearish for the EUR long term.

In my point of view too risky to take positions in EUR in the next days. Anything can happen. More than risky I would say cloudy, as it is impossible to see clearly what the future holds.

The most I would risk is positions with options in both directions. But this is more a gamble than a strategy, so it really needs to be almost no risk with a huge reward potential.

But if we behave like sensible people we should just wait a couple of days to see what is the outcome. If it is a movement down it will be violent so there is no problem to miss the first part and enter in a retracement. If it is a movement up I believe it will be sustained in time, so again there will be a chance to enter at some stage.

Otherwise we better dedicate to gambling. There are so many variables which make this situation impossible to predict.

This is my prediction. Cyprus stays within the EU. A deal is passed & EUR gaps up but then recedes after the initial euphoria.

Unfortunately all bets have now been placed and the wheel spun

Mr. Crabs

Established member

- Messages

- 598

- Likes

- 3

Only an idiot fool would sell euro still.

You missed the boat when it was at 1.36/37, so dont chase now that its at 1.29!! :whistling

Instead sell AUD/CHF at around the 0.9886 level. 😎

Aud will follow euro, and in panic money will flood out of aussie and into swiss franc,

however look at chart of aud/chf and you will see that it still has a huge downside potential compared to the euro (which has already crashed huge amount).

I'll be keeping my eye on the AUD / CHF but you really think the EUR doesn't have a lot more downside from here? This quarter I speculate the EUR could have a downside of 500+ more pips on average this quarter. GBP, CHF, USD and JPY would be good pairs to short the EUR with. I think you may have the AUD confused with the EUR, we haven't hit bottom yet it only just started on its' way down. The AUD has illustrated nothing but strength, there has been no definite signal of a reversal as of now so you might be wayyyyyy ahead of the curve. IMO of course; but I think many deep pocketed forex traders will see last week as just a confirmation of the Euros' downtrend.

Mr. Crabs

Established member

- Messages

- 598

- Likes

- 3

will probably gap open a touch,then anything can happen

I had a feeling of the same thing, a bounce on open could lead to a down week but right on anything can happen. EUR operates like a pump and dump job. Next week is anybodies game.

Mr. Crabs

Established member

- Messages

- 598

- Likes

- 3

This is my prediction. Cyprus stays within the EU. A deal is passed & EUR gaps up but then recedes after the initial euphoria.

Unfortunately all bets have now been placed and the wheel spun

Cyprus will be a major drag on the Eurosystem in any case, money that would be piling in the EUR will flock elsewhere which leaves a lot of downside open on the EUR. Not to mention if the EUR wants to pick up its' export market it will have to become either more competitive, or simply devalue their currency. I would bet on the latter more confidently than the former.

There are a lot of incentives to dropping the value of the EUR, huge money to be made on the downside, etc. I would bet the EUR hasn't hit rock bottom for the quarter quite yet, as a matter of fact I think it has a downside of up to 20 % for this year! 😱

Lord Flasheart

Legendary member

- Messages

- 9,826

- Likes

- 985

what are the odds of it gaping up to fill the gap it made last week. Youd think it unlikely as no deal done,but who knows its only 60 pips away

Mr. Crabs

Established member

- Messages

- 598

- Likes

- 3

what are the odds of it gaping up to fill the gap it made last week. Youd think it unlikely as no deal done,but who knows its only 60 pips away

Right on it wouldn't be very surprising if the EUR touched the price it was at before the big gap. I figure that would be a hot spot for shorts to re-load at.

BigBootyBabe

Newbie

- Messages

- 0

- Likes

- 10

I'll be keeping my eye on the AUD / CHF but you really think the EUR doesn't have a lot more downside from here? This quarter I speculate the EUR could have a downside of 500+ more pips on average this quarter. GBP, CHF, USD and JPY would be good pairs to short the EUR with. I think you may have the AUD confused with the EUR, we haven't hit bottom yet it only just started on its' way down. The AUD has illustrated nothing but strength, there has been no definite signal of a reversal as of now so you might be wayyyyyy ahead of the curve. IMO of course; but I think many deep pocketed forex traders will see last week as just a confirmation of the Euros' downtrend.

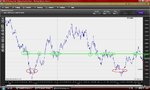

Yes the eur/usd COULD drop another 600pips down to the 1.2336 area over the next 1-2weeks,

however it could also JUST AS EASILY rebound back up 200pips to the 1.3226 or 400pips to the 1.3365 area.

Look at the chart ive attached and you will see how mid-range eur/usd actually is,

and how wide and abrupt the swings of few hundred pips can be. 👎

But then look at the aud/chf chart.. 😉

0.9886 is an extremely strong and solid resistance level which has repeatedly held for years, and is the very top of the range.

Yet there is a huge huge amount of downside potential. :whistling

The reason why aussie has been so strong over the last few months and then even the last few weeks when euro been crashing is because;

From January to end of feb when Dow rocketedup 20% the risk currencies like aussie and euro got so much stronger,

and then even whilst euro been crashing from 1.37 to 1.29 over last few weeks the reason why aussie didnt follow is because the RBA chose to keep interest rate at 3% instead of cutting to 2.75% like many people thought they would.

If they had cut to 2.75% aud/usd would of followed eur/usd to down around 1.10 instead of 1.40+.

This is extremely good for traders, as it basically means that aud has been temporarily kept artificially high for 2weeks,

thus giving us time to now get our short trades executed into the market before it starts to tank. 😎

As 3% interest rate is now fully baked and priced in, dow 20% vertical rise has priced in, bernanke printing out hundreds of trillions of dollars has ALREADY been fully and completely priced in,

and so for aussie to now rise any further from these current levels it will need some new fresh good news.

When the 5-6% correction comes in Dow over the next few weeks, europe panics because of cyprus italy and slovenia, and some new fresh bad news comes out somewhere in asia,

money will race out of the risk currency of aussie dollar and flood into swiss franc!

Euro will also fall abit lower, however in the mean time/at anytime it could so very easily jolt around a few hundred pips to the upside over just 1-2 days of good news/hope,

wheras the potential upside for aud/chf is extremely limited! 🙂

Plus even if aud/chf does manage to rise slightly that merely allows you to get an even better average entry price by adding more sells at 1.004 level.

Im not short aud/chf yet as all my capital is currently tied-up in a short-selling Dax trade at £6.50 per point from 7,983 (target of 7,756).

But once that target level is reached im going to be looking to sell aud/chf at 0.9886 if market hasn't crashed down already by then.

Attachments

Mr. Crabs

Established member

- Messages

- 598

- Likes

- 3

Yes the eur/usd COULD drop another 600pips down to the 1.2336 area over the next 1-2weeks,

however it could also JUST AS EASILY rebound back up 200pips to the 1.3226 or 400pips to the 1.3365 area.

Look at the chart ive attached and you will see how mid-range eur/usd actually is,

and how wide and abrupt the swings of few hundred pips can be. 👎

But then look at the aud/chf chart.. 😉

0.9886 is an extremely strong and solid resistance level which has repeatedly held for years, and is the very top of the range.

Yet there is a huge huge amount of downside potential. :whistling

The reason why aussie has been so strong over the last few months and then even the last few weeks when euro been crashing is because;

From January to end of feb when Dow rocketedup 20% the risk currencies like aussie and euro got so much stronger,

and then even whilst euro been crashing from 1.37 to 1.29 over last few weeks the reason why aussie didnt follow is because the RBA chose to keep interest rate at 3% instead of cutting to 2.75% like many people thought they would.

If they had cut to 2.75% aud/usd would of followed eur/usd to down around 1.10 instead of 1.40+.

This is extremely good for traders, as it basically means that aud has been temporarily kept artificially high for 2weeks,

thus giving us time to now get our short trades executed into the market before it starts to tank. 😎

As 3% interest rate is now fully baked and priced in, dow 20% vertical rise has priced in, bernanke printing out hundreds of trillions of dollars has ALREADY been fully and completely priced in,

and so for aussie to now rise any further from these current levels it will need some new fresh good news.

When the 5-6% correction comes in Dow over the next few weeks, europe panics because of cyprus italy and slovenia, and some new fresh bad news comes out somewhere in asia,

money will race out of the risk currency of aussie dollar and flood into swiss franc!

Euro will also fall abit lower, however in the mean time/at anytime it could so very easily jolt around a few hundred pips to the upside over just 1-2 days of good news/hope,

wheras the potential upside for aud/chf is extremely limited! 🙂

Plus even if aud/chf does manage to rise slightly that merely allows you to get an even better average entry price by adding more sells at 1.004 level.

Im not short aud/chf yet as all my capital is currently tied-up in a short-selling Dax trade at £6.50 per point from 7,983 (target of 7,756).

But once that target level is reached im going to be looking to sell aud/chf at 0.9886 if market hasn't crashed down already by then.

Cool looking at the most basic of charts it does appear that the bears are consuming the bulls in the AUD, but there is a lot of clout behind the scenes that can always burn up the shorts. I've been burned enough times to know to wait for the reversal to become obvious before buying in, expect a thread from me to pop up on the forum when I expect the AUD breakdown has been established. The CHF does seem to be a good pair for it on the AUD downside but I'll be looking into other pairs as well. The JPY could be a volatile pair for it.

BigBootyBabe

Newbie

- Messages

- 0

- Likes

- 10

News just announced a few minutes ago that Cyprus has been given a bailout. 😡😡

Euro and all indicies have shotup nearly 1% in seconds on the news!! 😡👎🙁

Euro and all indicies have shotup nearly 1% in seconds on the news!! 😡👎🙁

Mr. Crabs

Established member

- Messages

- 598

- Likes

- 3

News just announced a few minutes ago that Cyprus has been given a bailout. 😡😡

Euro and all indicies have shotup nearly 1% in seconds on the news!! 😡👎🙁

I was expecting them to get bailed out, but this situation should still be shocking for Eurosystem confidence, how many more of these bailouts can they afford?!? It seems like it's just one after the other. I wonder what country will be next.

But yeah this completely falls in the prediction of Lord Flasheart, gap and bounce in the morning. But the week has only just started. We have been 1 hour deep into the week, there are more than enough to go for the EUR to end down 100 pips or so.

Mr. Crabs

Established member

- Messages

- 598

- Likes

- 3

News just announced a few minutes ago that Cyprus has been given a bailout. 😡😡

Euro and all indicies have shotup nearly 1% in seconds on the news!! 😡👎🙁

How fantastic of the eurosystem to come through with that news at such convenient timing. :whistling

Last edited:

Similar threads

- Replies

- 0

- Views

- 3K