What an interesting Holiday Session

As mentioned previously I am monitoring only and that is a good thing

because here in "Sunny" California USA, it is stormy, windy and several power

outages this morning. My appliances and computer system are running on

an emergency generator powered by natural gas. My Internet has been in

and out and I am using my Iphone "hotspot" as my Internet connection now.

Wonderful

The day is going about as expected, low volume, not much early follow through

but enough that adventurous traders have reason to be happy

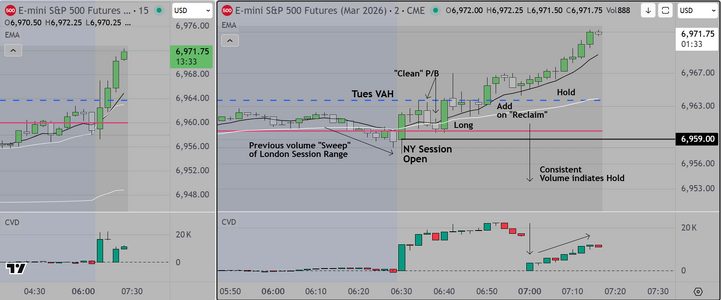

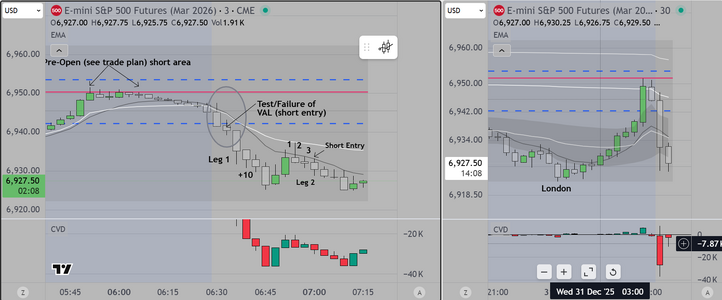

Posting a chart that shows the following (just the broad outlines)

1) during London, typical "drift" higher, and then in the last auction, the market

"Sweeps" the range to the downside. This tells experienced traders that there will

likely be a reversal at the open

2) At the open the anticipated reversal happens and for those of us with the requisite

experience (and the ability to execute), it is simply a matter of assessing whether you

want to take risk on a day like this. (I would not)

3) For those who DO want to accept risk, you wait for the first "Clean" pullback (clean p/b on

my chart) to test one or more key references, you look at volume and you ask yourself

"do I feel lucky" (a Clint Eastwood reference). IF you do (feel lucky) long entry and monitor

volume.

4) The rest of the session is about recognizing repetitive behavior (that is an important part

of what I teach) and you hold as long as volume continues in your direction.

Good luck

Postscript

Observant folks may notice the text "Add on Reclaim". Look carefully. Price breaks above

the previous VAH (Value Area High), then retests. Volume comes in and price takes off to

the upside. This is a "reclaim" and institutional algos are triggered by this behavior. It is

a high probability long entry and it also means that there is likely going to be at least

some follow through (which was not expected in this shortened session). This has to be

a nice surprise for professionals.

As mentioned previously I am monitoring only and that is a good thing

because here in "Sunny" California USA, it is stormy, windy and several power

outages this morning. My appliances and computer system are running on

an emergency generator powered by natural gas. My Internet has been in

and out and I am using my Iphone "hotspot" as my Internet connection now.

Wonderful

The day is going about as expected, low volume, not much early follow through

but enough that adventurous traders have reason to be happy

Posting a chart that shows the following (just the broad outlines)

1) during London, typical "drift" higher, and then in the last auction, the market

"Sweeps" the range to the downside. This tells experienced traders that there will

likely be a reversal at the open

2) At the open the anticipated reversal happens and for those of us with the requisite

experience (and the ability to execute), it is simply a matter of assessing whether you

want to take risk on a day like this. (I would not)

3) For those who DO want to accept risk, you wait for the first "Clean" pullback (clean p/b on

my chart) to test one or more key references, you look at volume and you ask yourself

"do I feel lucky" (a Clint Eastwood reference). IF you do (feel lucky) long entry and monitor

volume.

4) The rest of the session is about recognizing repetitive behavior (that is an important part

of what I teach) and you hold as long as volume continues in your direction.

Good luck

Postscript

Observant folks may notice the text "Add on Reclaim". Look carefully. Price breaks above

the previous VAH (Value Area High), then retests. Volume comes in and price takes off to

the upside. This is a "reclaim" and institutional algos are triggered by this behavior. It is

a high probability long entry and it also means that there is likely going to be at least

some follow through (which was not expected in this shortened session). This has to be

a nice surprise for professionals.

Attachments

Last edited: