The answer is, because “simple” works, but that’s not enough information to fill up an article. So, let’s take a look at some unrelated examples to really see if “simple” is the best approach to most of the things we do.

Have you been to a gym lately where they offer personal training? I have been going to the gym for as long as I can remember and my routine has not really changed much over the years. These days, however, I see some interesting exercises going on during personal training sessions around me. I see people standing on one foot, on a big rubber ball, doing arm curls. The first time I saw something like that I thought of the circus. Just the other day I was bench pressing and to my left I saw this man walking toward me with his trainer right behind him, only this was no normal walk. The trainer had him taking huge steps and touching his knee to the ground while lifting a medicine ball over his head. I could have sworn I saw this before at a Cirque Du Solei show.

Don’t get me wrong, I think the big push into personal training is great. At least it gets more people into the gym; who without personal training would still be eating chips on the couch. Make no mistake about it though, when you go to any gym and look around, who are the people in the best shape? It’s the people doing the same basic exercises people have been doing for decades. A stair machine or treadmill mixed with some basic weight training and I am all set. And, let’s not forget the even more important part of fitness, what you eat. There are so many diet fads going on these days that it’s easy to forget that the main issue is very simple, calories in vs. calories out. Is the problem really choosing between the thousands of diets available, or is it the simple answer that people eat too much food and lack self control? The answer, as always, is very simple. You don’t need the expensive gym and fancy workout routine, everything you need is at your local YMCA or your home for a small investment. Expensive diets are not the answer either, no matter how much hype. A well balanced, low calorie, and low fat diet is the simple solution. Just like gravity, you can’t ever get away from the calories in vs. calories out equation, it is what it is…

I have had two multi-year stints coaching youth ice hockey. The important part of the story I am about to tell is that there was about a 7 year break in between. Hockey, like other sports is a simple game, strategy wise. It’s all about getting down the ice faster and smarter than the other team and scoring more than they do. All the team drills I have the kids do are very simple drills that have them getting the puck down the ice quickly. After taking a break from my first multi–year coaching experience, I decided to do it again. As the year began and we were a week away from our first practice I received a huge manual in the mail from the president of the hockey club. It was a new coaching manual created by USA Hockey and it was filled with all kinds of new drills that I had never seen before. As I turned the pages, I saw that the drills were getting more and more creative, each drill required more and more cones and arrows than the next. Something disturbed me about this new bible of hockey drills I was supposed to unleash on my young fresh hockey kids.

The more I read, the more I noticed that kids were spending more time skating from side to side than they were skating up and down the ice to the other team’s goal. This is like a football player running with the ball, having nothing but space in front of him, and deciding to put on the breaks and start running from sideline to sideline. Very soon he is going to get caught and either lose the ball, get tackled or both! Why the need for the new fancy drills? Because people are never content sticking to basics and mastering them. There is always this desire to reinvent, make some kind of statement, get fancy and so on. I felt it was in the best interest of the kids to throw the book in the garbage and stick to the basics. Now that the competition was learning all these new drills that would slow them down, I figured my team had an advantage competing against that strategy. We ended up winning the Presidents Cup that year which means we were the top team that season. Our banner hangs in the rafters today from that season. We had a great team as well, but I think you get the point. I always tell the kids that the main difference between them and NHL players is doing all the basics faster. Look at some of the great basketball players like MJ and Kobe. They master the simple and basic jump shot better than anyone else.

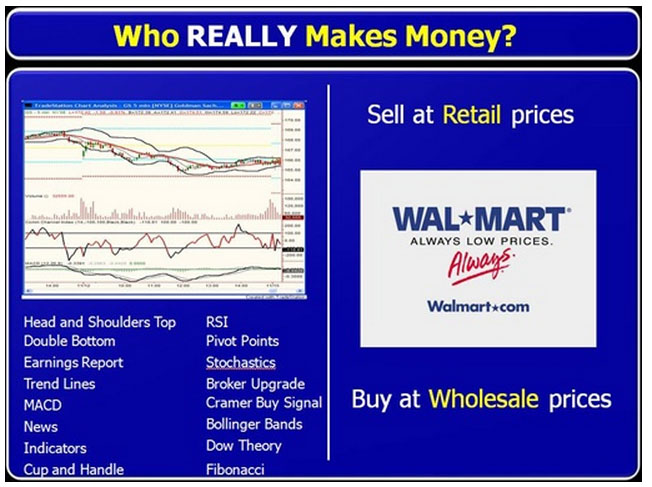

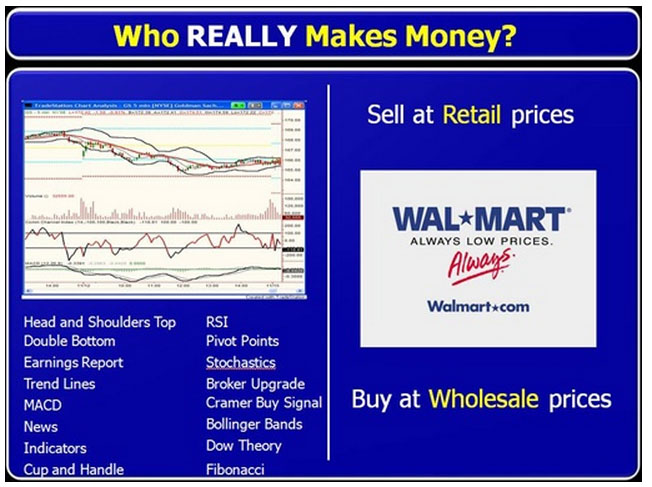

Fig 1

Now, let’s take a look at speculating in markets. Take a look at the chart on the left, above. Now be honest, have you ever known anyone who has made a consistent low risk living using a chart like that or any of the items below the chart? I could have made that list much bigger but I ran out of room. Some of those items are in every trading book ever written yet I don’t know anyone who has ever made a consistent living using any of that stuff. What I do know for a fact, however, is that Walmart is one of the most successful companies the world has ever seen because they have mastered one, and only one, simple skill. The buy low and sell a little bit higher. They repeat this thousands of times each day, maybe millions sometimes. This is where everyone gets it wrong in trading. They think how Walmart makes money is somehow different from how you make a consistent living trading the financial markets. The truth is, there is no difference. Walmart buys at wholesale prices and sells to us at retail prices. They are so good at it that they can sell things to us a little cheaper than their competition, which is why they are the top traders in their industry, if you will.

Here is an example of a trade from last week that I took from our Supply / Demand grid. This is no different than Walmart selling at retail prices. Instead of me selling toilet paper at retail prices, I sold the DAX at retail prices (supply) to someone who was willing to pay retail prices. That buyer on the other side of my trade likely used one of the items in the first example as a buy signal. Unfortunately, that trader doesn’t realize that most of those tools that give a buy signal have you buying at retail prices and selling at wholesale prices. And by the way, it may not sound sexy but I love being Walmart when it comes to trading.

Occam’s Razor, it is a scientific principle that suggests the simplest answer is typically the right answer. If you’re trading or investing results are not where you want them to be, take a look at every component of your plan and begin to question any part of it that seems complicated. Chances are, it is a small set of “simple” answers that will get you where you want to be.

Sam Seiden can be contacted on this link: Sam Seiden

Have you been to a gym lately where they offer personal training? I have been going to the gym for as long as I can remember and my routine has not really changed much over the years. These days, however, I see some interesting exercises going on during personal training sessions around me. I see people standing on one foot, on a big rubber ball, doing arm curls. The first time I saw something like that I thought of the circus. Just the other day I was bench pressing and to my left I saw this man walking toward me with his trainer right behind him, only this was no normal walk. The trainer had him taking huge steps and touching his knee to the ground while lifting a medicine ball over his head. I could have sworn I saw this before at a Cirque Du Solei show.

Don’t get me wrong, I think the big push into personal training is great. At least it gets more people into the gym; who without personal training would still be eating chips on the couch. Make no mistake about it though, when you go to any gym and look around, who are the people in the best shape? It’s the people doing the same basic exercises people have been doing for decades. A stair machine or treadmill mixed with some basic weight training and I am all set. And, let’s not forget the even more important part of fitness, what you eat. There are so many diet fads going on these days that it’s easy to forget that the main issue is very simple, calories in vs. calories out. Is the problem really choosing between the thousands of diets available, or is it the simple answer that people eat too much food and lack self control? The answer, as always, is very simple. You don’t need the expensive gym and fancy workout routine, everything you need is at your local YMCA or your home for a small investment. Expensive diets are not the answer either, no matter how much hype. A well balanced, low calorie, and low fat diet is the simple solution. Just like gravity, you can’t ever get away from the calories in vs. calories out equation, it is what it is…

I have had two multi-year stints coaching youth ice hockey. The important part of the story I am about to tell is that there was about a 7 year break in between. Hockey, like other sports is a simple game, strategy wise. It’s all about getting down the ice faster and smarter than the other team and scoring more than they do. All the team drills I have the kids do are very simple drills that have them getting the puck down the ice quickly. After taking a break from my first multi–year coaching experience, I decided to do it again. As the year began and we were a week away from our first practice I received a huge manual in the mail from the president of the hockey club. It was a new coaching manual created by USA Hockey and it was filled with all kinds of new drills that I had never seen before. As I turned the pages, I saw that the drills were getting more and more creative, each drill required more and more cones and arrows than the next. Something disturbed me about this new bible of hockey drills I was supposed to unleash on my young fresh hockey kids.

The more I read, the more I noticed that kids were spending more time skating from side to side than they were skating up and down the ice to the other team’s goal. This is like a football player running with the ball, having nothing but space in front of him, and deciding to put on the breaks and start running from sideline to sideline. Very soon he is going to get caught and either lose the ball, get tackled or both! Why the need for the new fancy drills? Because people are never content sticking to basics and mastering them. There is always this desire to reinvent, make some kind of statement, get fancy and so on. I felt it was in the best interest of the kids to throw the book in the garbage and stick to the basics. Now that the competition was learning all these new drills that would slow them down, I figured my team had an advantage competing against that strategy. We ended up winning the Presidents Cup that year which means we were the top team that season. Our banner hangs in the rafters today from that season. We had a great team as well, but I think you get the point. I always tell the kids that the main difference between them and NHL players is doing all the basics faster. Look at some of the great basketball players like MJ and Kobe. They master the simple and basic jump shot better than anyone else.

Fig 1

Now, let’s take a look at speculating in markets. Take a look at the chart on the left, above. Now be honest, have you ever known anyone who has made a consistent low risk living using a chart like that or any of the items below the chart? I could have made that list much bigger but I ran out of room. Some of those items are in every trading book ever written yet I don’t know anyone who has ever made a consistent living using any of that stuff. What I do know for a fact, however, is that Walmart is one of the most successful companies the world has ever seen because they have mastered one, and only one, simple skill. The buy low and sell a little bit higher. They repeat this thousands of times each day, maybe millions sometimes. This is where everyone gets it wrong in trading. They think how Walmart makes money is somehow different from how you make a consistent living trading the financial markets. The truth is, there is no difference. Walmart buys at wholesale prices and sells to us at retail prices. They are so good at it that they can sell things to us a little cheaper than their competition, which is why they are the top traders in their industry, if you will.

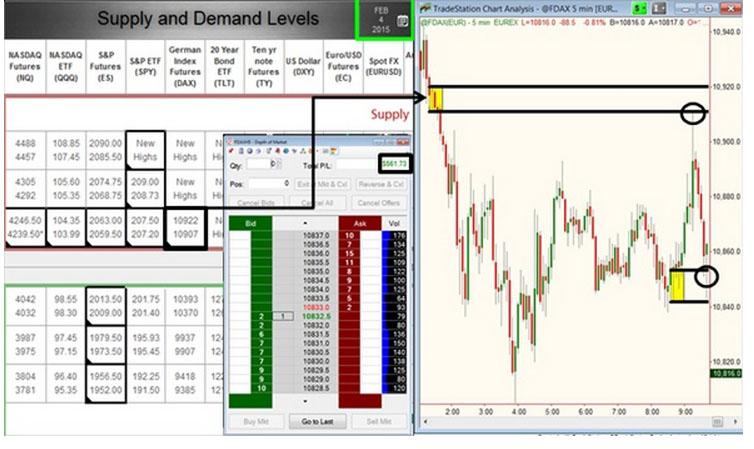

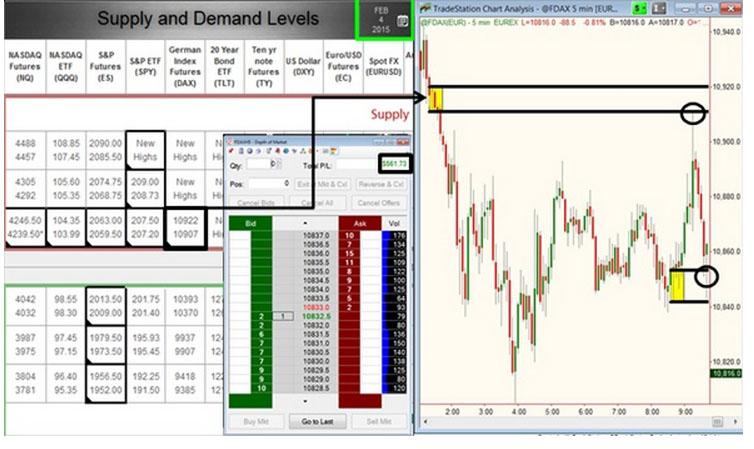

Supply/Demand Income Trade. 2nd Feb 2015

Fig 2

Fig 2

Here is an example of a trade from last week that I took from our Supply / Demand grid. This is no different than Walmart selling at retail prices. Instead of me selling toilet paper at retail prices, I sold the DAX at retail prices (supply) to someone who was willing to pay retail prices. That buyer on the other side of my trade likely used one of the items in the first example as a buy signal. Unfortunately, that trader doesn’t realize that most of those tools that give a buy signal have you buying at retail prices and selling at wholesale prices. And by the way, it may not sound sexy but I love being Walmart when it comes to trading.

Occam’s Razor, it is a scientific principle that suggests the simplest answer is typically the right answer. If you’re trading or investing results are not where you want them to be, take a look at every component of your plan and begin to question any part of it that seems complicated. Chances are, it is a small set of “simple” answers that will get you where you want to be.

Sam Seiden can be contacted on this link: Sam Seiden

Last edited by a moderator: