Thanks Again TuscanSun

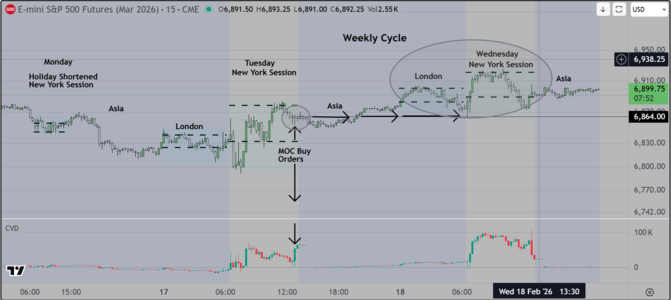

Our chart frames the market referencing the MOC orders that occur at the same time

every (NY) session. For the broader market, those MOC "D orders" as they are known in

the industry) are reported at 3:50pm ET. IF the imbalance is significant, it signals that

price is likely to move in a specific way during the sessions that follow. Rather than rattle

on about this I will simply say that skilled professionals know this and use it to obtain an edge

The advantage we have is as follows.

1) Prior to the NY open of the S&P 500 Futures, we can (if the evidence is there) figure out

who is trapped and where the vulnerable inventory is staged

2) From this, we can guess which side is comfortable (in the money), which side is leaning

the wrong way and has to manage inventory that is losing money (losing more with each point

price moves away from their positions). At some point the losses trigger what we call a "give up"

bar. Its not a sudden move, rather it is a steady consistent move with similar volume or slightly

increasing volume bar after bar.

3) Traders familiar with this can spot it and they know (when) it is safe (low risk) to get on board and hold

New York Session Summary

On the first bar of the NY session, price dropped, convincing traders to sell. Sell volume was trapped early.

Near the end of the Euro/US Overlap, institutions moved the "Marked Up" inventory back down to retest the lows,

making a profit both ways. Institutional traders call this a "Round Trip". This basic "Wholesale/Retail" model is in

common use, where participants attempt to buy cheap inventory, mark it up and sell higher at a profit, and vice versa.

On the Third Chart, we show a process called the "London Sweep". Simply put, during the London Session, price sweeps

or reverses previous price action, which changes the status of the inventory. If the direction of the market continues

it creates a way for institutions to trap volume, and reverse at (or near) the open of the next session (usually the NY session).

So the bottom line for traders, is that when you see a "sweep" in the context of the London Market, be careful not be

on the side that gets "liquidated" if price reverses

We attach a second chart showing the New York Session in greater detail

Good luck