No need to apologize for asking a question. If more folks (me included) did that, we’d be farther along the trail than we already are.

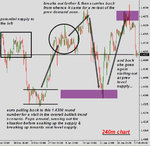

If you take your time & flick thru your timeframe(s) of choice, you’ll uncover clusters of support (demand) & resistance (supply).

If you share the view that price is purely a function of supply & demand, generated solely on the back of, & as a result of, mass psychology, then it seems logical to seek out & focus in on an area where this battle is hotting up.

Some of these zones harbour more active & aggressive activity than others, but essentially these mini & minor fulcrums play out constantly during a typical session, across all timeframes.

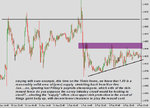

Again, depending on your tactics & strategy plays, you can trade them each-way (long as well as short) or in synch with the dominant price flows.

As long as you got a handle on your upper & lower boundaries, you can calculate your risk exposure in accordance with your size & the aims of your trade intent.

The types of opportunities which spark your interest will obviously hinge on your trading style & preferences etc, but nonetheless if you stand back & observe with an easy eye, you’ll spot these occurances playing out time & again.

Don’t get too close to the action & most definitely don’t start looking for stuff which isn’t there!!

Good news is, you don’t even require to load your technical charts up with the array of fancy colourful indicators to help you on your journey - & that my friend is one big, sexy advantage, I kid you not. Nothing like a nice clean canvas to keep you (& the object of the exercise....price action) honest.

May as well haul up an example of what I’m jawing on about, a picture often explains things a little clearer. Given this thread has EURUSD in the title, lets remain loyal to this pair. It’s exactly the same principles across any pair you care to utilize.