Hello London & Euro Traders

Here are the pending High Impact Economic Reports for the week

-------------------

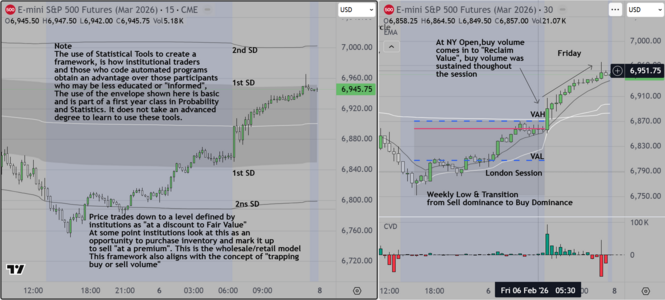

NY Session Outlook – S&P 500 E-mini Futures

This document provides a professional institutional-style outlook for the upcoming NY Session, combining high-impact macroeconomic releases with an intraday regime and scenario analysis based on the provided S&P 500 E-mini Futures chart.

1. High-Impact Economic Releases

Monday:

- ISM Manufacturing PMI (10:00 am EST) – High impact

Tuesday:

- JOLTS Job Openings (10:00 am EST) – Medium impact

Wednesday:

- ADP Employment Change (8:15 am EST) – Medium impact

- ISM Services PMI (10:00 am EST) – Medium/High impact

Thursday:

- Bank of England Rate Decision (7:00 am EST) – Global risk impact

Friday:

- U.S. Employment Situation Report (8:30 am EST) – Highest weekly impact

And our Scenarios

NY Session Scenarios

Scenario A – Bearish Continuation (Primary):

- Failure to reclaim prior session value

- Rejection at VWAP or London session resistance

- Acceptance below prior NY lows

Scenario B – Mean Reversion / Short Covering:

- Oversold open with inability to continue lower

- Responsive buying into early NY

- Rotation toward VWAP before sellers re-engage

Scenario C – News-Driven Reversal:

- Strong labor or macro surprise

- Sharp impulse move followed by pullback

- Structure flip confirmed by higher low above VWAP

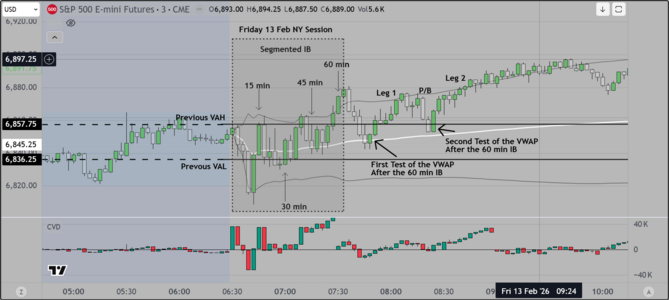

Regime Identification

The 1-hour ES chart reflects a transition from an upside rotational environment earlier in the week to a late-week downside regime. Early week sessions showed controlled higher highs with acceptance, particularly during London and early NY trade. However, Thursday marked a clear regime shift as price failed to sustain prior highs and initiated directional selling.

Friday follow-through selling confirmed distribution and a bearish intraday bias. The structure now shows lower highs, weaker acceptance above VWAP, and downside continuation into the close.

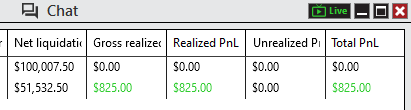

For this type of day, we would monitor only for 30 minutes, waiting for the early discovery process

to unfold. We would enter a position based on clean break to either side, although we favor downside

continuation early.