You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Hello Trader333

Thanks for being kind (and posting a "like")

I post this because (if you review the previous comment)

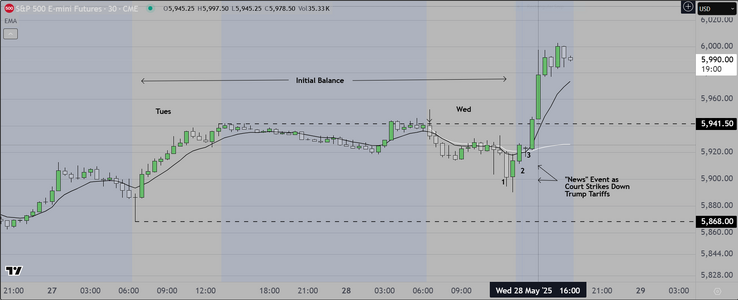

I suggest that the upside from the "news" (Courts blocking

Trump Tariffs) would continue. Obviously I was wrong

What I want to show you (Paul), is that even when you are wrong

using this system you have a "2nd chance" to make money...How you may ask?

Looking at the chart below, notice that I label the initial open and the bars that

follow as "Leg1"....This is why we ask retail students to refrain from trading AT

the open, and instead to monitor only. What you see is something that I teach

and that is to observe formation of "Leg 1" and THEN to trade "Leg 2" because the

odds favor a continuation entry. Same Setup (1-2-3)

What I am discovering during my weekend analysis is that, there are often multiple

"Leg 1-Leg 2 setups" on the 5 min time frame.

Good luck

Thanks for being kind (and posting a "like")

I post this because (if you review the previous comment)

I suggest that the upside from the "news" (Courts blocking

Trump Tariffs) would continue. Obviously I was wrong

What I want to show you (Paul), is that even when you are wrong

using this system you have a "2nd chance" to make money...How you may ask?

Looking at the chart below, notice that I label the initial open and the bars that

follow as "Leg1"....This is why we ask retail students to refrain from trading AT

the open, and instead to monitor only. What you see is something that I teach

and that is to observe formation of "Leg 1" and THEN to trade "Leg 2" because the

odds favor a continuation entry. Same Setup (1-2-3)

What I am discovering during my weekend analysis is that, there are often multiple

"Leg 1-Leg 2 setups" on the 5 min time frame.

Good luck

Attachments

RolloTape2025

Active member

- Messages

- 116

- Likes

- 27

Nvidia earnings might have helped a bit too 🙂Some readers may know of the "News Event" that dropped after the close of the NY session

(Trump's tariffs struck down"). We assume that this effect will have legs and continue into

the next session and beyond.

Last edited:

London Session opened less then an hour ago

and already we have +5 on a small scalp at the open

We have a person sitting in from our first class, and

they are going to try out this simplified version of

our original VWAP envelope. This version requires

only the Ema, AVWAP, FRVP, and the ability to learn

the system rules, and wait patiently for the setups

to present.

Here is the chart

and already we have +5 on a small scalp at the open

We have a person sitting in from our first class, and

they are going to try out this simplified version of

our original VWAP envelope. This version requires

only the Ema, AVWAP, FRVP, and the ability to learn

the system rules, and wait patiently for the setups

to present.

Here is the chart

Attachments

Last edited:

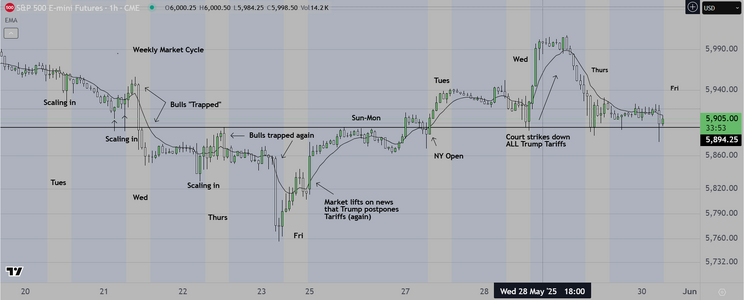

We attach a chart showing what professionals call the "Backend" of the Weekly Cycle

"Reset Wednesday" is the start of this side of the cycle. On Wed, institutions look at price

in relation to previous highs/lows, THEN they will either "Dump" inventory (as they did this

week) followed by moving price up ("Pump") where they will accumulate and later sell during

the "Off Hours" (at or near the close of London Session). This cycle can and will reverse of course.

The attached chart also shows the obvious (multiple) tests of the "Reset" low. Notice that at each

retest, buyers came in to defend and also to add to their long inventory. THEN TODAY, we saw

institutions move the market down, convincing everyone that the market was headed lower, only

to reverse, TRAPPING bears who will now have to decide whether to buy back their shorts and get long

or to scale in. If they decide to buy back shorts, the market is going to continue up

Earlier today, as we watched this unfold, we took a long scalp, then waited while the market opened

and dropped. I had several former students watching along with me, some of them took the short

trade and made money. I waited for the retest of the lows.

Here are two charts, one showing the "big picture" the other showing today's session and showing

the reversal. HERE IS HOW YOU GO FROM LOSING TO WINNING.

1) Learn to see the big picture (keep the weekly chart in front of you) so that you can anticipate where

the big institutions might move the market.

2) When you see a breakout (up or down) check your Weekly Chart. How likely is it that this breakout will

continue?

3) All of this is about awareness of the context. Professionals operate from the big picture chart, and they

while they DO trade the false breakouts (for scalps), they KNOW that the real money is made by catching

the reversal. This one was worth +60 pts.

Final Note

I woke up and saw this developing scenario and made the necessary changes to my trading plan

and when my friends saw this they said, "how confident are you that this WILL happen?"

I replied, I can tell you that I have seen it before many times. I don't know if it will play out

but if it does, at least you will start to recognize it sooner, because it is on your radar NOW

Lets watch and see

"Reset Wednesday" is the start of this side of the cycle. On Wed, institutions look at price

in relation to previous highs/lows, THEN they will either "Dump" inventory (as they did this

week) followed by moving price up ("Pump") where they will accumulate and later sell during

the "Off Hours" (at or near the close of London Session). This cycle can and will reverse of course.

The attached chart also shows the obvious (multiple) tests of the "Reset" low. Notice that at each

retest, buyers came in to defend and also to add to their long inventory. THEN TODAY, we saw

institutions move the market down, convincing everyone that the market was headed lower, only

to reverse, TRAPPING bears who will now have to decide whether to buy back their shorts and get long

or to scale in. If they decide to buy back shorts, the market is going to continue up

Earlier today, as we watched this unfold, we took a long scalp, then waited while the market opened

and dropped. I had several former students watching along with me, some of them took the short

trade and made money. I waited for the retest of the lows.

Here are two charts, one showing the "big picture" the other showing today's session and showing

the reversal. HERE IS HOW YOU GO FROM LOSING TO WINNING.

1) Learn to see the big picture (keep the weekly chart in front of you) so that you can anticipate where

the big institutions might move the market.

2) When you see a breakout (up or down) check your Weekly Chart. How likely is it that this breakout will

continue?

3) All of this is about awareness of the context. Professionals operate from the big picture chart, and they

while they DO trade the false breakouts (for scalps), they KNOW that the real money is made by catching

the reversal. This one was worth +60 pts.

Final Note

I woke up and saw this developing scenario and made the necessary changes to my trading plan

and when my friends saw this they said, "how confident are you that this WILL happen?"

I replied, I can tell you that I have seen it before many times. I don't know if it will play out

but if it does, at least you will start to recognize it sooner, because it is on your radar NOW

Lets watch and see

Attachments

Last edited:

This should finish my project, showing traders how to make the transition

And the way you do that is to change

1) How you see the market (the Big Picture)

2) What you focus on (Weekly Cycle)

3) Changing the way you think about trading

The markets are controlled by big banks and brokerages

The operate on larger time frames (hourly, daily, weekly, quarterly, yearly)

If a trader operates strictly on a minute based time frame, they will be

consistently "trapped" into losing positions, and out of, winning ones.

Its that simple.

The attached chart shows one option for retail traders to use as a screen display

The second option is simply a screen showing daily and weekly candles. I am

skeptical that anyone will take the time to look closely at the daily/weekly chart

and yet, in many ways, it is the most important chart for skilled professionals.

Using these longer time frame charts, pros can figure out what the institutions

are doing, the general direction they intend, and most importantly the timing

because they have to report earnings at specific intervals.

One final anecdote, it was Richard Dennis who said that "he could publish his

entire system rules in the daily paper and no one would follow them". My experience

suggests that this is largely true.

That's about it I will try to check in to answer (some) questions.

Good luck

And the way you do that is to change

1) How you see the market (the Big Picture)

2) What you focus on (Weekly Cycle)

3) Changing the way you think about trading

The markets are controlled by big banks and brokerages

The operate on larger time frames (hourly, daily, weekly, quarterly, yearly)

If a trader operates strictly on a minute based time frame, they will be

consistently "trapped" into losing positions, and out of, winning ones.

Its that simple.

The attached chart shows one option for retail traders to use as a screen display

The second option is simply a screen showing daily and weekly candles. I am

skeptical that anyone will take the time to look closely at the daily/weekly chart

and yet, in many ways, it is the most important chart for skilled professionals.

Using these longer time frame charts, pros can figure out what the institutions

are doing, the general direction they intend, and most importantly the timing

because they have to report earnings at specific intervals.

One final anecdote, it was Richard Dennis who said that "he could publish his

entire system rules in the daily paper and no one would follow them". My experience

suggests that this is largely true.

That's about it I will try to check in to answer (some) questions.

Good luck

Attachments

Last edited:

RolloTape2025

Active member

- Messages

- 116

- Likes

- 27

Sorry if I missed it earlier in the thread. What is your typical initial stop size, and typical loss size? Your profit size I have seen is typically +10, +20

There is no typical size. It depends on where price is in the distribution. Traders may not

understand that stops are "hunted" by institutions. If you put a stop in the obvious place

the odds of getting hit are high.

AND finally, success is in part about changing the way you think. Its not about winning or losing

its about what you have to spend to make money, and how to view expectancy. If you concern

yourself with short term results you will always be caught in the short term randomness of the market.

If instead you find a system approach that has an edge, then over a period of time, you will see that

edge play out. Retail traders trade by the seat of their pants never knowing what their expectation is

and that is in part why they almost always lose. I was gratified to learn that some of my early students

have seen results in line with my system, suggesting that they are operating in a disciplined way.

understand that stops are "hunted" by institutions. If you put a stop in the obvious place

the odds of getting hit are high.

AND finally, success is in part about changing the way you think. Its not about winning or losing

its about what you have to spend to make money, and how to view expectancy. If you concern

yourself with short term results you will always be caught in the short term randomness of the market.

If instead you find a system approach that has an edge, then over a period of time, you will see that

edge play out. Retail traders trade by the seat of their pants never knowing what their expectation is

and that is in part why they almost always lose. I was gratified to learn that some of my early students

have seen results in line with my system, suggesting that they are operating in a disciplined way.

Last edited:

RolloTape2025

Active member

- Messages

- 116

- Likes

- 27

Yes of course.There is no typical size. It depends on where price is in the distribution. Traders may not

understand that stops are "hunted" by institutions. If you put a stop in the obvious place

the odds of getting hit are high.

AND finally, success is in part about changing the way you think. Its not about winning or losing

its about what you have to spend to make money, and how to view expectancy. If you concern

yourself with short term results you will always be caught in the short term randomness of the market.

If instead you find a system approach that has an edge, then over a period of time, you will see that

edge play out. Retail traders trade by the seat of their pants never knowing what their expectation is

and that is in part why they almost always lose. I was gratified to learn that some of my early students

have seen results in line with my system, suggesting that they are operating in a disciplined way.

So with expectancy, you need to know what the average loser is. What is the initial stop loss on a trade, and more importantly what is the average loser.

The average changes from week to week depending on the type of price action. but I have already said that haven't I.

Last week the initial stop loss was approximately 8 pts and the average loss was $350, and that is because I am able to

see when I am wrong and exit sooner than my stop. It is also important to note that the "fill" affects the size of loss as

well and that cannot be quantified.

Thanks for giving me a "peek" into your mindset. Now I am clear on what is important to you.

Last week the initial stop loss was approximately 8 pts and the average loss was $350, and that is because I am able to

see when I am wrong and exit sooner than my stop. It is also important to note that the "fill" affects the size of loss as

well and that cannot be quantified.

Thanks for giving me a "peek" into your mindset. Now I am clear on what is important to you.

RolloTape2025

Active member

- Messages

- 116

- Likes

- 27

Makes sense. Thank you.

Hello,

Interesting development since I last posted. A small group of

traders contacted me to say that my system didn't actually work.

They suggested that they tried it out in the Asia market and it did NOT

work. I brought them in (virtually of course via Zoom) to watch me trade

tonight's Asia Market. Here is the markup (the Market is still "in play").

My comment is simple. Markets are fractal. If a system has an edge, that edge

works in all liquid markets. If the liquidity dries up, then EVERYONE has a problem

and should probably try trading options instead of shares or contracts.. Fortunately

that hasn't happened. To determine if a market is "in play" simply check out the

pending economic news. THAT is what motivates the institutions to put money to work.

Posting tonight's chart. The people watching me had many questions, however I was not

in the mood to answer them. What they were doing was taking screen shots of my

display, then trying to use the information as if it were an ATM......it doesn't work that way.

Its not "plug & play".

While I am still finishing rebuilding my home, I won't have time to hold another class

I will check back if/when that changes.

Good luck

Interesting development since I last posted. A small group of

traders contacted me to say that my system didn't actually work.

They suggested that they tried it out in the Asia market and it did NOT

work. I brought them in (virtually of course via Zoom) to watch me trade

tonight's Asia Market. Here is the markup (the Market is still "in play").

My comment is simple. Markets are fractal. If a system has an edge, that edge

works in all liquid markets. If the liquidity dries up, then EVERYONE has a problem

and should probably try trading options instead of shares or contracts.. Fortunately

that hasn't happened. To determine if a market is "in play" simply check out the

pending economic news. THAT is what motivates the institutions to put money to work.

Posting tonight's chart. The people watching me had many questions, however I was not

in the mood to answer them. What they were doing was taking screen shots of my

display, then trying to use the information as if it were an ATM......it doesn't work that way.

Its not "plug & play".

While I am still finishing rebuilding my home, I won't have time to hold another class

I will check back if/when that changes.

Good luck

Attachments

Another example showing the Asia Session

Most of the movement is in response to news

(as was mentioned previously). I simply monitor

and respond

Important to know where to anchor the tools and

(as usual) one has to be disciplined, managing trades

in a reasonable way.

This trade shows the Asia open, the initial balance

and the statistical skew. The trade is based on the

idea that markets are forward looking

Good luck

Most of the movement is in response to news

(as was mentioned previously). I simply monitor

and respond

Important to know where to anchor the tools and

(as usual) one has to be disciplined, managing trades

in a reasonable way.

This trade shows the Asia open, the initial balance

and the statistical skew. The trade is based on the

idea that markets are forward looking

Good luck

Attachments

On the West Coast US (Los Angeles area) we see news reports of

civil disturbances with people protesting activities of federal agents

who have been removing illegal immigrants from California

So that is the news

The chart attached below, shows what we have mentioned several times now

and that is that the financial markets are "forward looking". Review of previous

posts shows the same basic process.

Observant readers may notice that for this chart I am using my favorite screen

display, which is a VWAP envelope. I like it. It is clear to me and easy to make

good decisions.

On the chart you can see an initial move (higher) right after the start of

the Asia Session. The profit target is (to us) obvious and that is the previous

session high.

civil disturbances with people protesting activities of federal agents

who have been removing illegal immigrants from California

So that is the news

The chart attached below, shows what we have mentioned several times now

and that is that the financial markets are "forward looking". Review of previous

posts shows the same basic process.

Observant readers may notice that for this chart I am using my favorite screen

display, which is a VWAP envelope. I like it. It is clear to me and easy to make

good decisions.

On the chart you can see an initial move (higher) right after the start of

the Asia Session. The profit target is (to us) obvious and that is the previous

session high.

Attachments

Last edited:

Today we post two (2) charts, the first showing daily candles and we have our

overhead profit target marked at 92. Professionals look at fluctuations in volatility

to determine the probability of price getting there during a given session.

The second chart shows price action on a 2 minute basis. What readers can see

is that on the open, price probed down, the reverse as institutions came in to lift

the market higher (towards our overhead target). Professional operators see this

as basic and easy to trade. you get in either at the first or second entry and you hold

as long as the market continues to show momentum

In an effort to help those who struggle, we suggest reading the previous posts. As mentioned

the markets are "forward looking", and so we survey the social and political scene and determine

that pending events favor the upside as the US president attempts to create positive news

dealing with China and his own political problems in California and across the country

On the economic side, inflation has yet to show the negative effects of tariffs, but we believe

it is just a matter of time before we see problems with both the US economy and other

countries (including UK) who may be affected by these policies. Again we show traders how

to plan for these contingencies. Smart traders may want to consider how long they can wait

before they create a 2nd stream of income? This may be the way to do that.

Postscript

For those interested in financial security, I have a couple of thoughts as to how to view

the subject of obtaining training for a possible career in this industry

One of the primary issues struggling traders face is mental, specifically the issue of confidence

If when you look at the screen you are uncertain, because you are often wrong, you are in good

company. I remember that feeling. What you may want to consider is what can be done to change

that. The goal is to look at a chart and see opportunity, not uncertainty. The three step process

that worked for me was 1) Quality education, 2) Good practice and 3) Experience.

Today was for me an example of how this can work. Students from my first class visited and watched

me trade. At the first entry, several traders commented that when they looked at this screen they

mainly felt uncertain. I said that when I look at the screen I see opportunity based on my evaluation

of the probabilities (the simple math). I referred back to the skew. It went from negative to positive

and when it did, I entered. Experience comes in to play after that. Knowing that I was on the same

side as the institutions, I felt good (strong positive feeling) about holding my position long enough

to reach my target(s). When I did cash out, they said that they saw what I did, but NOT SOON ENOUGH

and that is the reason I bring up the subject of experience. In my opinion you have to see it done by

a skilled person, before you can believe it is possible. I enjoy demonstrating that skill.

Good luck

overhead profit target marked at 92. Professionals look at fluctuations in volatility

to determine the probability of price getting there during a given session.

The second chart shows price action on a 2 minute basis. What readers can see

is that on the open, price probed down, the reverse as institutions came in to lift

the market higher (towards our overhead target). Professional operators see this

as basic and easy to trade. you get in either at the first or second entry and you hold

as long as the market continues to show momentum

In an effort to help those who struggle, we suggest reading the previous posts. As mentioned

the markets are "forward looking", and so we survey the social and political scene and determine

that pending events favor the upside as the US president attempts to create positive news

dealing with China and his own political problems in California and across the country

On the economic side, inflation has yet to show the negative effects of tariffs, but we believe

it is just a matter of time before we see problems with both the US economy and other

countries (including UK) who may be affected by these policies. Again we show traders how

to plan for these contingencies. Smart traders may want to consider how long they can wait

before they create a 2nd stream of income? This may be the way to do that.

Postscript

For those interested in financial security, I have a couple of thoughts as to how to view

the subject of obtaining training for a possible career in this industry

One of the primary issues struggling traders face is mental, specifically the issue of confidence

If when you look at the screen you are uncertain, because you are often wrong, you are in good

company. I remember that feeling. What you may want to consider is what can be done to change

that. The goal is to look at a chart and see opportunity, not uncertainty. The three step process

that worked for me was 1) Quality education, 2) Good practice and 3) Experience.

Today was for me an example of how this can work. Students from my first class visited and watched

me trade. At the first entry, several traders commented that when they looked at this screen they

mainly felt uncertain. I said that when I look at the screen I see opportunity based on my evaluation

of the probabilities (the simple math). I referred back to the skew. It went from negative to positive

and when it did, I entered. Experience comes in to play after that. Knowing that I was on the same

side as the institutions, I felt good (strong positive feeling) about holding my position long enough

to reach my target(s). When I did cash out, they said that they saw what I did, but NOT SOON ENOUGH

and that is the reason I bring up the subject of experience. In my opinion you have to see it done by

a skilled person, before you can believe it is possible. I enjoy demonstrating that skill.

Good luck

Attachments

Last edited:

Here we are again and I am posting a 5 min chart showing the Asia session

Same tools, same strategy and same result (+10 pts)

Review of the previous posts should provide confirmation that this strategy

continues to work. This is not a surprise. It was used by my mentor and the

only difference was that he added a VWAP envelope.

For struggling traders, I hope you can see how similar these charts are. Now the

question is do you want to continue to trade in a way that loses money, OR

would you be willing to learn something new, and in the process create

a sustainable business model?

Same tools, same strategy and same result (+10 pts)

Review of the previous posts should provide confirmation that this strategy

continues to work. This is not a surprise. It was used by my mentor and the

only difference was that he added a VWAP envelope.

For struggling traders, I hope you can see how similar these charts are. Now the

question is do you want to continue to trade in a way that loses money, OR

would you be willing to learn something new, and in the process create

a sustainable business model?

Attachments

Similar threads

- Replies

- 5

- Views

- 4K

- Replies

- 3

- Views

- 4K